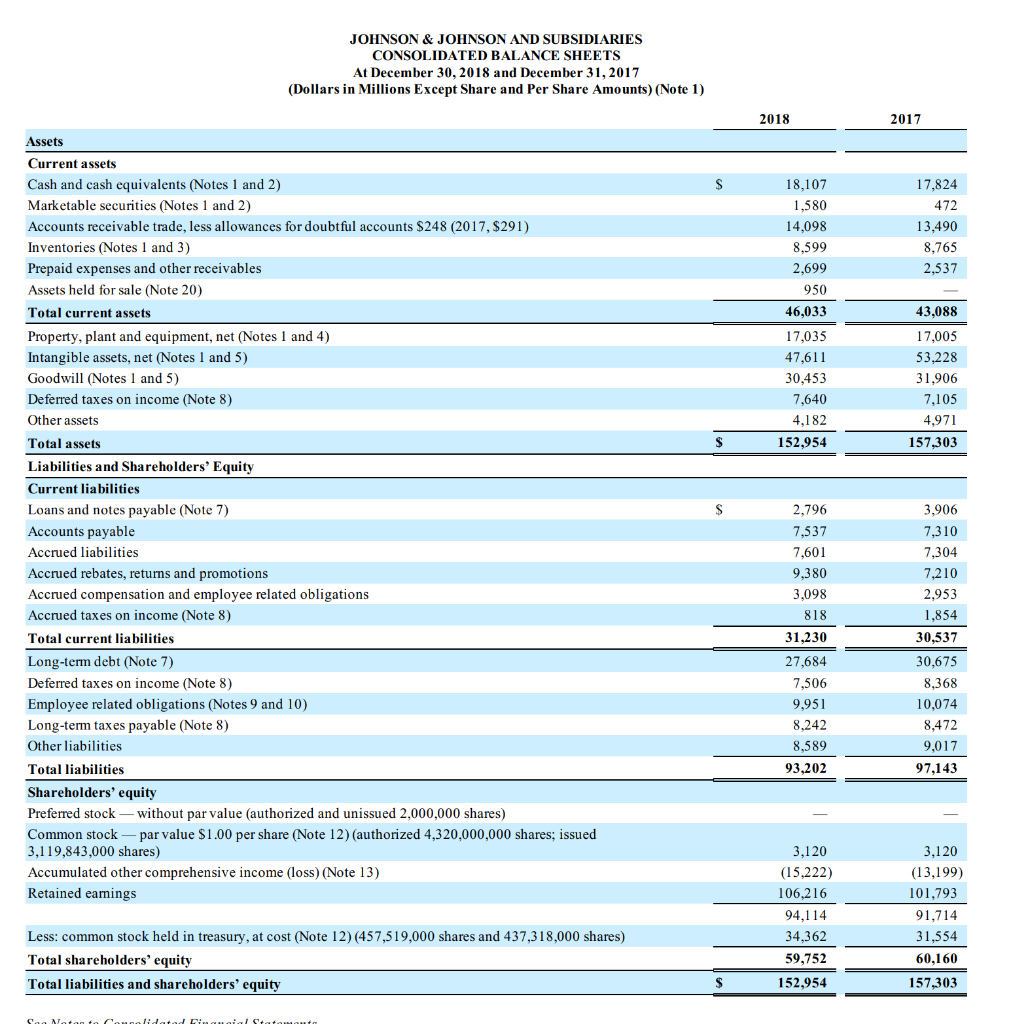

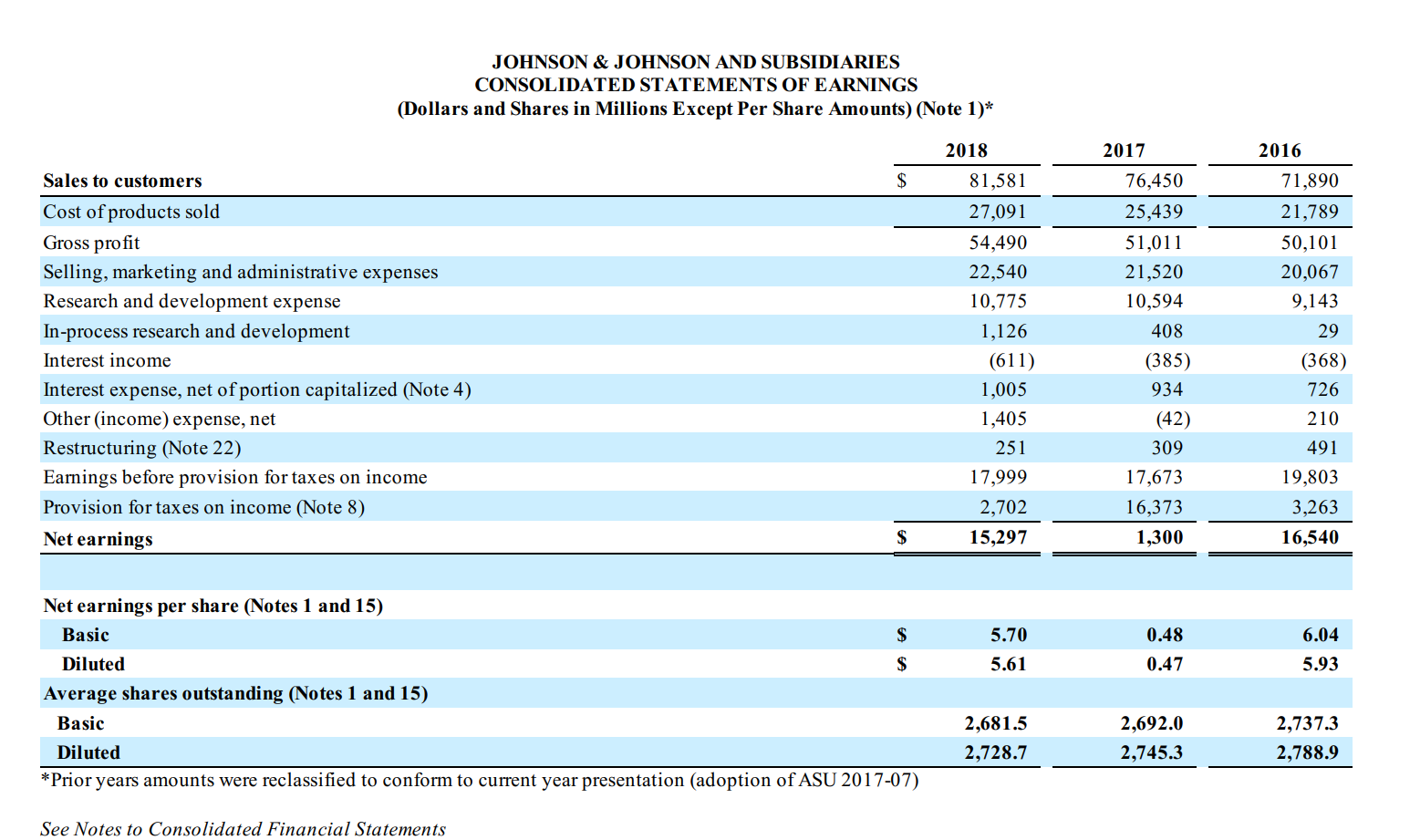

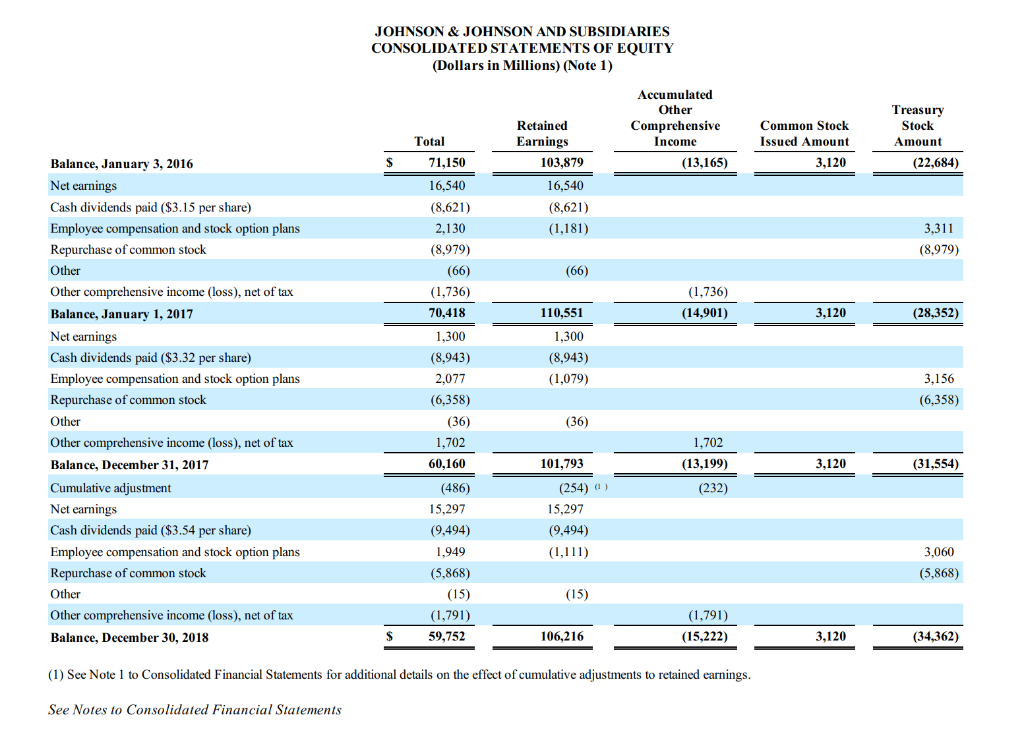

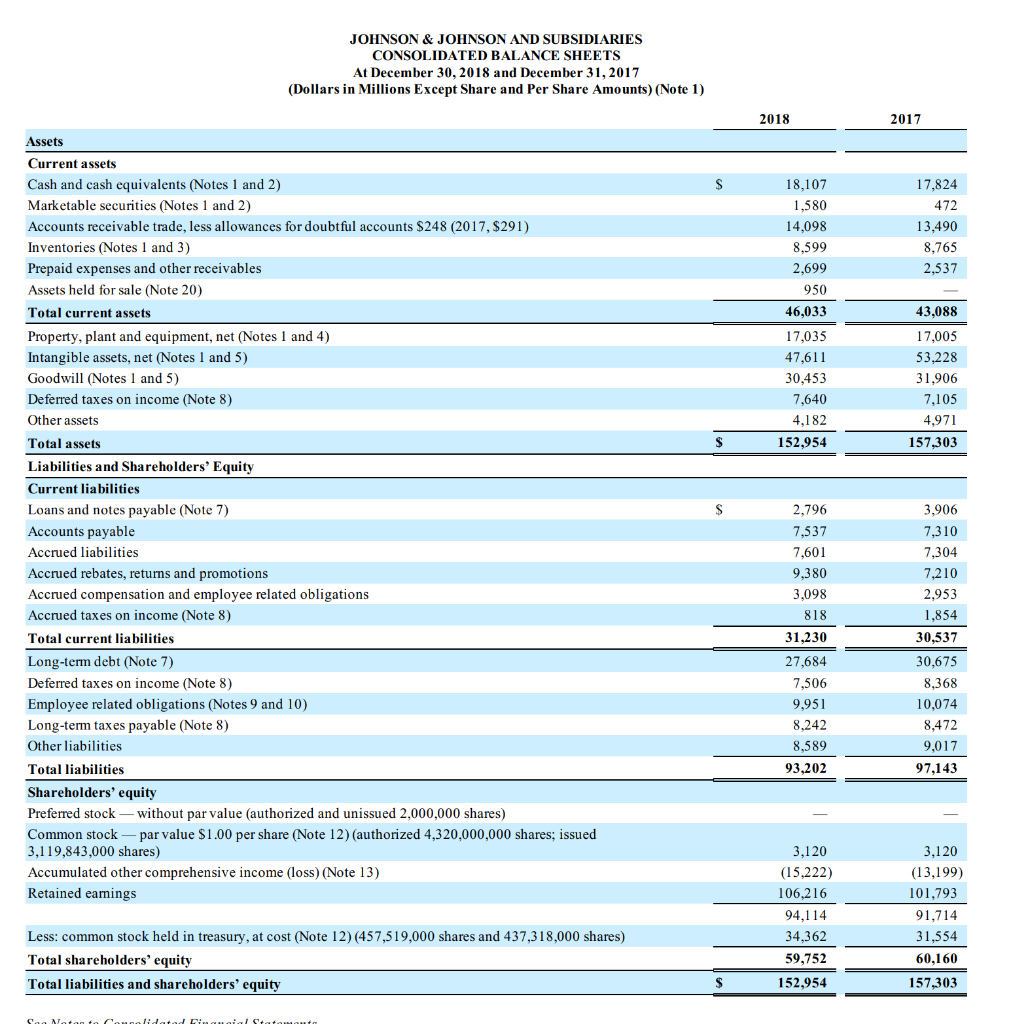

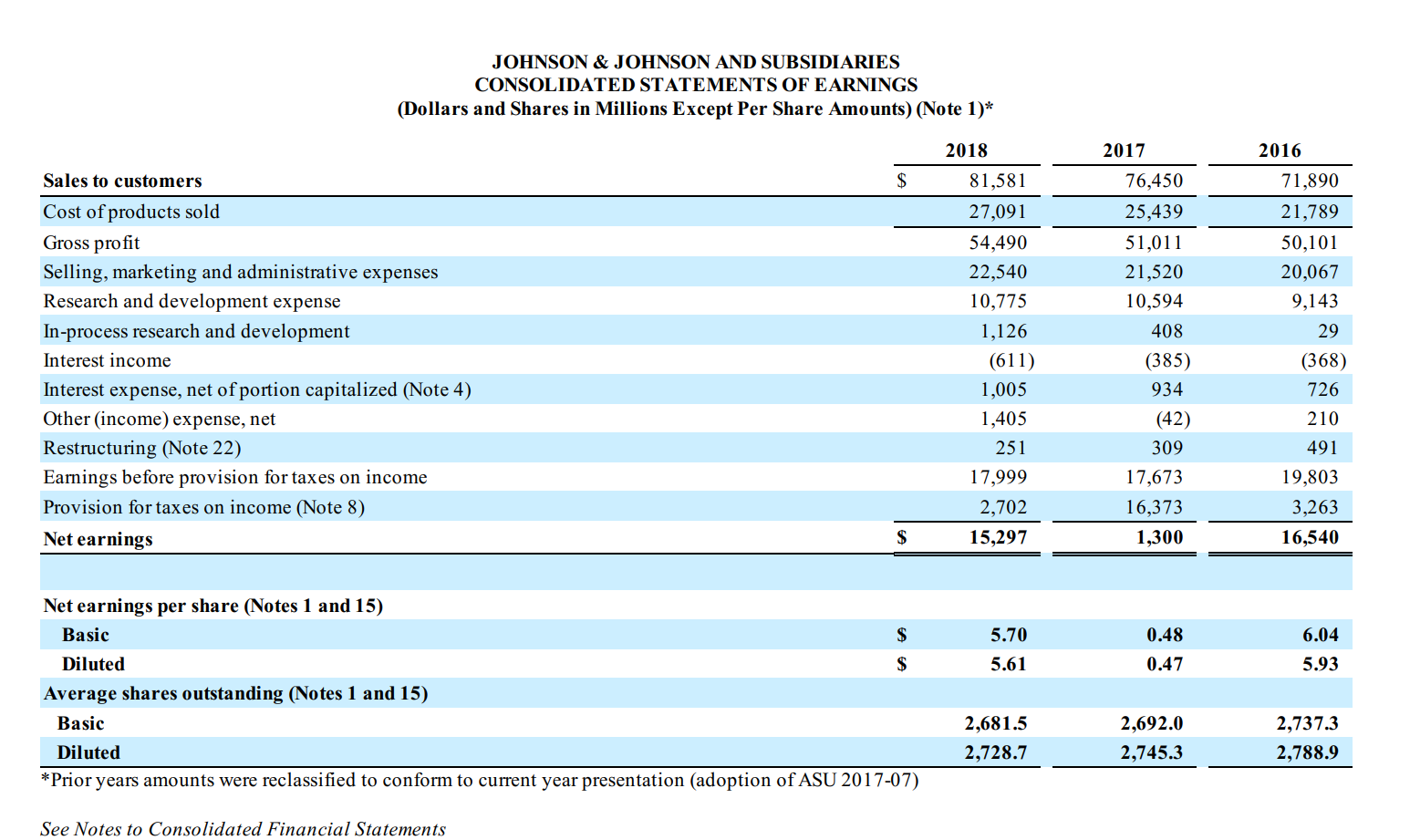

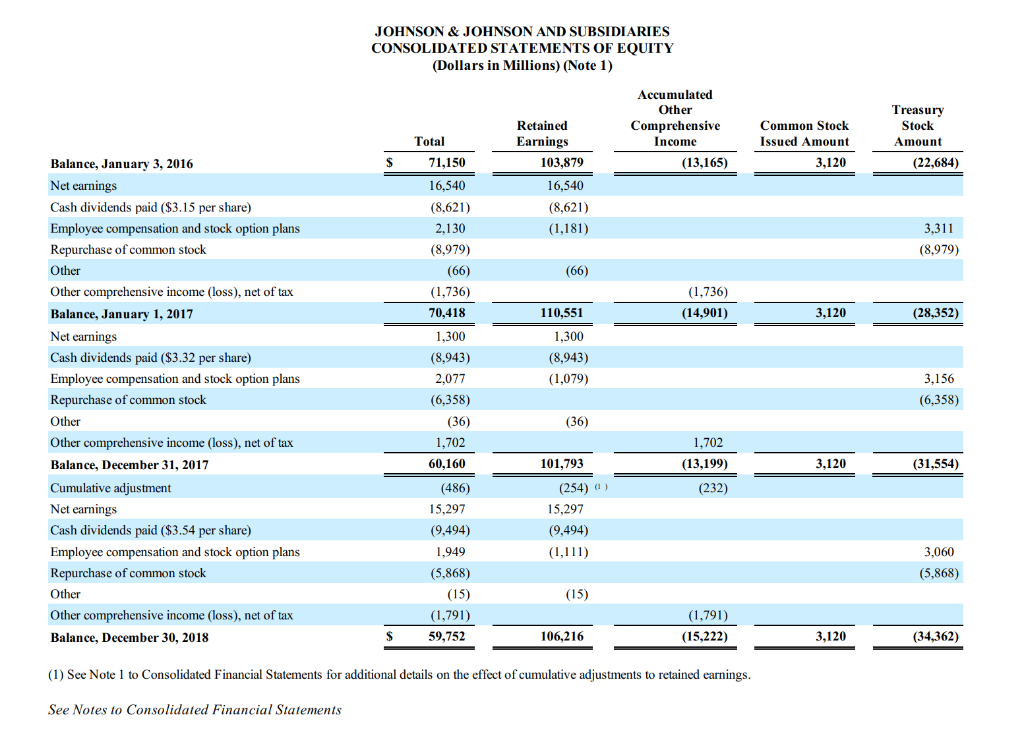

JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS At December 30, 2018 and December 31, 2017 (Dollars in Millions Except Share and Per Share Amounts) (Note 1) 2018 2017 Assets 18,107 1,580 14,098 8,599 2,699 950 46,033 17,824 472 13,490 8,765 2,537 43,088 17,035 47,611 30,453 7,640 4,182 152,954 17,005 53,228 31,906 7,105 4,971 157,303 S $ Current assets Cash and cash equivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) Accounts receivable trade, less allowances for doubtful accounts $248 (2017. $291) Inventories (Notes 1 and 3) Prepaid expenses and other receivables Assets held for sale (Note 20) Total current assets Property, plant and equipment, net (Notes 1 and 4) Intangible assets, net (Notes 1 and 5) Goodwill (Notes 1 and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accrued liabilities Accrued rebates, returns and promotions Accrued compensation and employee related obligations Accrued taxes on income (Note 8) Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-term taxes payable (Note 8) Other liabilities Total liabilities Shareholders' equity Preferred stock - without par value (authorized and unissued 2,000,000 shares) Common stock par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3,119,843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earnings 2,796 7,537 7,601 9,380 3,098 818 31,230 27,684 7,506 9,951 8,242 8,589 93,202 3,906 7,310 7,304 7,210 2,953 1,854 30,537 30,675 8,368 10,074 8,472 9,017 97,143 3,120 (15,222) 106,216 94,114 34,362 59,752 152,954 3,120 (13,199) 101,793 91,714 31,554 60,160 157,303 Less: common stock held in treasury, at cost (Note 12) (457,519,000 shares and 437,318,000 shares) Total shareholders' equity Total liabilities and shareholders' equity $ Soo Motom to Couldadad Santo JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS (Dollars and Shares in Millions Except Per Share Amounts) (Note 1)* 2016 71,890 21,789 50,101 20,067 9,143 29 Sales to customers Cost of products sold Gross profit Selling, marketing and administrative expenses Research and development expense In-process research and development Interest income Interest expense, net of portion capitalized (Note 4) Other (income) expense, net Restructuring (Note 22) Earnings before provision for taxes on income Provision for taxes on income (Note 8) Net earnings 2018 81,581 27,091 54,490 22,540 10,775 1,126 (611) 1,005 1,405 251 17,999 | 2,702 15,297 2017 