Answered step by step

Verified Expert Solution

Question

1 Approved Answer

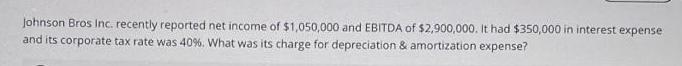

Johnson Bros Inc. recently reported net income of $1,050,000 and EBITDA of $2,900,000. It had $350,000 in interest expense and its corporate tax rate

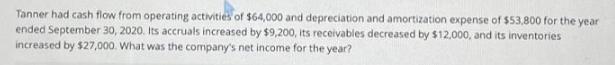

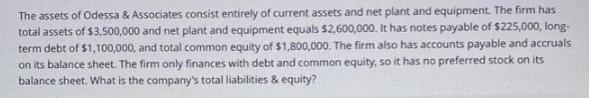

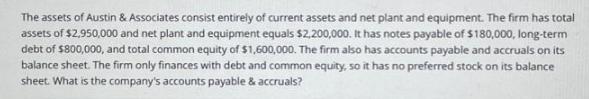

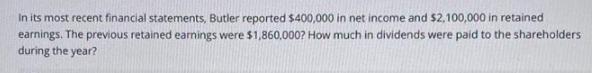

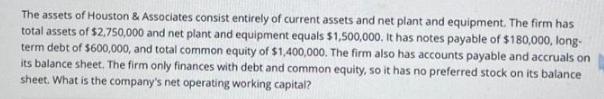

Johnson Bros Inc. recently reported net income of $1,050,000 and EBITDA of $2,900,000. It had $350,000 in interest expense and its corporate tax rate was 40 % . What was its charge for depreciation & amortization expense? Tanner had cash flow from operating activities of $64,000 and depreciation and amortization expense of $53,800 for the year ended September 30, 2020. Its accruals increased by $9,200, its receivables decreased by $12,000, and its inventories increased by $27,000. What was the company's net income for the year? The assets of Odessa & Associates consist entirely of current assets and net plant and equipment. The firm has total assets of $3,500,000 and net plant and equipment equals $2,600,000. It has notes payable of $225,000, long- term debt of $1,100,000, and total common equity of $1,800,000. The firm also has accounts payable and accruals on its balance sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. What is the company's total liabilities & equity? The assets of Austin & Associates consist entirely of current assets and net plant and equipment. The firm has total assets of $2,950,000 and net plant and equipment equals $2,200,000. It has notes payable of $180,000, long-term debt of $800,000, and total common equity of $1,600,000. The firm also has accounts payable and accruals on its balance sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. What is the company's accounts payable & accruals? In its most recent financial statements, Butler reported $400,000 in net income and $2,100,000 in retained earnings. The previous retained earnings were $1,860,000? How much in dividends were paid to the shareholders during the year? The assets of Houston & Associates consist entirely of current assets and net plant and equipment. The firm has total assets of $2,750,000 and net plant and equipment equals $1,500,000. It has notes payable of $180,000, long- term debt of $600,000, and total common equity of $1,400,000. The firm also has accounts payable and accruals on its balance sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. What is the company's net operating working capital?

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the net operating working capital NOWC you need to subtract the nonoperating current liabilities from the current assets Nonoperating current liabilities include accounts payable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started