Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson CPA Firm has been assisting a client with tax preparation work. The client is a small business who hired Johnson CPA Firm because

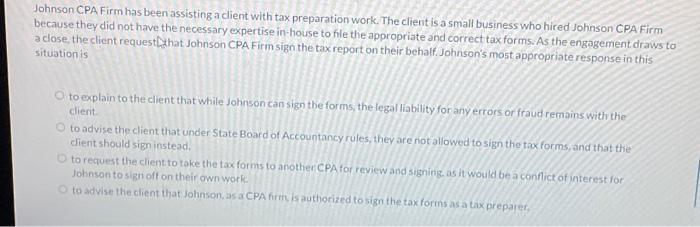

Johnson CPA Firm has been assisting a client with tax preparation work. The client is a small business who hired Johnson CPA Firm because they did not have the necessary expertise in-house to file the appropriate and correct tax forms. As the engagement draws to a close, the client request that Johnson CPA Firm sign the tax report on their behalf. Johnson's most appropriate response in this situation is O to explain to the client that while Johnson can sign the forms, the legal liability for any errors or fraud remains with the client. O to advise the client that under State Board of Accountancy rules, they are not allowed to sign the tax forms, and that the client should sign instead. O to request the client to take the tax forms to another CPA for review and signing, as it would be a conflict of interest for Johnson to sign off on their own work O to advise the client that Johnson, as a CPA firm, is authorized to sign the tax forms as a tax preparer,

Step by Step Solution

★★★★★

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started