76,450 25,439 51,011 21,520 10,594 408 (385) 934 (42) 309 17,673 16,373 1,300 (368) 726 210 491 19,803 3,263 16,540 $ 5.70 5.61 0.48 0.47 6.04 5.93 Net earnings per share (Notes 1 and 15) Basic $ Diluted $ Average shares outstanding (Notes 1 and 15) Basic Diluted *Prior years amounts were reclassified to conform to current year presentation (adoption of ASU 2017-07) 2,681.5 2,728.7 2,692.0 2,745.3 2,737.3 2,788.9 See Notes to Consolidated Financial Statements JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EQUITY (Dollars in Millions) (Note 1) Accumulated Other Comprehensive Income (13,165) Common Stock Issued Amount 3,120 Treasury Stock Amount (22,684) Retained Earnings 103,879 16,540 (8,621) (1,181) 3,311 (8,979) (66) Total 71,150 16,540 (8,621) 2,130 (8,979) (66) (1,736) 70,418 1,300 (8,943) 2,077 (6,358) (36) 1,702 60,160 (1,736) (14,901) 110,551 901) 3,120 (28,352) Balance, January 3, 2016 Net earnings Cash dividends paid ($3.15 per share) Employee compensation and stock option plans Repurchase of common stock Other Other comprehensive income (loss), net of tax Balance, January 1, 2017 Net earnings Cash dividends paid ($3.32 per share) Employee compensation and stock option plans Repurchase of common stock Other Other comprehensive income (loss), net of tax Balance, December 31, 2017 Cumulative adjustment Net earnings Cash dividends paid ($3.54 per share) Employee compensation and stock option plans Repurchase of common stock Other Other comprehensive income (loss), net of tax Balance, December 30, 2018 1,300 (8,943) (1,079) 3,156 (6,358) (36) 1,702 (13,199) (232) 3,120 (31,554) 101,793 (254) a) 15,297 (9,494) (1,111) (486) 15,297 (9,494) 1,949 (5,868) (15) (1,791) 59,752 3,060 (5,868) (15) (1,791) 106,216 3,120 (34,362) (1) See Note 1 to Consolidated Financial Statements for additional details on the effect of cumulative adjustments to retained earnings. See Notes to Consolidated Financial Statements JOHNSON & JOHNSON AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in Millions) (Note 1) 2018 2017 2016 15,297 1,300 16,540 6,929 978 1,258 (1,217) (1,016) (31) 5,642 962 795 (1,307) 2,406 17 3,754 878 283 (563) (341) (11) (1,185) (644) 3,951 (275) (1,844) 22,201 (633) 581 2,725 (411) 8,979 21,056 (1,065) (249) 656 (529) (586) 18,767 Cash flows from operating activities Net earnings Adjustments to reconcile net earnings to cash flows from operating activities: Depreciation and amortization of property and intangibles Stock based compensation Asset write-downs Gain on sale of assets/businesses Deferred tax provision Accounts receivable allowances Changes in assets and liabilities, net of effects from acquisitions