Question

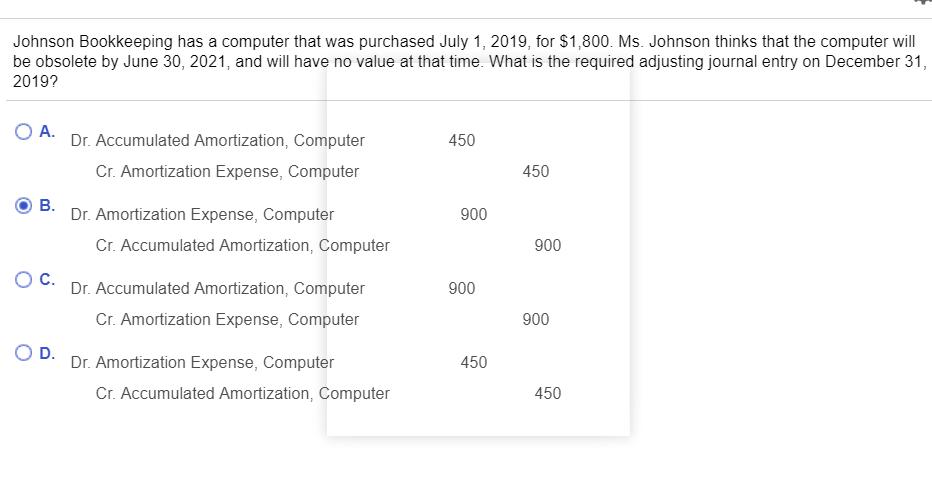

Johnson Bookkeeping has a computer that was purchased July 1, 2019, for $1,800. Ms. Johnson thinks that the computer will be obsolete by June

Johnson Bookkeeping has a computer that was purchased July 1, 2019, for $1,800. Ms. Johnson thinks that the computer will be obsolete by June 30, 2021, and will have no value at that time. What is the required adjusting journal entry on December 31, 2019? O A. B. O C. O D. Dr. Accumulated Amortization, Computer Cr. Amortization Expense, Computer Dr. Amortization Expense, Computer Cr. Accumulated Amortization, Computer Dr. Accumulated Amortization, Computer Cr. Amortization Expense, Computer Dr. Amortization Expense, Computer Cr. Accumulated Amortization, Computer 450 900 900 450 450 900 900 450

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is C Dr Accu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy

10th Canadian Edition Volume 2

1118300858, 978-1118300855

Students also viewed these Civil Engineering questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App