Answered step by step

Verified Expert Solution

Question

1 Approved Answer

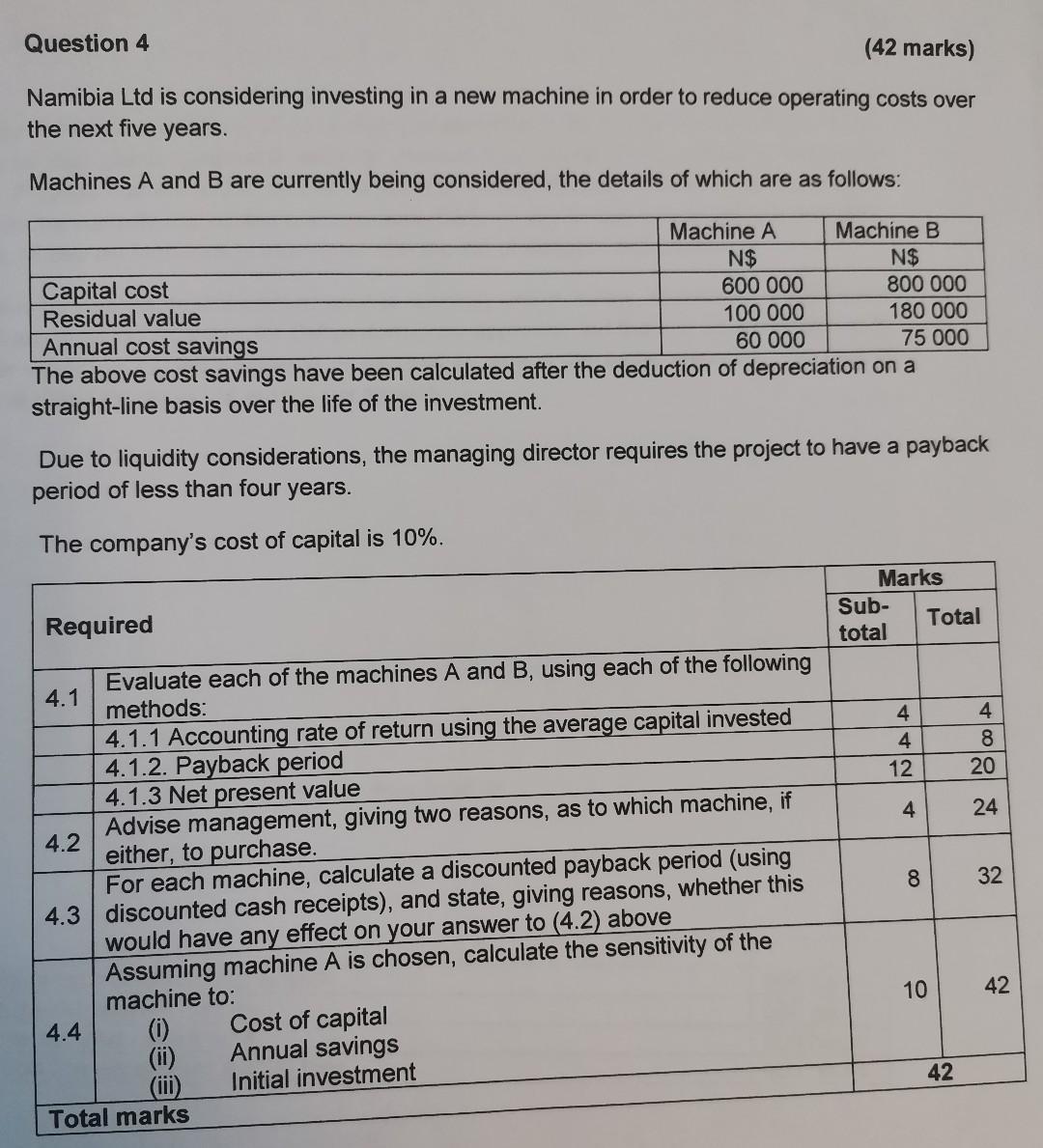

(42 marks) Namibia Ltd is considering investing in a new machine in order to reduce operating costs over the next five years. Machines A

(42 marks) Namibia Ltd is considering investing in a new machine in order to reduce operating costs over the next five years. Machines A and B are currently being considered, the details of which are as follows: Question 4 Machine B N$ 800 000 180 000 75 000 The above cost savings have been calculated after the deduction of depreciation on a straight-line basis over the life of the investment. Capital cost Residual value Annual cost savings Due to liquidity considerations, the managing director requires the project to have a payback period of less than four years. The company's cost of capital is 10%. Required 4.1 4.2 Machine A N$ 600 000 100 000 60 000 4.4 Evaluate each of the machines A and B, using each of the following methods: 4.1.1 Accounting rate of return using the average capital invested 4.1.2. Payback period 4.1.3 Net present value Advise management, giving two reasons, as to which machine, if either, to purchase. For each machine, calculate a discounted payback period (using 4.3 discounted cash receipts), and state, giving reasons, whether this would have any effect on your answer to (4.2) above Assuming machine A is chosen, calculate the sensitivity of the machine to: (i) (iii) Total marks Cost of capital Annual savings Initial investment Marks Sub- total 4 4 12 4 00 8 Total 10 42 4884 20 24 32 42

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

411 ARR method ARR Net income average investmentx100 Machine A60000250000x10024 Machine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started