and divestitures: Increase in accounts receivable (Increase) Decrease in inventories Increase in accounts payable and accrued liabilities Increase in other current and non-current assets (Decrease) Increase in other current and non-current liabilities Net cash flows from operating activities Cash flows from investing activities Additions to property, plant and equipment Proceeds from the disposal of assets/businesses, net Acquisitions, net of cash acquired (Note 20) Purchases of investments Sales of investments Other (primarily intangibles) Net cash used by investing activities Cash flows from financing activities Dividends to shareholders Repurchase of common stock Proceeds from short-term debt Retirement of short-term debt Proceeds from long-term debt, net of issuance costs Retirement of long-term debt Proceeds from the exercise of stock options/employee withholding tax on stock awards, net Other Net cash used by financing activities Effect of exchange rate changes on cash and cash equivalents Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year (Note 1) Cash and cash equivalents, end of year (Note 1) (3,670) 3,203 (899) (5,626) 4.289 (464) (3,167) (3,279) 1,832 (35,151) (6,153) 28,117 (234) (14,868) (3,226) 1,267 (4,509) (33,950) 35,780 (123) (4,761) (9,494) (5,868) 80 (2.479) 5 (1,555) 949 (148) (18,510) (241) 283 17.824 18,107 (8,943) (6,358) 869 (1,330) 8,992 (1,777) 1,062 (188) (7,673) 337 (1,148) 18,972 17,824 (8,621) (8,979) 111 (2,017) 12,004 (2,223) 1,189 (15) (8,551) (215) 5,240 13,732 S 18,972 Supplemental cash flow data Cash paid during the year for: Interest Interest, net of amount capitalized $ 1,049 963 960 866 730 628 Income taxes 4,570 3,312 2,843 presented in the financial statements. The Company's operating leases will result in the recognition of additional assets and the corresponding liabilities on its Consolidated Balance Sheets. The adoption of this standard will not have a material impact on the Company's consolidated financial statements. Cash Equivalents The Company classifies all highly liquid investments with stated maturities of three months or less from date of purchase as cash equivalents and all highly liquid investments with stated maturities of greater than three months from the date of purchase as current marketable securities. The Company has a policy of making investments only with commercial institutions that have at least an investment grade credit rating. The Company invests its cash primarily in government securities and obligations, corporate debt securities, money market funds and reverse repurchase agreements (RRAs). RRAs are collateralized by deposits in the form of