Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson Controls is a manufacturing company and had the following investment related activities during 20Y3: 1. The company purchased Jones & Co.'s 5-year, 5%,

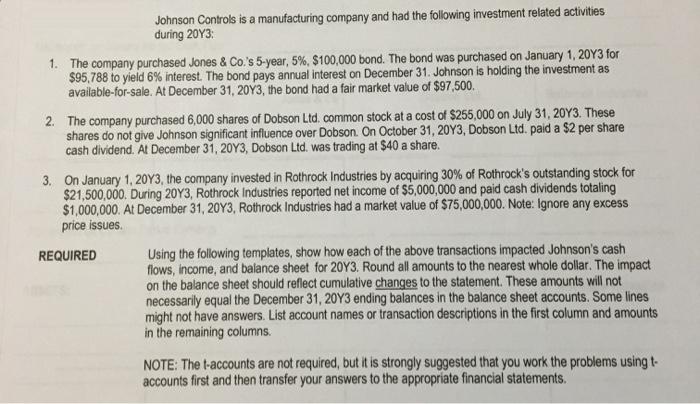

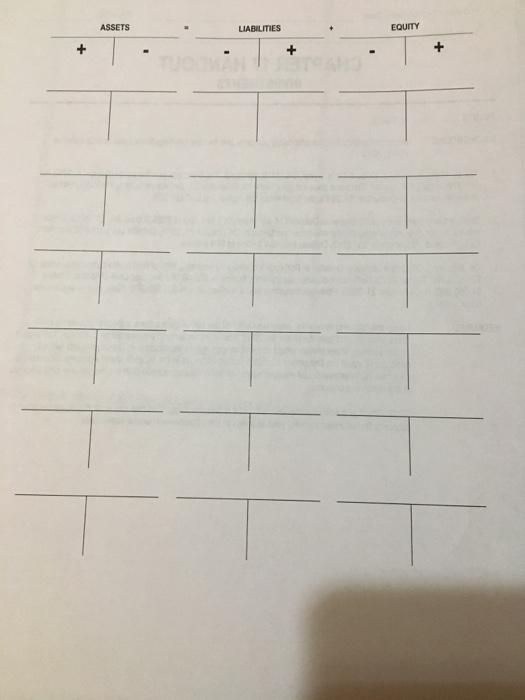

Johnson Controls is a manufacturing company and had the following investment related activities during 20Y3: 1. The company purchased Jones & Co.'s 5-year, 5%, $100,000 bond. The bond was purchased on January 1, 20Y3 for $95,788 to yield 6% interest. The bond pays annual interest on December 31. Johnson is holding the investment as available-for-sale. At December 31, 20Y3, the bond had a fair market value of $97,500. 2. The company purchased 6,000 shares of Dobson Ltd. common stock at a cost of $255,000 on July 31, 20Y3. These shares do not give Johnson significant influence over Dobson. On October 31, 20Y3, Dobson Ltd. paid a $2 per share cash dividend. At December 31, 20Y3, Dobson Ltd. was trading at $40 a share. 3. On January 1, 20Y3, the company invested in Rothrock Industries by acquiring 30% of Rothrock's outstanding stock for $21,500,000. During 20Y3, Rothrock Industries reported net income of $5,000,000 and paid cash dividends totaling $1,000,000. At December 31, 20Y3, Rothrock Industries had a market value of $75,000,000. Note: Ignore any excess price issues. REQUIRED Using the following templates, show how each of the above transactions impacted Johnson's cash flows, income, and balance sheet for 20Y3. Round all amounts to the nearest whole dollar. The impact on the balance sheet should reflect cumulative changes to the statement. These amounts will not necessarily equal the December 31, 20Y3 ending balances in the balance sheet accounts. Some lines might not have answers. List account names or transaction descriptions in the first column and amounts in the remaining columns. NOTE: The t-accounts are not required, but it is strongly suggested that you work the problems using t- accounts first and then transfer your answers to the appropriate financial statements. ASSETS LIABILITIES + - EQUITY IMPACT ON CURRENT PERIOD CASH FLOW Net Impact on Current Period Cash Flow Net Impact on Current Period Earnings ASSETS: Cumulative Change in Assets LIABILITIES+EQUITY: Cumulative Change in Liabilities + Equity Jones & Co Jones & Co Jones & Co Dobson Ltd. Dobson Ltd. Dobson Ltd. Rothrock Industries Rothrock Industries Rothrock Industries CHAPTER 17 HANDOUT PAGE:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 2 3 Date Jan 1 20Y3 July 3120Y3 Oct31 20Y3 31Dec 1Jan 31De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started