Question

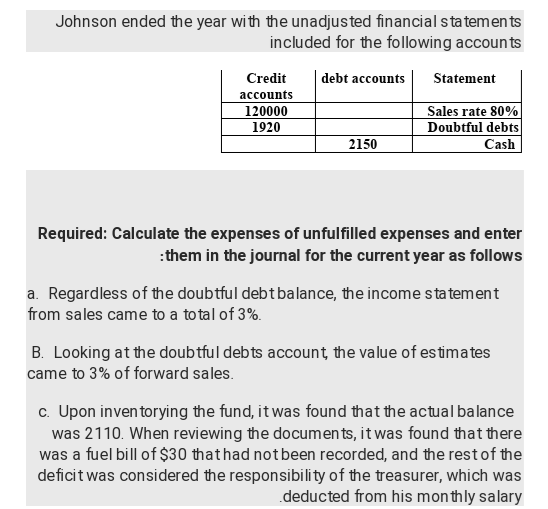

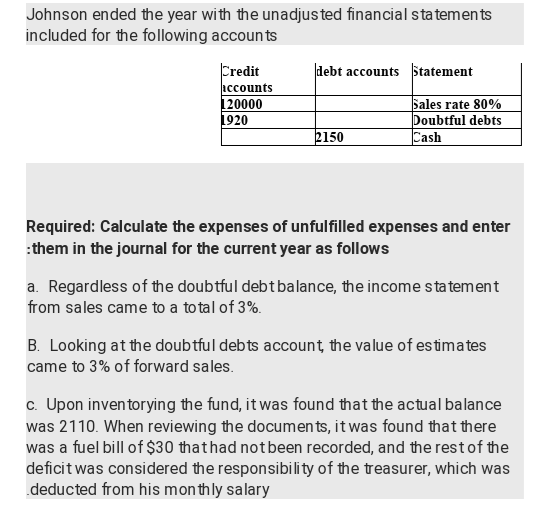

Johnson ended the year with the unadjusted financial statements included for the following accounts Statement debt accounts Credit accounts Sales rate 80% 120000 Doubtful debts

Johnson ended the year with the unadjusted financial statements included for the following accounts Statement debt accounts Credit accounts Sales rate 80% 120000 Doubtful debts 1920 Cash

2150 Required: Calculate the expenses of unfulfilled expenses and enter them in the journal for the current year as follows: a. Regardless of the doubtful debt balance, the income statement from sales came to a total of 3%. B. Looking at the doubtful debts account, the value of estimates came to 3% of forward sales. c. Upon inventorying the fund, it was found that the actual balance was 2110. When reviewing the documents, it was found that there was a fuel bill of $30 that had not been recorded, and the rest of the deficit was considered the responsibility of the treasurer, which was deducted from his monthly salary.

Johnson ended the year with the unadjusted financial statements included for the following accounts debt accounts Statement Credit accounts 120000 1920 Sales rate 80% Doubtful debts Cash 2150 Required: Calculate the expenses of unfulfilled expenses and enter them in the journal for the current year as follows a. Regardless of the doubtful debt balance, the income statement from sales came to a total of 3%. B. Looking at the doubtful debts account the value of estimates came to 3% of forward sales. c. Upon inventorying the fund, it was found that the actual balance was 2110. When reviewing the documents, it was found that there was a fuel bill of $30 that had not been recorded, and the rest of the deficit was considered the responsibility of the treasurer, which was deducted from his monthly salary Johnson ended the year with the unadjusted financial statements included for the following accounts debt accounts Statement Credit accounts 120000 1920 Sales rate 80% Doubtful debts Cash 2150 Required: Calculate the expenses of unfulfilled expenses and enter them in the journal for the current year as follows a. Regardless of the doubtful debt balance, the income statement from sales came to a total of 3%. B. Looking at the doubtful debts account the value of estimates came to 3% of forward sales. c. Upon inventorying the fund, it was found that the actual balance was 2110. When reviewing the documents, it was found that there was a fuel bill of $30 that had not been recorded, and the rest of the deficit was considered the responsibility of the treasurer, which was deducted from his monthly salaryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started