Government Securities and Obligations for an amount not less than 102% of their value. The Company does not record an asset or liability as the Company is not permitted to sell or repledge the associated collateral. The Company has a policy that the collateral has at least an A (or equivalent) credit rating. The Company utilizes a third party custodian to manage the exchange of funds and ensure that collateral received is maintained at 102% of the value of the RRAs on a daily basis. RRAs with stated maturities of greater than three months from the date of purchase are classified as marketable securities. Investments Investments classified as held to maturity investments are reported at amortized cost and realized gains or losses are reported in eamings. Investments classified as available-for-sale are carried at estimated fair value with unrealized gains and losses recorded as a component of accumulated other comprehensive income. Available-for-sale securities available for current operations are classified as current assets otherwise, they are classified as long term. Management determines the appropriate classification of its investment in debt and equity securities at the time of purchase and re-evaluates such determination at each balance sheet date. The Company reviews its investments in equity securities for impairment and adjusts these investments to fair value through earnings, as required. Property, Plant and Equipment and Depreciation Property, plant and equipment are stated at cost. The Company utilizes the straight-line method of depreciation over the estimated useful lives of the assets: Building and building equipment Land and leasehold improvements Machinery and equipment 20 - 30 years 10 - 20 years 2 - 13 years The Company capitalizes certain computer software and development costs, included in machinery and equipment, when incurred in connection with developing or obtaining computer software for intemal use. Capitalized software costs are amortized over the estimated useful lives of the software, which generally range from 3 to 8 years. The Company reviews long-lived assets to assess recoverability using undiscounted cash flows. When certain events or changes in operating or economic conditions occur, an impairment assessment may be performed on the recoverability of the carrying value of these assets. If the asset is determined to be impaired, the loss is measured based on the difference between the asset's fair value and its carrying value. If quoted market prices are not available, the Company will estimate fair value using a discounted value of estimated future cash flows. Revenue Recognition The Company