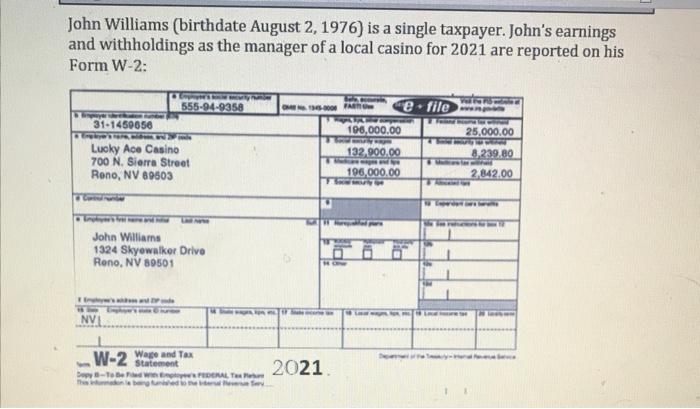

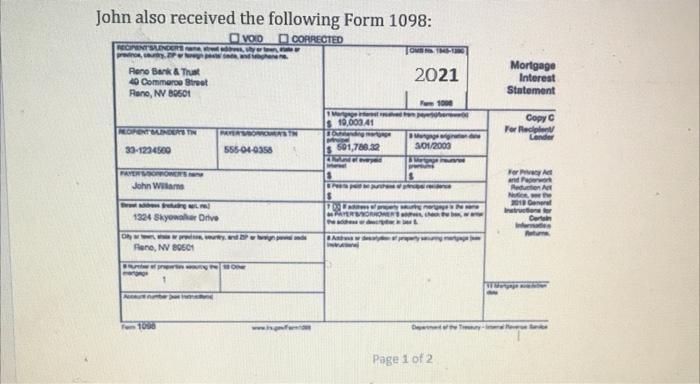

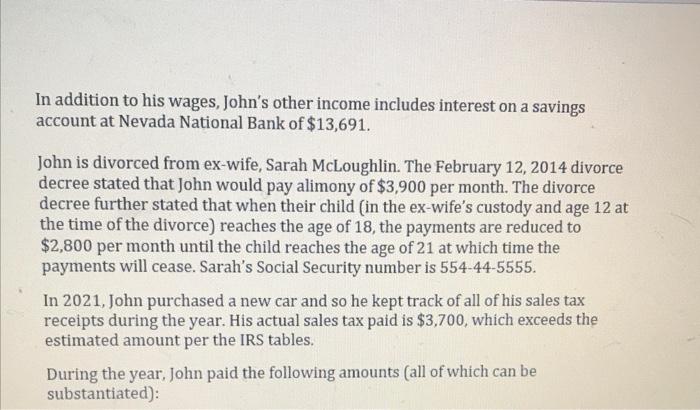

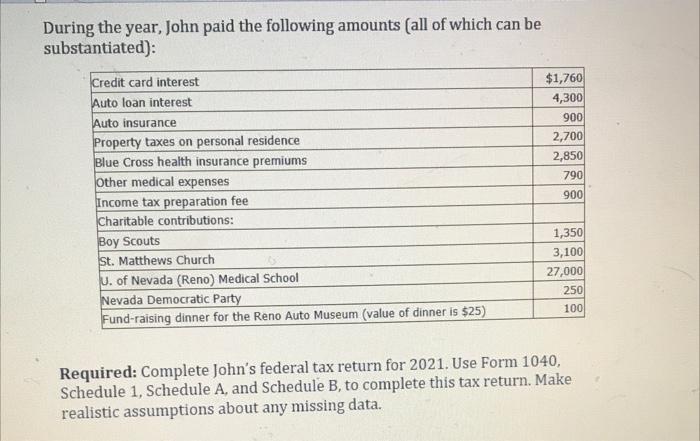

John Williams (birthdate August 2, 1976) is a single taxpayer. John's earnings and withholdings as the manager of a local casino for 2021 are reported on his Form W-2: John also received the following Form 1098: In addition to his wages, John's other income includes interest on a savings account at Nevada National Bank of $13,691. John is divorced from ex-wife, Sarah McLoughlin. The February 12, 2014 divorce decree stated that John would pay alimony of $3,900 per month. The divorce decree further stated that when their child (in the ex-wife's custody and age 12 at the time of the divorce) reaches the age of 18 , the payments are reduced to $2,800 per month until the child reaches the age of 21 at which time the payments will cease. Sarah's Social Security number is 554-44-5555. In 2021, John purchased a new car and so he kept track of all of his sales tax receipts during the year. His actual sales tax paid is $3,700, which exceeds the estimated amount per the IRS tables. During the year, John paid the following amounts (all of which can be substantiated): During the year, John paid the following amounts (all of which can be substantiated): Required: Complete John's federal tax return for 2021. Use Form 1040 , Schedule 1, Schedule A, and Schedule B, to complete this tax return. Make realistic assumptions about any missing data. John Williams (birthdate August 2, 1976) is a single taxpayer. John's earnings and withholdings as the manager of a local casino for 2021 are reported on his Form W-2: John also received the following Form 1098: In addition to his wages, John's other income includes interest on a savings account at Nevada National Bank of $13,691. John is divorced from ex-wife, Sarah McLoughlin. The February 12, 2014 divorce decree stated that John would pay alimony of $3,900 per month. The divorce decree further stated that when their child (in the ex-wife's custody and age 12 at the time of the divorce) reaches the age of 18 , the payments are reduced to $2,800 per month until the child reaches the age of 21 at which time the payments will cease. Sarah's Social Security number is 554-44-5555. In 2021, John purchased a new car and so he kept track of all of his sales tax receipts during the year. His actual sales tax paid is $3,700, which exceeds the estimated amount per the IRS tables. During the year, John paid the following amounts (all of which can be substantiated): During the year, John paid the following amounts (all of which can be substantiated): Required: Complete John's federal tax return for 2021. Use Form 1040 , Schedule 1, Schedule A, and Schedule B, to complete this tax return. Make realistic assumptions about any missing data