Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnny possesses $250,000 in cash savings and has a goal of purchasing a house. The current market price for a house that meets his

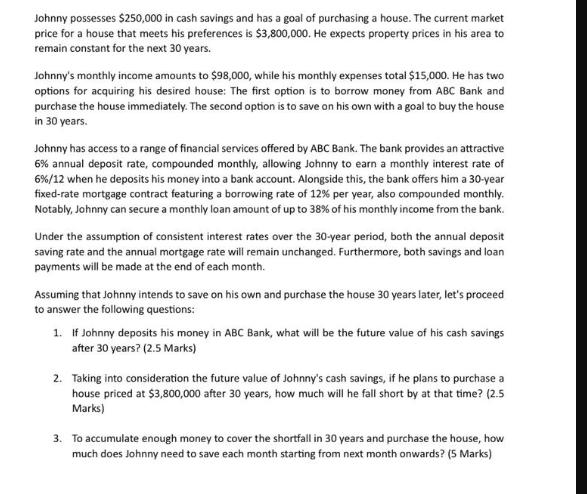

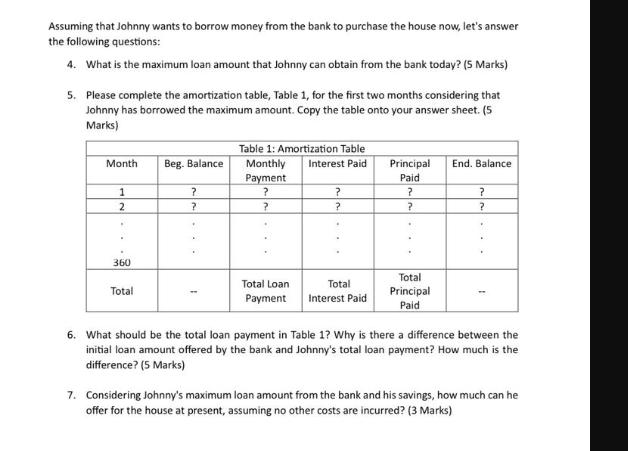

Johnny possesses $250,000 in cash savings and has a goal of purchasing a house. The current market price for a house that meets his preferences is $3,800,000. He expects property prices in his area to remain constant for the next 30 years. Johnny's monthly income amounts to $98,000, while his monthly expenses total $15,000. He has two options for acquiring his desired house: The first option is to borrow money from ABC Bank and purchase the house immediately. The second option is to save on his own with a goal to buy the house in 30 years. Johnny has access to a range of financial services offered by ABC Bank. The bank provides an attractive 6% annual deposit rate, compounded monthly, allowing Johnny to earn a monthly interest rate of 6%/12 when he deposits his money into a bank account. Alongside this, the bank offers him a 30-year fixed-rate mortgage contract featuring a borrowing rate of 12% per year, also compounded monthly. Notably, Johnny can secure a monthly loan amount of up to 38% of his monthly income from the bank. Under the assumption of consistent interest rates over the 30-year period, both the annual deposit saving rate and the annual mortgage rate will remain unchanged. Furthermore, both savings and loan payments will be made at the end of each month. Assuming that Johnny intends to save on his own and purchase the house 30 years later, let's proceed to answer the following questions: 1. If Johnny deposits his money in ABC Bank, what will be the future value of his cash savings after 30 years? (2.5 Marks) 2. Taking into consideration the future value of Johnny's cash savings, if he plans to purchase a house priced at $3,800,000 after 30 years, how much will he fall short by at that time? (2.5 Marks) 3. To accumulate enough money to cover the shortfall in 30 years and purchase the house, how much does Johnny need to save each month starting from next month onwards? (5 Marks) Assuming that Johnny wants to borrow money from the bank to purchase the house now, let's answer the following questions: 4. What is the maximum loan amount that Johnny can obtain from the bank today? (5 Marks) 5. Please complete the amortization table, Table 1, for the first two months considering that Johnny has borrowed the maximum amount. Copy the table onto your answer sheet. (5 Marks) Table 1: Amortization Table Month Beg. Balance Monthly Interest Paid Principal End. Balance Payment Paid 1 ? ? ? ? ? 2 ? ? ? ? ? 360 Total Total Total Loan Payment Total Interest Paid Principal Paid 6. What should be the total loan payment in Table 1? Why is there a difference between the initial loan amount offered by the bank and Johnny's total loan payment? How much is the difference? (5 Marks) 7. Considering Johnny's maximum loan amount from the bank and his savings, how much can he offer for the house at present, assuming no other costs are incurred? (3 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started