recognizes revenue from product sales when obligations under the terms of a contract with the customer are satisfied; generally, this occurs with the transfer of control of the goods to customers. The Company's global payment terms are typically between 30 to 90 days. Provisions for certain rebates, sales incentives, trade promotions, coupons, product retums and discounts to customers are accounted for as variable consideration and recorded as a reduction in sales. Product discounts granted are based on the terms of arrangements with direct, indirect and other market participants, as well as market conditions, including consideration of competitor pricing. Rebates are estimated based on contractual terms, historical experience, patient outcomes, trend analysis and projected market conditions in the various markets served. The Company evaluates market conditions for products or groups of products primarily through the analysis of wholesaler and other third-party sell-through and market research data, as well as intemally generated information. Sales returns are estimated and recorded based on historical sales and returns information. Products that exhibit unusual sales or return pattems due to dating, competition or other marketing matters are specifically investigated and analyzed as part of the accounting for sales return accruals. Sales returns allowances represent a reserve for products that may be retumed due to expiration, destruction in the field, or in specific areas, product recall. The sales retums reserve is based on historical return trends by product and by market as a percent to gross sales. In accordance with the Company's accounting policies, the Company generally issues credit to customers for returned goods. The Company's sales retums reserves are accounted for in accordance with the U.S. GAAP guidance for revenue recognition when right of return exists. Sales returns reserves are recorded at full sales value. Sales returns in the Consumer and Pharmaceutical segments are almost exclusively not resalable. Sales returns for certain franchises in the Medical Devices segment are typically resalable but are not material. The Company in frequently exchanges products from inventory for retumed products. The sales retums reserve for the total Company has been approximately 1.0% of annual net trade sales during the fiscal reporting years 2018, 2017 and 2016. Promotional programs, such as product listing allowances and cooperative advertising arrangements, are recorded in the same period as related sales. Continuing promotional programs include coupons and volume-based sales incentive programs. The redemption cost of consumer