Answered step by step

Verified Expert Solution

Question

1 Approved Answer

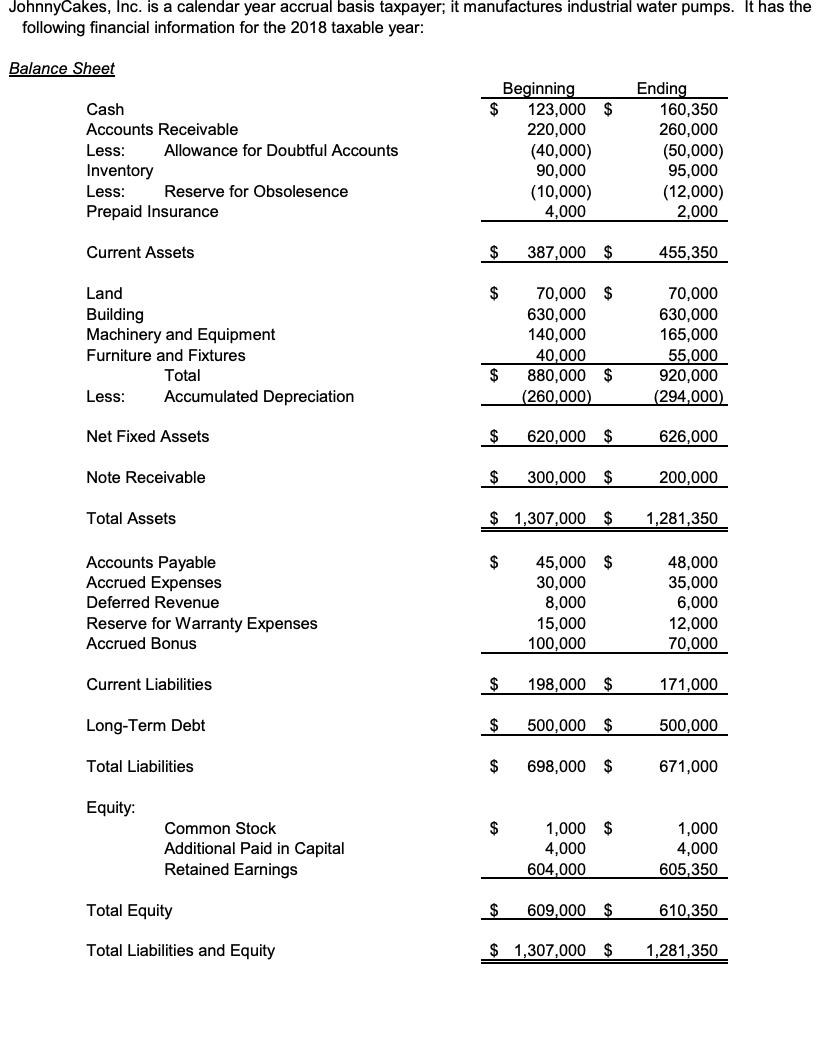

