Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson Control Systems Limited is examining the possibility of closing down production at one of its factories in Southern Ontario. A partial balance sheet

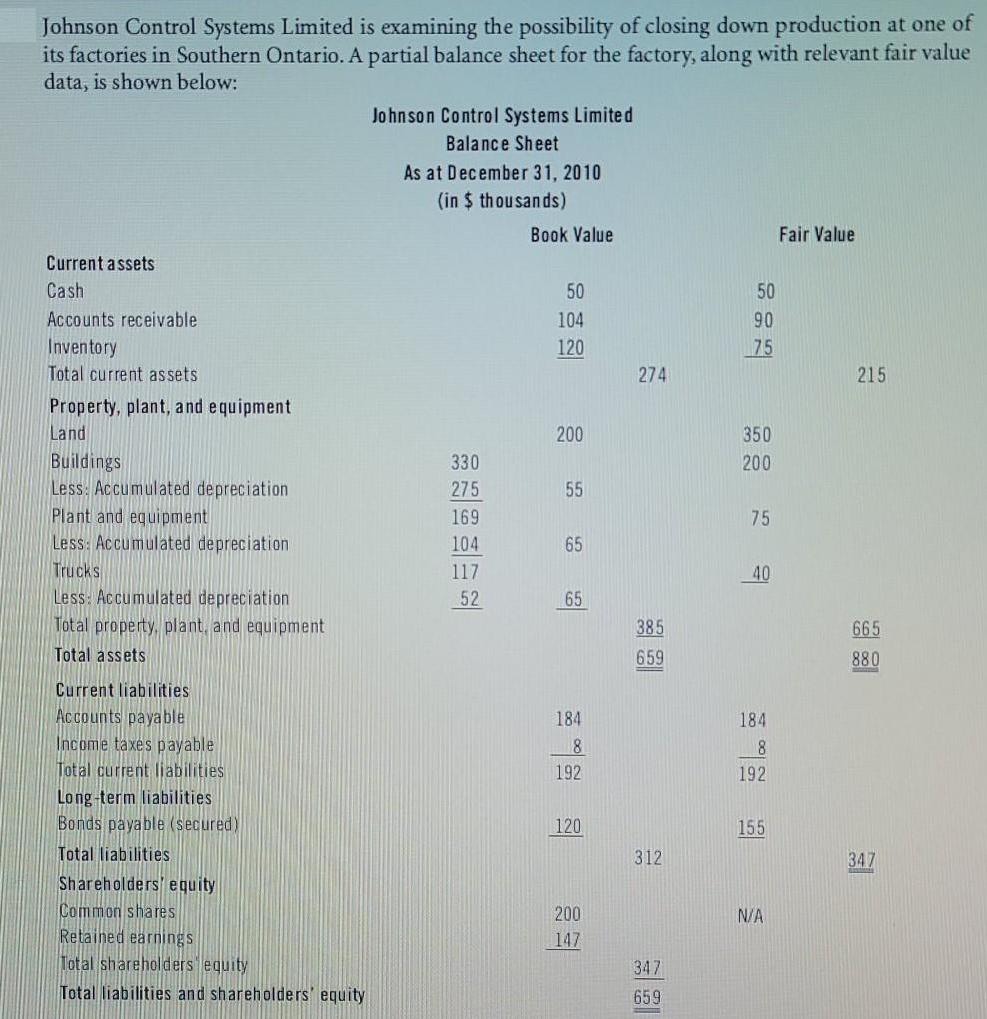

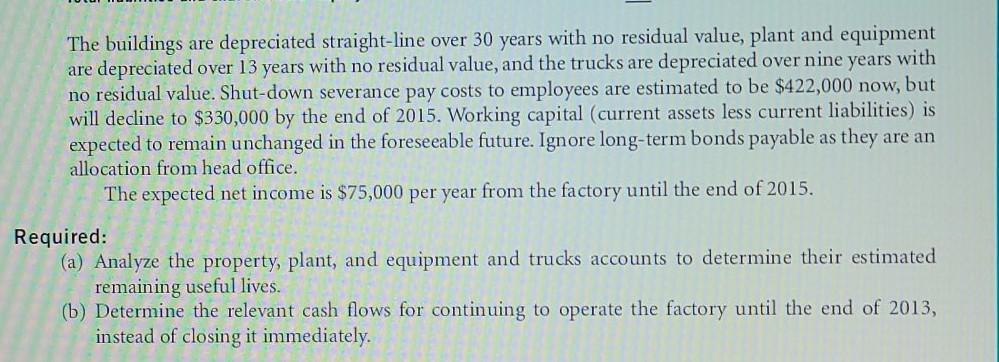

Johnson Control Systems Limited is examining the possibility of closing down production at one of its factories in Southern Ontario. A partial balance sheet for the factory, along with relevant fair value data, is shown below: Johnson Control Systems Limited Balance Sheet As at December 31, 2010 (in $ thousands) Book Value Fair Value Current a ssets Cash 50 50 Accounts receivable 104 90 Inventory Total current assets 120 75 274 215 Property, plant, and equipment Land 200 350 Buildings Less: Accumulated depreciation 330 200 275 55 Plant and equipment Less: Accumulated depreciation Trucks Less: Accumulated depreciation 169 75 104 65 117 40 52 65 Total property, plant, and equipment 385 665 Total assets 659 880 Current liabilities Accounts payable Income taxes payable Total current liabilities 184 184 8 192 192 Long -term liabilities Bonds payable (secured) Total liabilities 120 155 312 347 Shareholders' equity Common shares 200 N/A Retained earnings Total shareholders equity 147 347 Total liabilities and shareholders' equity 659 The buildings are depreciated straight-line over 30 years with no residual value, plant and equipment are depreciated over 13 years with no residual value, and the trucks are depreciated over nine years with no residual value. Shut-down severance pay costs to employees are estimated to be $422,000 now, but will decline to $330,000 by the end of 2015. Working capital (current assets less current liabilities) is expected to remain unchanged in the foreseeable future. Ignore long-term bonds payable as they are an allocation from head office. The expected net income is $75,000 per year from the factory until the end of 2015. Required: (a) Analyze the property, plant, and equipment and trucks accounts to determine their estimated remaining useful lives. (b) Determine the relevant cash flows for continuing to operate the factory until the end of 2013, instead of closing it immediately. Johnson Control Systems Limited is examining the possibility of closing down production at one of its factories in Southern Ontario. A partial balance sheet for the factory, along with relevant fair value data, is shown below: Johnson Control Systems Limited Balance Sheet As at December 31, 2010 (in $ thousands) Book Value Fair Value Current a ssets Cash 50 50 Accounts receivable 104 90 Inventory Total current assets 120 75 274 215 Property, plant, and equipment Land 200 350 Buildings Less: Accumulated depreciation 330 200 275 55 Plant and equipment Less: Accumulated depreciation Trucks Less: Accumulated depreciation 169 75 104 65 117 40 52 65 Total property, plant, and equipment 385 665 Total assets 659 880 Current liabilities Accounts payable Income taxes payable Total current liabilities 184 184 8 192 192 Long -term liabilities Bonds payable (secured) Total liabilities 120 155 312 347 Shareholders' equity Common shares 200 N/A Retained earnings Total shareholders equity 147 347 Total liabilities and shareholders' equity 659 The buildings are depreciated straight-line over 30 years with no residual value, plant and equipment are depreciated over 13 years with no residual value, and the trucks are depreciated over nine years with no residual value. Shut-down severance pay costs to employees are estimated to be $422,000 now, but will decline to $330,000 by the end of 2015. Working capital (current assets less current liabilities) is expected to remain unchanged in the foreseeable future. Ignore long-term bonds payable as they are an allocation from head office. The expected net income is $75,000 per year from the factory until the end of 2015. Required: (a) Analyze the property, plant, and equipment and trucks accounts to determine their estimated remaining useful lives. (b) Determine the relevant cash flows for continuing to operate the factory until the end