coupons is based on historical redemption experience by product and value. Volume-based incentive programs are based on the estimated sales volumes for the incentive period and are recorded as products are sold. These arrangements are evaluated to determine the appropriate amounts to be deferred or recorded as a reduction of revenue. The Company also earns profit-share payments through collaborative arrangements for certain products, which are included in sales to customers. For all years presented, profit-share payments were less than 2.0% of the total revenues and are included in sales to customers. Shipping and Handling Shipping and handling costs incurred were $1,090 million, $1,042 million and $974 million in 2018, 2017 and 2016, respectively, and are included in selling, marketing and administrative expense. The amount of revenue received for shipping and handling is less than 0.5% of sales to customers for all periods presented. Inventories Inventories are stated at the lower of cost or net realizable value determined by the first-in, first-out method. Intangible Assets and Goodwill The authoritative literature on U.S. GAAP requires that goodwill and intangible assets with indefinite lives be assessed annually for impairment. The Company completed the annual impairment test for 2018 in the fiscal fourth quarter. Future impairment tests will be performed annually in the fiscal fourth quarter, or sooner if warranted. Purchased in-process research and development is accounted for as an indefinite lived intangible asset until the underlying project is completed, at which point the intangible asset will be accounted for as a definite lived intangible asset, or abandoned, at which point the intangible asset will be written off or partially impaired. Intangible assets that have finite useful lives continue to be amortized over their useful lives, and are reviewed for impairment when warranted by economic conditions. See Note 5 for further details on Intangible Assets and Goodwill. Financial Instruments As required by U.S. GAAP, all derivative instruments are recorded on the balance sheet at fair value. Fair value is the exit price that would be received to sell an asset or paid to transfer a liability. Fair value is a market-based measurement determined using assumptions that market participants would use in pricing an asset or liability. The authoritative literature establishes a three-level hierarchy to prioritize the inputs used in measuring fair value, with Level 1 having the highest priority and Level 3 having the lowest. Changes in the fair value of derivatives are recorded each period in current earnings or other