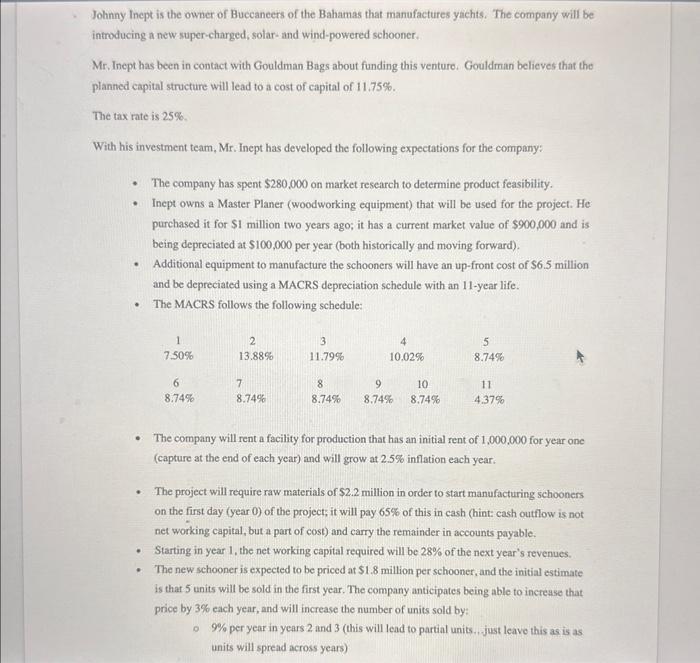

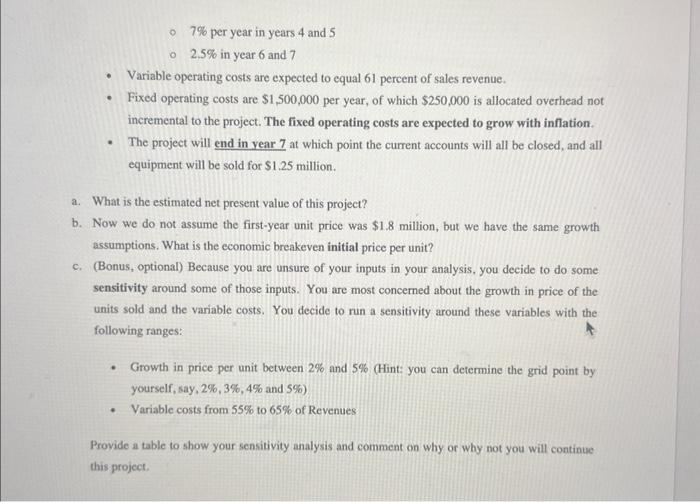

Johnny Inept is the owner of Buccaneers of the Bahamas that manufactures yachts. The company will be introducing a new super-charged, solar- and wind-powered schooner. Mr. Inept has been in contact with Gouldman Bags about funding this venture. Gouldman believes that the planned capital structure will lead to a cost of capital of 11.75%. The tax rate is 25% With his investment team, Mr. Inept has developed the following expectations for the company: - The company has spent $280,000 on market research to determine product feasibility. - Inept owns a Master Planer (woodworking equipment) that will be used for the project. He purchased it for $1 million two years ago; it has a current market value of $900,000 and is being depreciated at $100,000 per year (both historically and moving forward). - Additional equipment to manufacture the schooners will have an up-front cost of $6.5 million and be depreciated using a MACRS depreciation schedule with an 11-year life. - The MACRS follows the following schedule: - The company will rent a facility for production that has an initial rent of 1,000,000 for year one (capture at the end of each year) and will grow at 2.5% inflation each year. - The project will require raw materials of $2.2 million in order to start manufacturing schooners on the first day (year 0 ) of the project; it will pay 65% of this in cash (hint: cash outflow is not net working capital, but a part of cost) and carry the remainder in accounts payable. - Starting in year 1 , the net working capital required will be 28% of the next year's revenues. - The new schooner is expected to be priced at $1.8 million per schooner, and the initial estimate is that 5 units will be sold in the first year. The company anticipates being able to increase that price by 3% each year, and will increase the number of units sold by: - 9% per year in years 2 and 3 (this will lead to partial units., just leave this as is as units will spread across years) 7% per year in years 4 and 5 2.5% in year 6 and 7 - Variable operating costs are expected to equal 61 percent of sales revenue. - Fixed operating costs are $1,500,000 per year, of which $250,000 is allocated overhead not incremental to the project. The fixed operating costs are expected to grow with inflation. - The project will end in vear 7 at which point the current accounts will all be closed, and all equipment will be sold for $1.25 million. a. What is the estimated net present value of this project? b. Now we do not assume the first-year unit price was $1.8 million, but we have the same growth assumptions. What is the economic breakeven initial price per unit? c. (Bonus, optional) Because you are unsure of your inputs in your analysis, you decide to do some sensitivity around some of those inputs. You are most concerned about the growth in price of the units sold and the variable costs. You decide to run a sensitivity around these variables with the following ranges: - Growth in price per unit between 2% and 5% (Hint: you can determine the grid point by yourself, say, 2%,3%,4% and 5% ) - Variable costs from 55% to 65% of Revenues Provide a table to show your sensitivity analysis and comment on why