Answered step by step

Verified Expert Solution

Question

1 Approved Answer

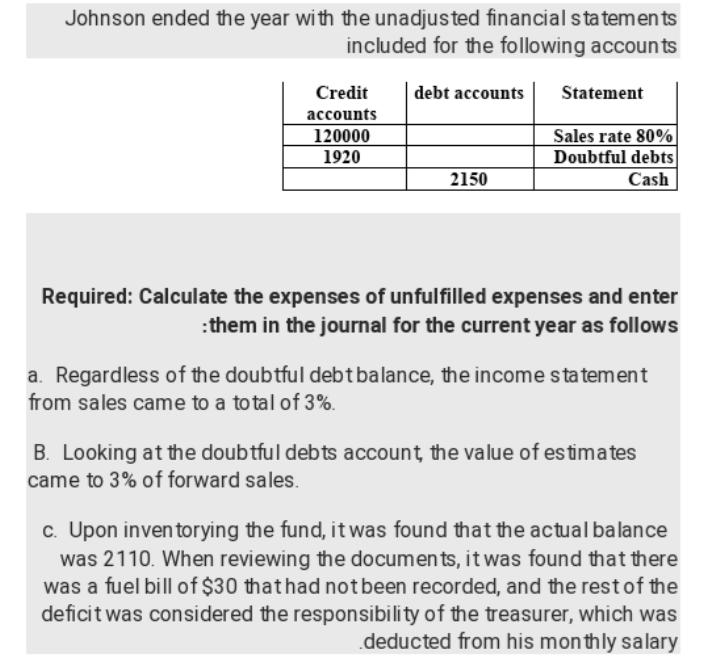

Johnson ended the year with the unadjusted financial statements included for the following accounts Credit accounts 120000 1920 debt accounts 2150 Statement Sales rate

Johnson ended the year with the unadjusted financial statements included for the following accounts Credit accounts 120000 1920 debt accounts 2150 Statement Sales rate 80% Doubtful debts Cash Required: Calculate the expenses of unfulfilled expenses and enter :them in the journal for the current year as follows a. Regardless of the doubtful debt balance, the income statement from sales came to a total of 3%. B. Looking at the doubtful debts account, the value of estimates came to 3% of forward sales. c. Upon inventorying the fund, it was found that the actual balance was 2110. When reviewing the documents, it was found that there was a fuel bill of $30 that had not been recorded, and the rest of the deficit was considered the responsibility of the treasurer, which was deducted from his monthly salary

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

General Guidance The answer provided below has been developed in a clear step by step manner Step 1 Given sales 80 120000 a Regardless of the doubtful debt balance the income statement from sales came ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started