comprehensive income, depending on whether the derivative is designated as part of a hedge transaction, and if so, the type of hedge transaction. The Company documents all relationships between hedged items and derivatives. The overall risk management strategy includes reasons for undertaking hedge transactions and entering into derivatives. The objectives of this strategy are: (1) minimize foreign currency exposure's impact on the Company's financial performance; (2) protect the Company's cash flow from adverse movements in foreign exchange rates; (3) ensure the appropriateness of financial instruments; and (4) manage the enterprise risk associated with financial institutions. See Note 6 for additional information on Financial Instruments. Product Liability Accruals for product liability claims are recorded, on an undiscounted basis, when it is probable that a liability has been incurred and the amount of the liability can be reasonably estimated based on existing information and actuarially determined estimates where applicable. The accruals are adjusted periodically as additional information becomes available. The Company accrues an estimate of the legal defense costs needed to defend each matter when those costs are probable and can be reasonably estimated. To the extent adverse verdicts have been rendered against the Company, the Company does not record an accrual until a loss is determined to be probable and can be reasonably estimated. As a result of cost and availability factors, effective November 1, 2005, the Company ceased purchasing third-party product liability insurance. The Company has self insurance through a wholly-owned captive insurance company. In addition to accruals in the self insurance program, claims that exceed the insurance coverage are accrued when losses are probable and amounts can be reasonably estimated. 4. Property, Plant and Equipment At the end of 2018 and 2017, property, plant and equipment at cost and accumulated depreciation were: S (Dollars in Millions) 2018 2017 Land and land improvements 807 829 Buildings and building equipment 11,176 11,240 Machinery and equipment 25,992 25,949 Construction in progress 3,876 3,448 Total property, plant and equipment, gross 41,851 41,466 Less accumulated depreciation 24,816 24,461 s Total property, plant and equipment, net 17.035 (1) 17,005 (1) Net of assets held for sale on the Consolidated Balance Sheet for approximately $0.1 billion related to the divestiture of the Advanced Sterilization Products business and $0.1 billion related to the strategic collaboration with Jabil Inc., both of which were pending as of December 30, 2018. The Company capitalizes