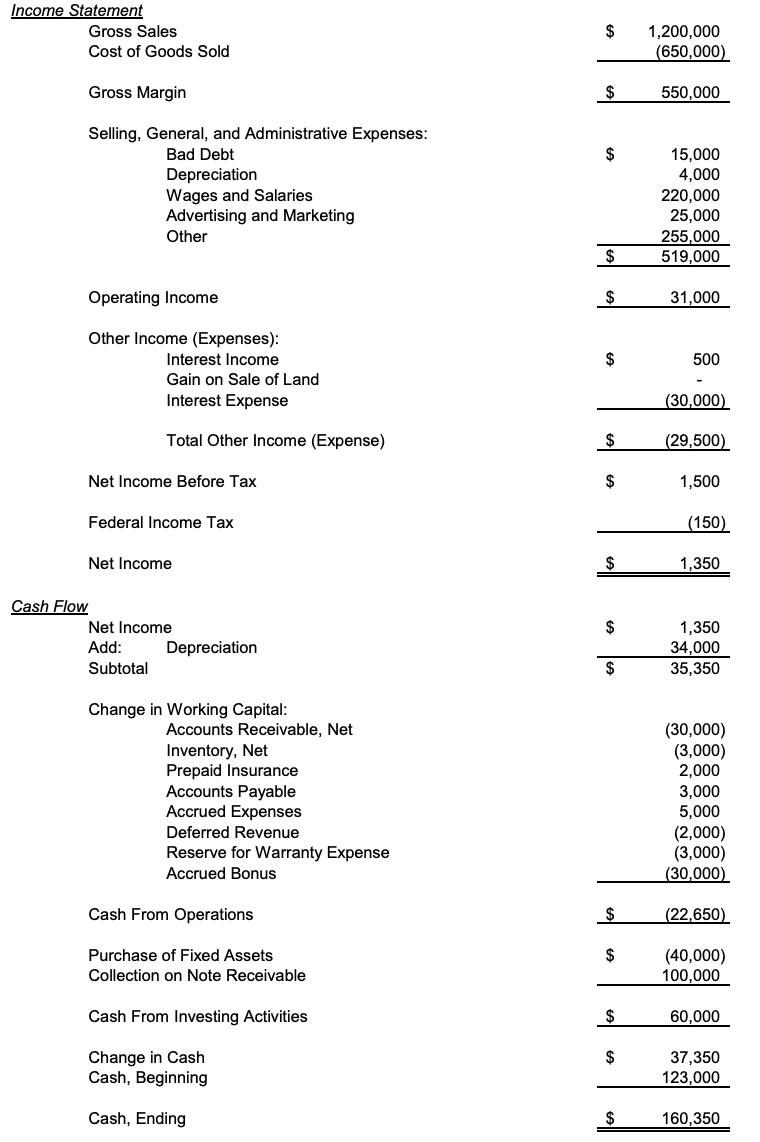

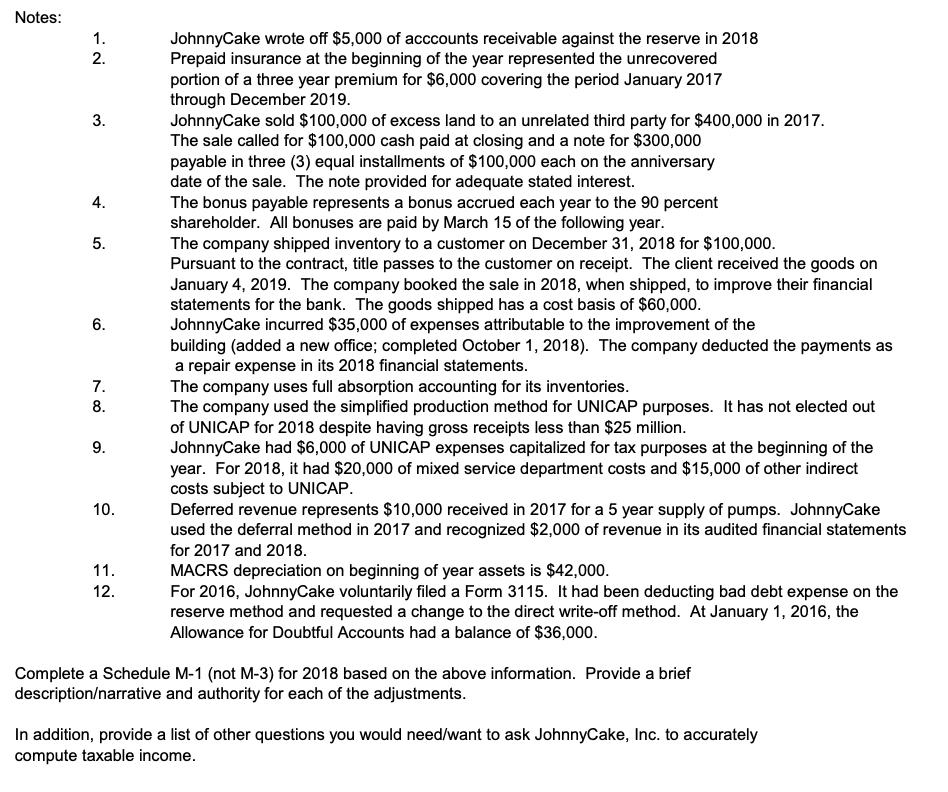

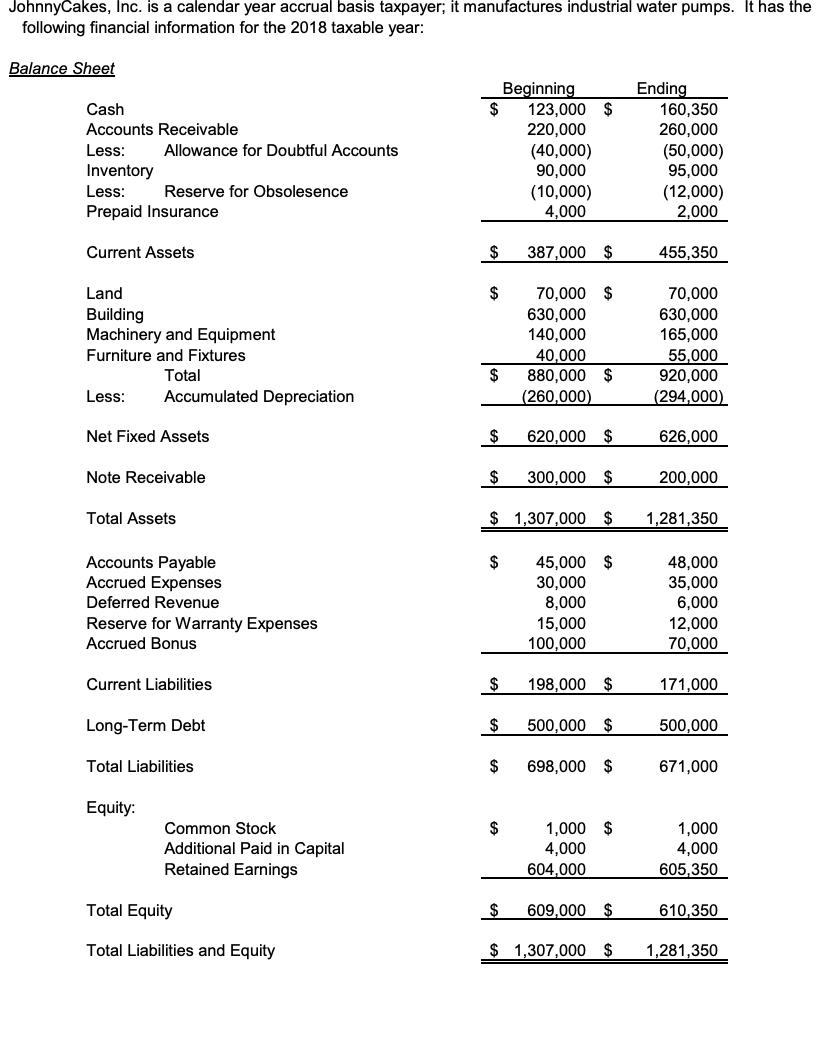

