Question

Johnson Company is considering two alternative investments in equipment for a five-year period. Bonuses are determined by the company's return on investment (ROI), which has

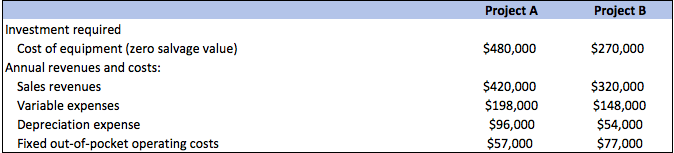

Johnson Company is considering two alternative investments in equipment for a five-year period. Bonuses are determined by the company's return on investment (ROI), which has exceeded 21% each of the last three years. Cost and revenue estimates for each project are as follows:

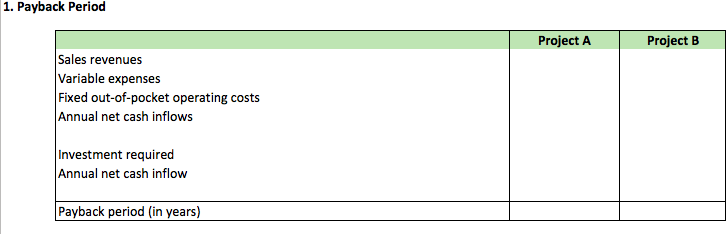

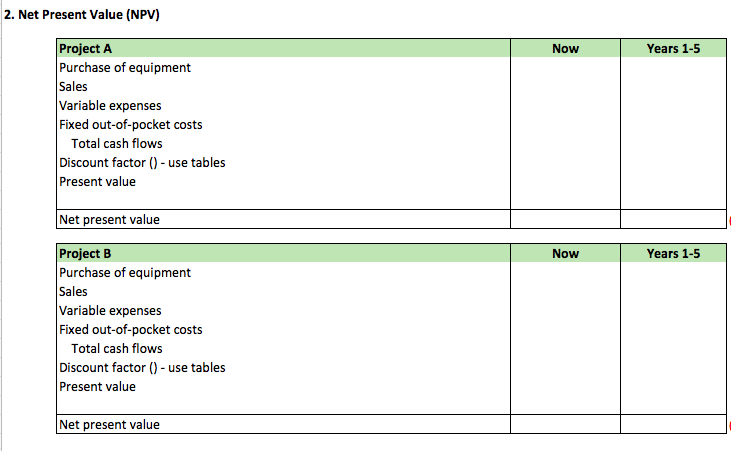

Johnson's discount rate is 19%

View Exhibits 12B-1 and 12B-2, in Appendix 12B: Present Value Tables of your textbook, to determine the appropriate discount factor (Brewer, Garrison, & Noreen, 2019, pp. 612 - 613).

You are required to compute the following:

1. Calculate the payback period for each project.

2. Calculate the net present value (NPV) for each project.

3. Calculate the internal rate of return (IRR) for each project.

4. Prepare a memo to the division president. State which project Johnson Company should invest in. Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started