or why not you will continue this project. Johnny Inept is the owner of Buccaneers of the Bahamas that manufactures yachts. The company will be introducing a new super-charged, solar- and wind-powered schooner. Mr. Inept has been in contact with Gouldman Bags about funding this venture. Gouldman believes that the planned capital structure will lead to a cost of capital of 11.75%. The tax rate is 25% With his investment team, Mr. Inept has developed the following expectations for the company: - The company has spent $280,000 on market research to determine product feasibility. - Inept owns a Master Planer (woodworking equipment) that will be used for the project. He purchased it for $1 million two years ago; it has a current market value of $900,000 and is being depreciated at $100,000 per year (both historically and moving forward). - Additional equipment to manufacture the schooners will have an up-front cost of $6.5 million and be depreciated using a MACRS depreciation schedule with an 11-year life. - The MACRS follows the following schedule: - The company will rent a facility for production that has an initial rent of 1,000,000 for year one (capture at the end of each year) and will grow at 2.5% inflation each year. - The project will require raw materials of $2.2 million in order to start manufacturing schooners on the first day (year 0 ) of the project; it will pay 65% of this in cash (hint: cash outflow is not net working capital, but a part of cost) and carry the remainder in accounts payable. - Starting in year 1 , the net working capital required will be 28% of the next year's revenues. - The new schooner is expected to be priced at $1.8 million per schooner, and the initial estimate is that 5 units will be sold in the first year. The company anticipates being able to increase that price by 3% each year, and will increase the number of units sold by: - 9% per year in years 2 and 3 (this will lead to partial units., just leave this as is as units will spread across years) 7% per year in years 4 and 5 2.5% in year 6 and 7 - Variable operating costs are expected to equal 61 percent of sales revenue. - Fixed operating costs are $1,500,000 per year, of which $250,000 is allocated overhead not incremental to the project. The fixed operating costs are expected to grow with inflation. - The project will end in vear 7 at which point the current accounts will all be closed, and all equipment will be sold for $1.25 million. a. What is the estimated net present value of this project? b. Now we do not assume the first-year unit price was $1.8 million, but we have the same growth assumptions. What is the economic breakeven initial price per unit? c. (Bonus, optional) Because you are unsure of your inputs in your analysis, you decide to do some sensitivity around some of those inputs. You are most concerned about the growth in price of the units sold and the variable costs. You decide to run a sensitivity around these variables with the following ranges: - Growth in price per unit between 2% and 5% (Hint: you can determine the grid point by yourself, say, 2%,3%,4% and 5% ) - Variable costs from 55% to 65% of Revenues Provide a table to show your sensitivity analysis and comment on why or why not you will continue this project