Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson Company started its operations on January 1, 2018 and decided to change its inventory costing method from LIFO to FIFO inventory costing method

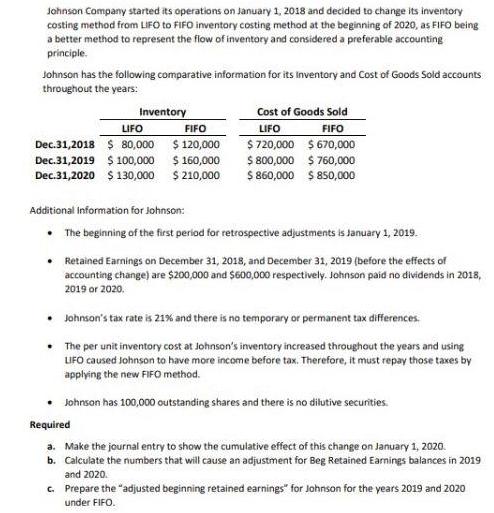

Johnson Company started its operations on January 1, 2018 and decided to change its inventory costing method from LIFO to FIFO inventory costing method at the beginning of 2020, as FIFO being a better method to represent the flow of inventory and considered a preferable accounting principle. Johnson has the following comparative information for its Inventory and Cost of Goods Sold accounts throughout the years: Inventory Cost of Goods Sold FIFO LIFO FIFO LIFO Dec.31,2018 $ 80,000 $120,000 $720,000 $670,000 Dec.31,2019 $ 100,000 $160,000 $ 800,000 $760,000 Dec.31,2020 $ 130,000 $ 210,000 $ 860,000 $ 850,000 Additional Information for Johnson: The beginning of the first period for retrospective adjustments is January 1, 2019. Retained Earnings on December 31, 2018, and December 31, 2019 (before the effects of accounting change) are $200,000 and $600,000 respectively. Johnson paid no dividends in 2018, 2019 or 2020. Johnson's tax rate is 21% and there is no temporary or permanent tax differences. The per unit inventory cost at Johnson's inventory increased throughout the years and using LIFO caused Johnson to have more income before tax. Therefore, it must repay those taxes by applying the new FIFO method. Johnson has 100,000 outstanding shares and there is no dilutive securities. Required a. Make the journal entry to show the cumulative effect of this change on January 1, 2020. b. Calculate the numbers that will cause an adjustment for Beg Retained Earnings balances in 2019 and 2020. c. Prepare the "adjusted beginning retained earnings" for Johnson for the years 2019 and 2020 under FIFO.

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

According to the data Ang Johnson Company started its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started