interest expense as part of the cost of construction of facilities and equipment. Interest expense capitalized in 2018, 2017 and 2016 was $86 million, $94 million and $102 million, respectively. Depreciation expense, including the amortization of capitalized interest in 2018, 2017 and 2016 was $2.6 billion, $2.6 billion and $2.5 billion, respectively. Upon retirement or other disposal of property, plant and equipment, the costs and related amounts of accumulated depreciation or amortization are eliminated from the asset and accumulated depreciation accounts, respectively. The difference, if any, between the net asset value and the proceeds are recorded in earnings. 5. Intangible Assets and Goodwill At the end of 2018 and 2017, the gross and net amounts of intangible assets were: (Dollars in Millions) 2018 2017 Intangible assets with definite lives: Patents and trademarks - gross $ 35,194 36,427 Less accumulated amortization 9,784 7,223 Patents and trademarks net 25,410 29,204 Customer relationships and other intangibles - gross $ 21,334 20,204 Less accumulated amortization 8,323 7,463 Customer relationships and other intangibles net $ 13,011 12,741 Intangible assets with indefinite lives: Trademarks 6.937 7,082 Purchased in-process research and development) 2.253 4,201 Total intangible assets with indefinite lives 9,190 11,283 Total intangible assets - net $ 47,611 53,228 (1) The decrease was primarily attributable to the write-down of $1.1 billion related to the assets acquired in the acquisitions of Alios Biopharma Inc. (Alios) and XO1 Limited (Xo1). Of the S1.1 billion, the Company recorded a partial impairment charge of $0.8 billion related to the development program of AL-8176, an investigational drug for the treatment of Respiratory Syncytial Virus (RSV) and human metapneumovirus (hMPV) acquired with the 2014 acquisition of Alios. The impairment charge was calculated based on updated cash flow projections discounted for the inherent risk in the asset development and reflects the impact of the phase 2b clinical trial suspension, a decrease in the probability of success factors and the ongoing analysis of asset development activities. In addition, an impairment charge of $0.3 billion was recorded for the discontinuation of the development project for an anti-thrombin antibody associated with the 2015 acquisition of X01. Additionally, $0.8 billion of IPR&D related to ERLEADATM was reclassified to definite lived intangible assets upon commercialization. Question 2 At the most recent balance sheet date, Johnson & Johnson's estimate of uncollectible accounts receivable was (in millions): O a. $31 b. $248 $14,346 d. $14,098