Question

Johnson Graphics Company was organized on January 1, 2017, by Cameron Johnson. At the end of the first 6 months of operations, the trial balance

Johnson Graphics Company was organized on January 1, 2017, by Cameron Johnson. At the end of the first 6 months of operations, the trial balance contained the accounts shown below.

| Debits | Credits | |||||

| Cash | $ 8,600 | Notes Payable | $ 20,000 | |||

| Accounts Receivable | 14,000 | Accounts Payable | 9,000 | |||

| Equipment | 45,000 | Owners Capital | 22,000 | |||

| Insurance Expense | 2,700 | Sales Revenue | 52,100 | |||

| Salaries and Wages Expense | 30,000 | Service Revenue | 6,000 | |||

| Supplies Expense | 3,700 | |||||

| Advertising Expense | 1,900 | |||||

| Rent Expense | 1,500 | |||||

| Utilities Expense | 1,700 | |||||

| $109,100 | $109,100 |

Analysis reveals the following additional data.

| 1. | The $3,700 balance in Supplies Expense represents supplies purchased in January. At June 30, $1,500 of supplies was on hand. | |

| 2. | The note payable was issued on February 1. It is a 9%, 6-month note. | |

| 3. | The balance in Insurance Expense is the premium on a one-year policy, dated March 1, 2017. | |

| 4. | Service revenues are credited to revenue when received. At June 30, service revenue of $1,300 is unearned. | |

| 5. | Revenue for services performed but unrecorded at June 30 totals $2,000. | |

| 6. | Depreciation is $2,250 per year. |

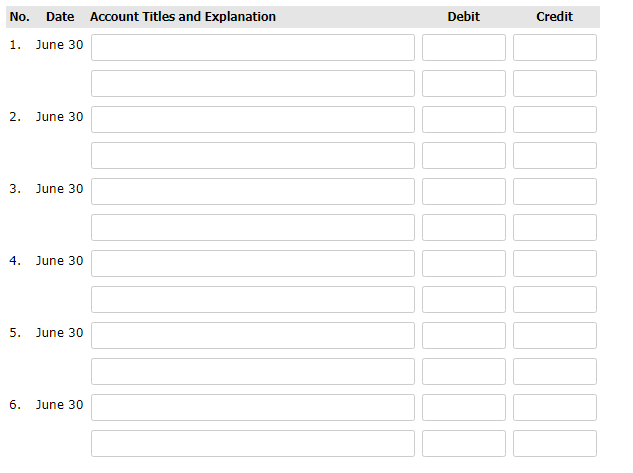

1. Journalize the adjusting entries at June 30. (Assume adjustments are recorded every 6 months.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