of 2013, instead of closing it immediately. Johnson Control Systems Limited is examining the possibility of closing down production at one of its factories in Southern Ontario. A partial balance sheet for the factory, along with relevant fair value data, is shown below: Johnson Control Systems Limited Balance Sheet As at December 31, 2010 (in $ thousands) Book Value Fair Value Current a ssets Cash 50 50 Accounts receivable 104 90 Inventory Total current assets 120 75 274 215 Property, plant, and equipment Land 200 350 Buildings Less: Accumulated depreciation 330 200 275 55 Plant and equipment Less: Accumulated depreciation Trucks Less: Accumulated depreciation 169 75 104 65 117 40 52 65 Total property, plant, and equipment 385 665 Total assets 659 880 Current liabilities Accounts payable Income taxes payable Total current liabilities 184 184 8 192 192 Long -term liabilities Bonds payable (secured) Total liabilities 120 155 312 347 Shareholders' equity Common shares 200 N/A Retained earnings Total shareholders equity 147 347 Total liabilities and shareholders' equity 659 The buildings are depreciated straight-line over 30 years with no residual value, plant and equipment are depreciated over 13 years with no residual value, and the trucks are depreciated over nine years with no residual value. Shut-down severance pay costs to employees are estimated to be $422,000 now, but will decline to $330,000 by the end of 2015. Working capital (current assets less current liabilities) is expected to remain unchanged in the foreseeable future. Ignore long-term bonds payable as they are an allocation from head office. The expected net income is $75,000 per year from the factory until the end of 2015. Required: (a) Analyze the property, plant, and equipment and trucks accounts to determine their estimated remaining useful lives. (b) Determine the relevant cash flows for continuing to operate the factory until the end of 2013, instead of closing it immediately. Johnson Control Systems Limited is examining the possibility of closing down production at one of its factories in Southern Ontario. A partial balance sheet for the factory, along with relevant fair value data, is shown below: Johnson Control Systems Limited Balance Sheet As at December 31, 2010 (in $ thousands) Book Value Fair Value Current a ssets Cash 50 50 Accounts receivable 104 90 Inventory Total current assets 120 75 274 215 Property, plant, and equipment Land 200 350 Buildings Less: Accumulated depreciation 330 200 275 55 Plant and equipment Less: Accumulated depreciation Trucks Less: Accumulated depreciation 169 75 104 65 117 40 52 65 Total property, plant, and equipment 385 665 Total assets 659 880 Current liabilities Accounts payable Income taxes payable Total current liabilities 184 184 8 192 192 Long -term liabilities Bonds payable (secured) Total liabilities 120 155 312 347 Shareholders' equity Common shares 200 N/A Retained earnings Total shareholders equity 147 347 Total liabilities and shareholders' equity 659 The buildings are depreciated straight-line over 30 years with no residual value, plant and equipment are depreciated over 13 years with no residual value, and the trucks are depreciated over nine years with no residual value. Shut-down severance pay costs to employees are estimated to be $422,000 now, but will decline to $330,000 by the end of 2015. Working capital (current assets less current liabilities) is expected to remain unchanged in the foreseeable future. Ignore long-term bonds payable as they are an allocation from head office. The expected net income is $75,000 per year from the factory until the end of 2015. Required: (a) Analyze the property, plant, and equipment and trucks accounts to determine their estimated remaining useful lives. (b) Determine the relevant cash flows for continuing to operate the factory until the end of 2013, instead of closing it immediately.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Remaining useful life Property Plant and equipment Building Cost of Building330 Accumulated deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started