Question

Johnson Company owns a plot of land on which is buried over 100 underground storage tanks filled with industrial waste. Since it will require

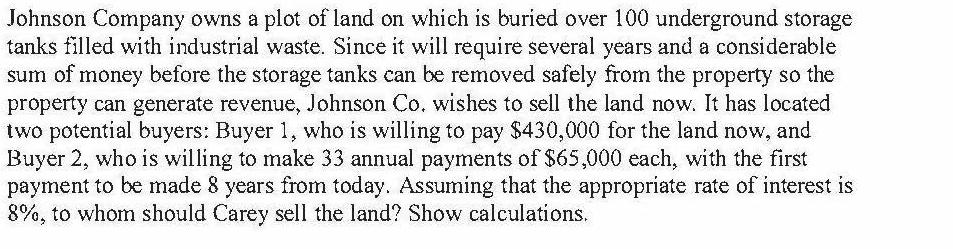

Johnson Company owns a plot of land on which is buried over 100 underground storage tanks filled with industrial waste. Since it will require several years and a considerable sum of money before the storage tanks can be removed safely from the property so the property can generate revenue, Johnson Co. wishes to sell the land now. It has located two potential buyers: Buyer 1, who is willing to pay $430,000 for the land now, and Buyer 2, who is willing to make 33 annual payments of $65,000 each, with the first payment to be made 8 years from today. Assuming that the appropriate rate of interest is 8%, to whom should Carey sell the land? Show calculations.

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Buyer 1 Present value of Cash Flow 430000 Buyer 2 Year Cash Flow PV Factor 8 Present Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Methods For Business

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam

11th Edition

978-0324651812, 324651813, 978-0324651751

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App