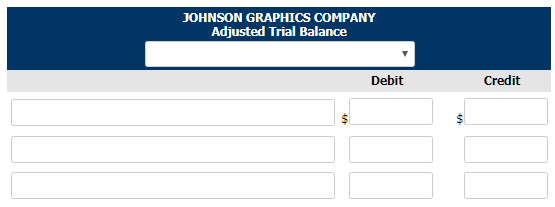

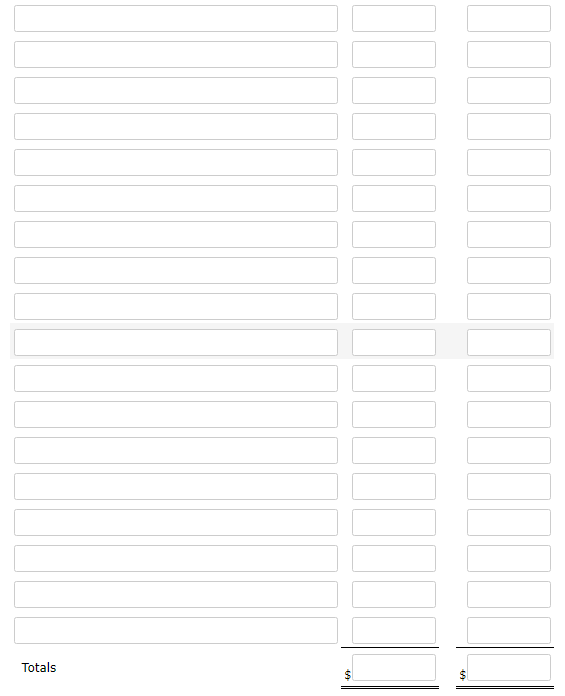

2. Prepare an adjusted trial balance.

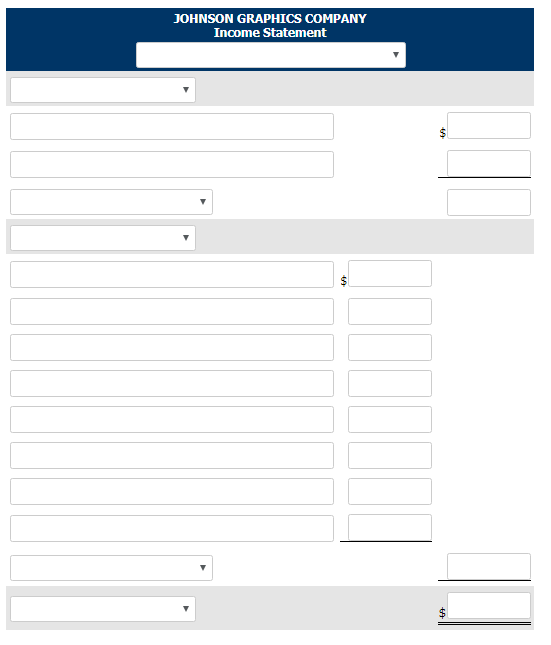

3. Prepare an income statement for the 6 months ended June 30.

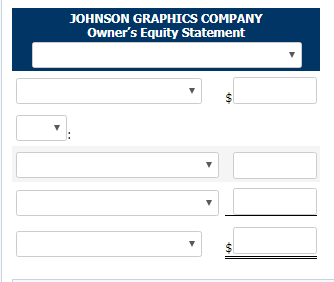

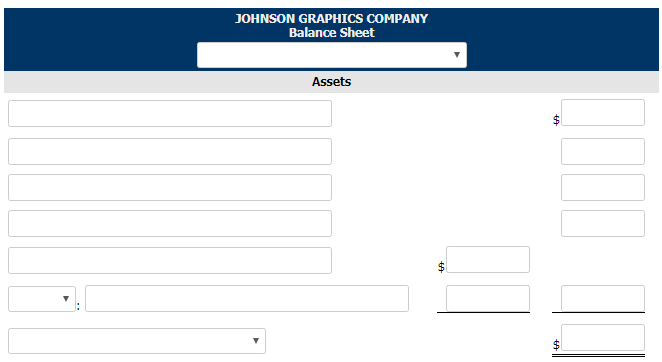

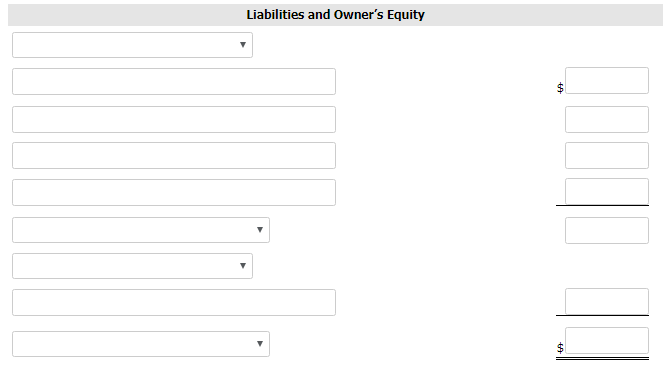

4. Prepare an owners equity statement for the 6 months ended June 30 and balance sheet (at June 30).

List of Accounts:

Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Buildings Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Land Maintenance and Repairs Expense Mortgage Payable No Entry Notes Payable Owner's Capital Owner's Drawings Prepaid Advertising Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Subscription Revenue Supplies Supplies Expense Ticket Revenue Unearned Rent Revenue Unearned Service Revenue Unearned Subscription Revenue Unearned Ticket Revenue Utilities Expense

Please help with as much as allowed. Please include any necessary calculations.

No. Date Account Titles and Explanation Debit Credit 1. June 30 2. June 30 3. June 30 4. June 30 5. June 30 6. June 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started