Answered step by step

Verified Expert Solution

Question

1 Approved Answer

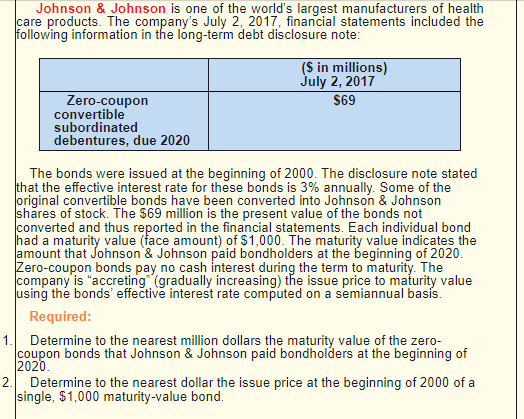

Johnson & Johnson is one of the world's largest manufacturers of health care products. The company's July 2, 2017, financial statements included the following

Johnson & Johnson is one of the world's largest manufacturers of health care products. The company's July 2, 2017, financial statements included the following information in the long-term debt disclosure note: ($ in millions) July 2, 2017 1. 2. Zero-coupon convertible subordinated debentures, due 2020 $69 The bonds were issued at the beginning of 2000. The disclosure note stated that the effective interest rate for these bonds is 3% annually. Some of the original convertible bonds have been converted into Johnson & Johnson shares of stock. The $69 million is the present value of the bonds not converted and thus reported in the financial statements. Each individual bond had a maturity value (face amount) of $1,000. The maturity value indicates the amount that Johnson & Johnson paid bondholders at the beginning of 2020. Zero-coupon bonds pay no cash interest during the term to maturity. The company is "accreting (gradually increasing) the issue price to maturity value using the bonds' effective interest rate computed on a semiannual bass. Required: Determine to the nearest million dollars the maturity value of the zero- coupon bonds that Johnson & Johnson paid bondholders at the beginning of 2020. Determine to the nearest dollar the issue price at the beginning of 2000 of a single, $1,000 maturity-value bond.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started