Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson and Co, is a public company incorporated on January 1, 2023 with an authorized share capital of unlimited no par value common shares,

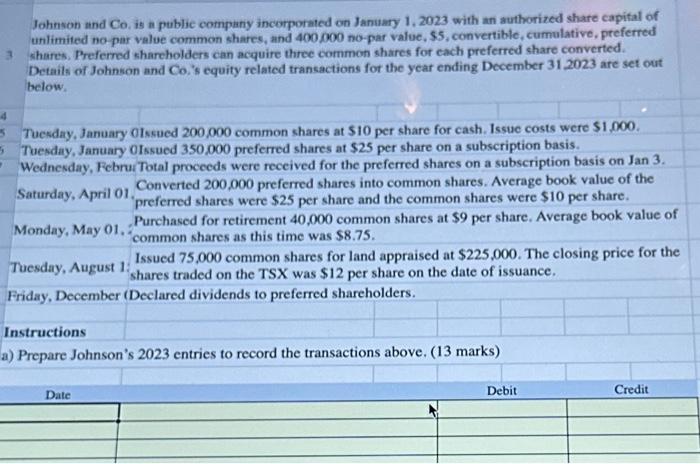

Johnson and Co, is a public company incorporated on January 1, 2023 with an authorized share capital of unlimited no par value common shares, and 400,000 no-par value, $5, convertible, cumulative, preferred 3 shares. Preferred shareholders can acquire three common shares for each preferred share converted. Details of Johnson and Co.'s equity related transactions for the year ending December 31,2023 are set out below. Tuesday, January Olssued 200,000 common shares at $10 per share for cash. Issue costs were $1,000. 5 Tuesday, January 0Issued 350,000 preferred shares at $25 per share on a subscription basis. 7 Wednesday, FebruiTotal proceeds were received for the preferred shares on a subscription basis on Jan 3. Converted 200,000 preferred shares into common shares. Average book value of the 'preferred shares were $25 per share and the common shares were $10 per share. Saturday, April 01, Monday, May 01.2 Issued 75,000 common shares for land appraised at $225,000. The closing price for the Tuesday, August 13 shares traded on the TSX was $12 per share on the date of issuance. Friday, December (Declared dividends to preferred shareholders. Purchased for retirement 40,000 common shares at $9 per share. Average book value of common shares as this time was $8.75. Instructions a) Prepare Johnson's 2023 entries to record the transactions above. (13 marks) Date Debit Credit

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The image displays a scenario describing various transactions made by a public company Johnson and Co related to equity for the year ending December 31 2023 Each transaction requires a corresponding j...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started