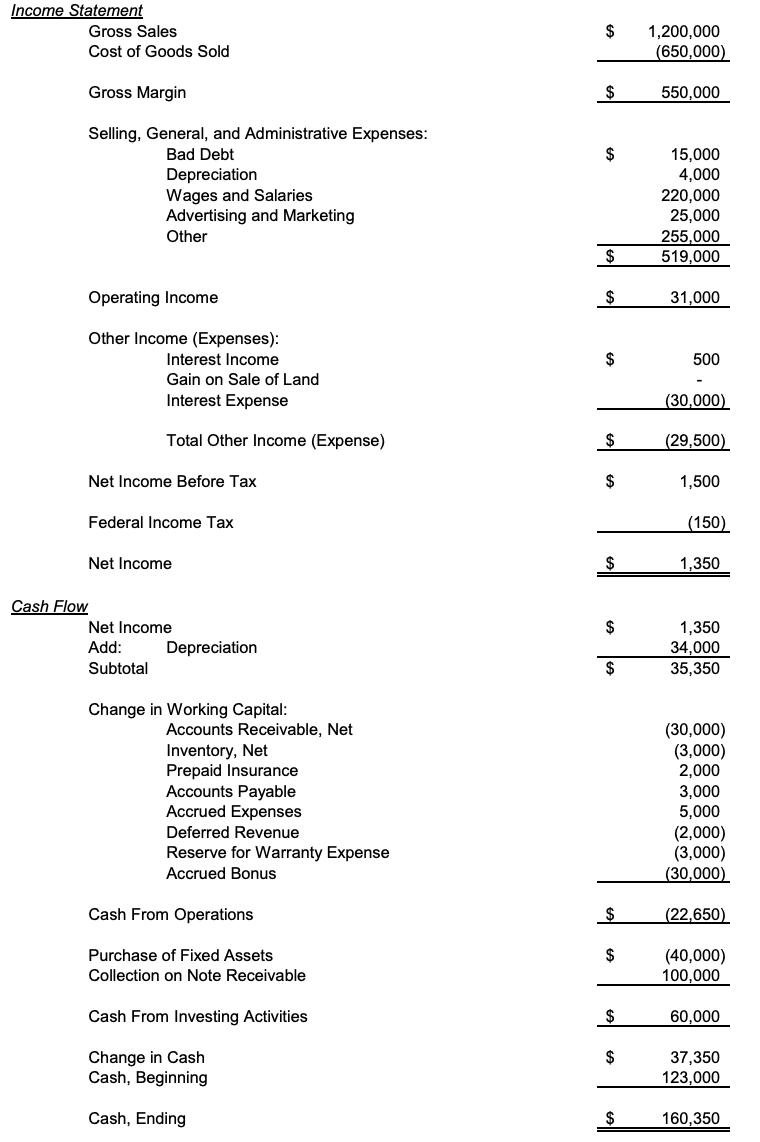

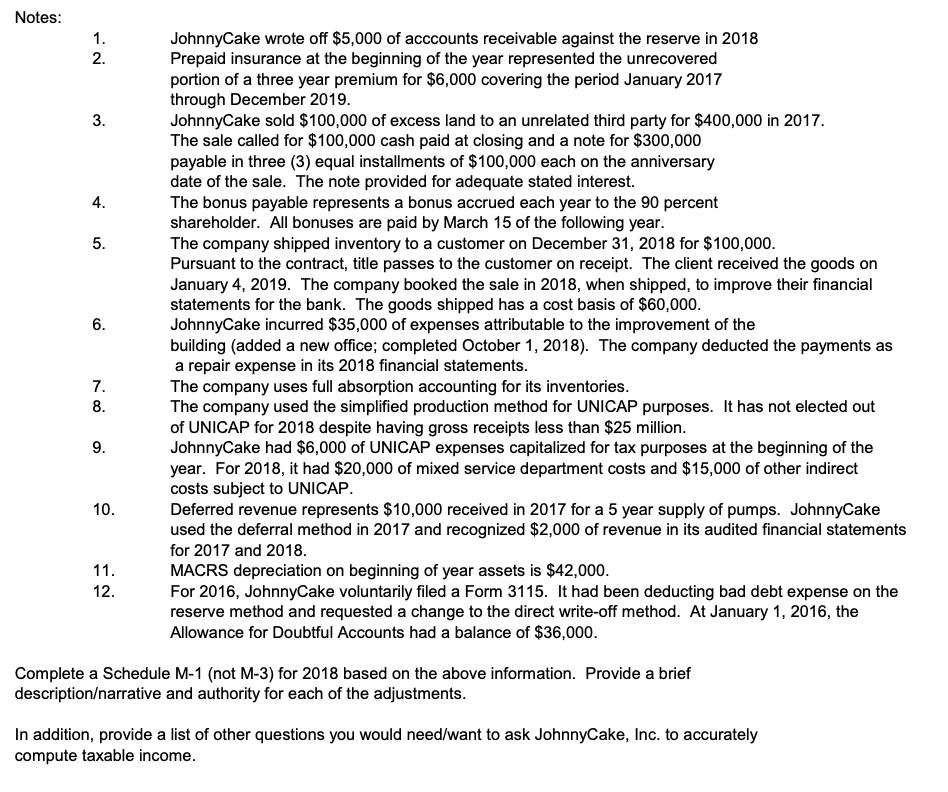

JohnnyCakes, Inc. is a calendar year accrual basis taxpayer; it manufactures industrial water pumps. It has the following financial information for the 2018 taxable

