Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John's company manufactures robots designed to do house cleaning and other manual chores. RRI prepares its financial statements in accordance with ASPE. RRI has

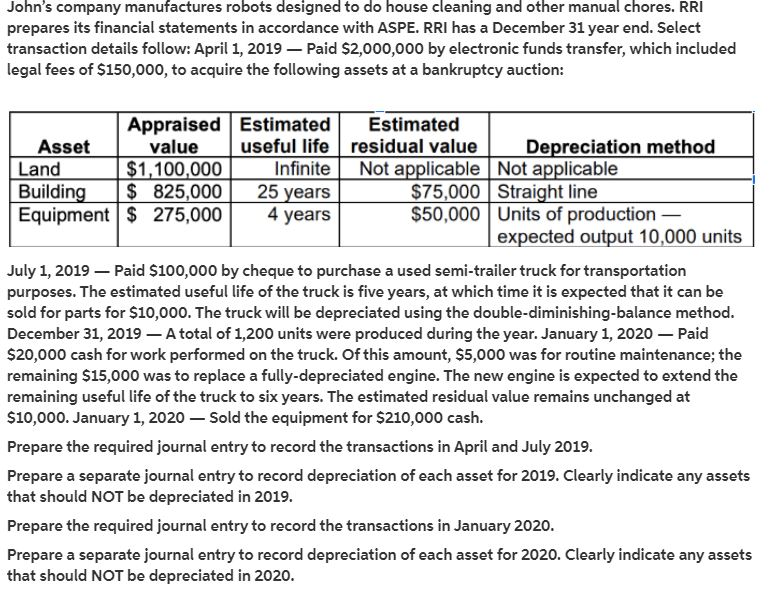

John's company manufactures robots designed to do house cleaning and other manual chores. RRI prepares its financial statements in accordance with ASPE. RRI has a December 31 year end. Select transaction details follow: April 1, 2019 - Paid $2,000,000 by electronic funds transfer, which included legal fees of $150,000, to acquire the following assets at a bankruptcy auction: Asset Appraised Estimated value useful life $1,100,000 Land Building $ 825,000 Equipment $ 275,000 Infinite 25 years 4 years Estimated residual value Not applicable $75,000 $50,000 Depreciation method Not applicable Straight line Units of production - expected output 10,000 units July 1, 2019 - Paid $100,000 by cheque to purchase a used semi-trailer truck for transportation purposes. The estimated useful life of the truck is five years, at which time it is expected that it can be sold for parts for $10,000. The truck will be depreciated using the double-diminishing-balance method. December 31, 2019 A total of 1,200 units were produced during the year. January 1, 2020 Paid $20,000 cash for work performed on the truck. Of this amount, $5,000 was for routine maintenance; the remaining $15,000 was to replace a fully-depreciated engine. The new engine is expected to extend the remaining useful life of the truck to six years. The estimated residual value remains unchanged at $10,000. January 1, 2020 - Sold the equipment for $210,000 cash. Prepare the required journal entry to record the transactions in April and July 2019. Prepare a separate journal entry to record depreciation of each asset for 2019. Clearly indicate any assets that should NOT be depreciated in 2019. Prepare the required journal entry to record the transactions in January 2020. Prepare a separate journal entry to record depreciation of each asset for 2020. Clearly indicate any assets that should NOT be depreciated in 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started