JohnnyCakes, Inc. is a calendar year accrual basis taxpayer; it manufactures industrial water pumps. It has the following financial information for the 2018 taxable year: Balance Sheet Beginning 123,000 $ 220,000 Ending 160,350 260,000 (50,000) 95,000 Cash Accounts Receivable Less: Allowance for Doubtful Accounts (40,000) 90,000 Inventory (10,000) 4,000 Less: Reserve for Obsolesence (12,000) 2,000 Prepaid Insurance Current Assets $ 387,000 $ 455,350 Land $ $ 70,000 630,000 140,000 40,000 70,000 630,000 165,000 Building Machinery and Equipment Furniture and Fixtures 55,000 $ 880,000 $ (260,000) Total 920,000 Less: Accumulated Depreciation (294,000) Net Fixed Assets 620,000 2$ 626,000 Note Receivable $ 300,000 $ 200,000 Total Assets $ 1,307,000 $ 1,281,350 Accounts Payable Accrued Expenses $ 45,000 $ 30,000 8,000 15,000 100,000 48,000 35,000 6,000 12,000 70,000 Deferred Revenue Reserve for Warranty Expenses Accrued Bonus Current Liabilities $ 198,000 $ 171,000 Long-Term Debt 500,000 $ 500,000 Total Liabilities $ 698,000 $ 671,000 Equity: $ 1,000 $ 4,000 604,000 1,000 4,000 605,350 Common Stock Additional Paid in Capital Retained Earnings Total Equity %24 609,000 $ 610,350 Total Liabilities and Equity $ 1,307,000 $ 1,281,350 Income Statement Gross Sales $ 1,200,000 Cost of Goods Sold (650,000) Gross Margin 2$ 550,000 Selling, General, and Administrative Expenses: Bad Debt Depreciation Wages and Salaries Advertising and Marketing $ 15,000 4,000 220,000 25,000 255,000 519,000 Other 2$ Operating Income $ 31,000 Other Income (Expenses): Interest Income $ 500 Gain on Sale of Land Interest Expense (30,000) Total Other Income (Expense) 2$ (29,500) Net Income Before Tax $ 1,500 Federal Income Tax (150) Net Income $ 1,350 Cash Flow 1,350 34,000 35,350 Net Income $ Add: Depreciation Subtotal $ Change in Working Capital: (30,000) (3,000) 2,000 3,000 5,000 (2,000) (3,000) (30,000) Accounts Receivable, Net Inventory, Net Prepaid Insurance Accounts Payable Accrued Expenses Deferred Revenue Reserve for Warranty Expense Accrued Bonus Cash From Operations (22,650) Purchase of Fixed Assets $ (40,000) 100,000 Collection on Note Receivable Cash From Investing Activities $ 60,000 Change in Cash Cash, Beginning $ 37,350 123,000 Cash, Ending 2$ 160,350 Notes: JohnnyCake wrote off $5,000 of acccounts receivable against the reserve in 2018 Prepaid insurance at the beginning of the year represented the unrecovered portion of a three year premium for $6,000 covering the period January 2017 through December 2019. JohnnyCake sold $100,000 of excess land to an unrelated third party for $400,000 in 2017. The sale called for $100,000 cash paid at closing and a note for $300,000 payable in three (3) equal installments of $100,000 each on the anniversary date of the sale. The note provided for adequate stated interest. The bonus payable represents a bonus accrued each year to the 90 percent shareholder. All bonuses are paid by March 15 of the following year. The company shipped inventory to a customer on December 31, 2018 for $100,000. Pursuant to the contract, title passes to the customer on receipt. The client received the goods on January 4, 2019. The company booked the sale in 2018, when shipped, to improve their financial statements for the bank. The goods shipped has a cost basis of $60,000. JohnnyCake incurred $35,000 of expenses attributable to the improvement of the building (added a new office; completed October 1, 2018). The company deducted the payments as a repair expense in its 2018 financial statements. The company uses full absorption accounting for its inventories. The company used the simplified production method for UNICAP purposes. It has not elected out of UNICAP for 2018 despite having gross receipts less than $25 million. JohnnyCake had $6,000 of UNICAP expenses capitalized for tax purposes at the beginning of the year. For 2018, it had $20,000 of mixed service department costs and $15,000 of other indirect costs subject to UNICAP. Deferred revenue represents $10,000 received in 2017 for a 5 year supply of pumps. JohnnyCake used the deferral method in 2017 and recognized $2,000 of revenue in its audited financial statements 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. for 2017 and 2018. MACRS depreciation on beginning of year assets is $42,000. For 2016, JohnnyCake voluntarily filed a Form 3115. It had been deducting bad debt expense on the reserve method and requested a change to the direct write-off method. At January 1, 2016, the Allowance for Doubtful Accounts had a balance of $36,000. 11. 12. Complete a Schedule M-1 (not M-3) for 2018 based on the above information. Provide a brief description/narrative and authority for each of the adjustments. In addition, provide a list of other questions you would need/want to ask JohnnyCake, Inc. to accurately compute taxable income. JohnnyCakes, Inc. is a calendar year accrual basis taxpayer; it manufactures industrial water pumps. It has the following financial information for the 2018 taxable year: Balance Sheet Beginning 123,000 $ 220,000 Ending 160,350 260,000 (50,000) 95,000 Cash Accounts Receivable Less: Allowance for Doubtful Accounts (40,000) 90,000 Inventory (10,000) 4,000 Less: Reserve for Obsolesence (12,000) 2,000 Prepaid Insurance Current Assets $ 387,000 $ 455,350 Land $ $ 70,000 630,000 140,000 40,000 70,000 630,000 165,000 Building Machinery and Equipment Furniture and Fixtures 55,000 $ 880,000 $ (260,000) Total 920,000 Less: Accumulated Depreciation (294,000) Net Fixed Assets 620,000 2$ 626,000 Note Receivable $ 300,000 $ 200,000 Total Assets $ 1,307,000 $ 1,281,350 Accounts Payable Accrued Expenses $ 45,000 $ 30,000 8,000 15,000 100,000 48,000 35,000 6,000 12,000 70,000 Deferred Revenue Reserve for Warranty Expenses Accrued Bonus Current Liabilities $ 198,000 $ 171,000 Long-Term Debt 500,000 $ 500,000 Total Liabilities $ 698,000 $ 671,000 Equity: $ 1,000 $ 4,000 604,000 1,000 4,000 605,350 Common Stock Additional Paid in Capital Retained Earnings Total Equity %24 609,000 $ 610,350 Total Liabilities and Equity $ 1,307,000 $ 1,281,350 Income Statement Gross Sales $ 1,200,000 Cost of Goods Sold (650,000) Gross Margin 2$ 550,000 Selling, General, and Administrative Expenses: Bad Debt Depreciation Wages and Salaries Advertising and Marketing $ 15,000 4,000 220,000 25,000 255,000 519,000 Other 2$ Operating Income $ 31,000 Other Income (Expenses): Interest Income $ 500 Gain on Sale of Land Interest Expense (30,000) Total Other Income (Expense) 2$ (29,500) Net Income Before Tax $ 1,500 Federal Income Tax (150) Net Income $ 1,350 Cash Flow 1,350 34,000 35,350 Net Income $ Add: Depreciation Subtotal $ Change in Working Capital: (30,000) (3,000) 2,000 3,000 5,000 (2,000) (3,000) (30,000) Accounts Receivable, Net Inventory, Net Prepaid Insurance Accounts Payable Accrued Expenses Deferred Revenue Reserve for Warranty Expense Accrued Bonus Cash From Operations (22,650) Purchase of Fixed Assets $ (40,000) 100,000 Collection on Note Receivable Cash From Investing Activities $ 60,000 Change in Cash Cash, Beginning $ 37,350 123,000 Cash, Ending 2$ 160,350 Notes: JohnnyCake wrote off $5,000 of acccounts receivable against the reserve in 2018 Prepaid insurance at the beginning of the year represented the unrecovered portion of a three year premium for $6,000 covering the period January 2017 through December 2019. JohnnyCake sold $100,000 of excess land to an unrelated third party for $400,000 in 2017. The sale called for $100,000 cash paid at closing and a note for $300,000 payable in three (3) equal installments of $100,000 each on the anniversary date of the sale. The note provided for adequate stated interest. The bonus payable represents a bonus accrued each year to the 90 percent shareholder. All bonuses are paid by March 15 of the following year. The company shipped inventory to a customer on December 31, 2018 for $100,000. Pursuant to the contract, title passes to the customer on receipt. The client received the goods on January 4, 2019. The company booked the sale in 2018, when shipped, to improve their financial statements for the bank. The goods shipped has a cost basis of $60,000. JohnnyCake incurred $35,000 of expenses attributable to the improvement of the building (added a new office; completed October 1, 2018). The company deducted the payments as a repair expense in its 2018 financial statements. The company uses full absorption accounting for its inventories. The company used the simplified production method for UNICAP purposes. It has not elected out of UNICAP for 2018 despite having gross receipts less than $25 million. JohnnyCake had $6,000 of UNICAP expenses capitalized for tax purposes at the beginning of the year. For 2018, it had $20,000 of mixed service department costs and $15,000 of other indirect costs subject to UNICAP. Deferred revenue represents $10,000 received in 2017 for a 5 year supply of pumps. JohnnyCake used the deferral method in 2017 and recognized $2,000 of revenue in its audited financial statements 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. for 2017 and 2018. MACRS depreciation on beginning of year assets is $42,000. For 2016, JohnnyCake voluntarily filed a Form 3115. It had been deducting bad debt expense on the reserve method and requested a change to the direct write-off method. At January 1, 2016, the Allowance for Doubtful Accounts had a balance of $36,000. 11. 12. Complete a Schedule M-1 (not M-3) for 2018 based on the above information. Provide a brief description/narrative and authority for each of the adjustments. In addition, provide a list of other questions you would need/want to ask JohnnyCake, Inc. to accurately compute taxable income.

Step by Step Solution

★★★★★

3.43 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Notes 1 JohnnyCake wrote off 5000 of accounts receivable against the reserve in 2018 2 Prepaid insurance at the beginning of the year represented the unrecovered portion of a threeyear premium for 600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started