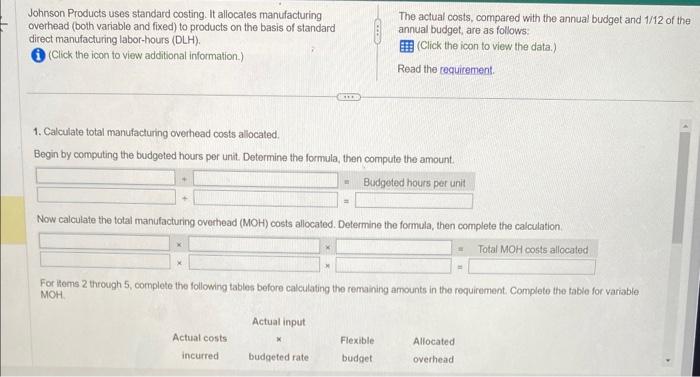

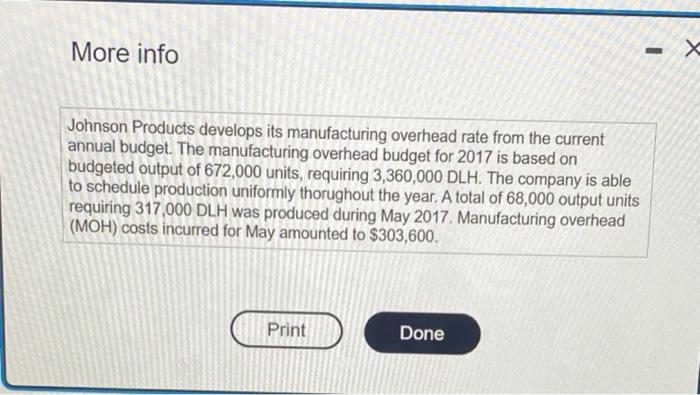

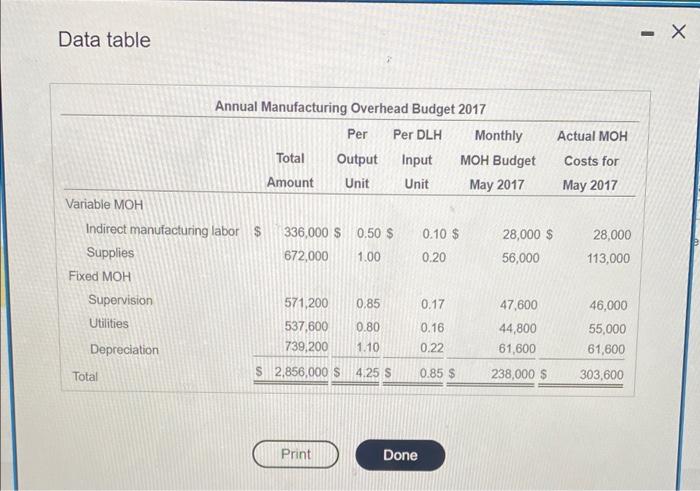

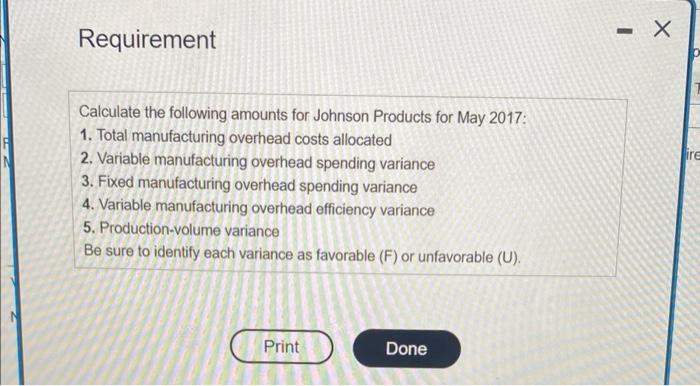

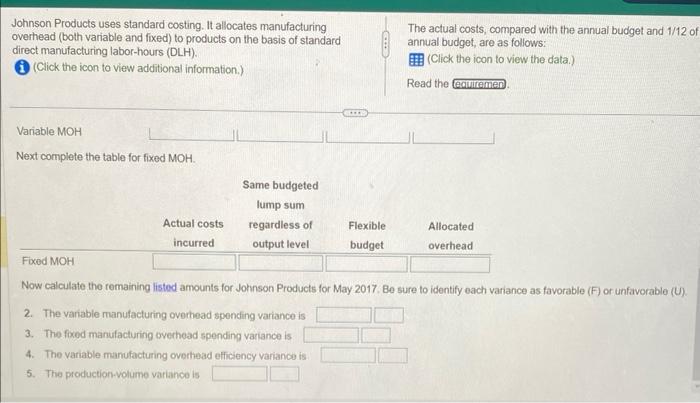

Johnson Products uses standard costing. It allocates manufacturing The actual costs, compared with the annual budget and 1/12 of the overhead (both variable and fixed) to products on the basis of standard budget, are as follows: overhead (both variable and fixed) to pro- direct manufacturing labor-hours (DLH). (Click the icon to view additional information.) (Click the icon to view the data.) Read the requirement. 1. Calculate total manufacturing overhead costs allocated. Begin by computing the budgeted hours per unit. Determine the formula, then compute the amount. For Homs 2 through 5 , complete the following tables before calculating the remaining amounts in the requirement. Complete the tabie for variable More info Johnson Products develops its manufacturing overhead rate from the current annual budget. The manufacturing overhead budget for 2017 is based on budgeted output of 672,000 units, requiring 3,360,000DLH. The company is able to schedule production uniformly thorughout the year. A total of 68,000 output units requiring 317,000 DLH was produced during May 2017. Manufacturing overhead (MOH) costs incurred for May amounted to $303,600. Data table Requirement Calculate the following amounts for Johnson Products for May 2017: 1. Total manufacturing overhead costs allocated 2. Variable manufacturing overhead spending variance 3. Fixed manufacturing overhead spending variance 4. Variable manufacturing overhead efficiency variance 5. Production-volume variance Be sure to identify each variance as favorable (F) or unfavorable (U). Johnson Products uses standard costing. It allocates manufacturing overhead (both variable and fixed) to products on the basis of standard direct manufacturing labor-hours (DLH). (Click the icon to view additional information.) Now calculate the remaining listed amounts for Johnson Products for May 2017. Be sure to identify each variance as favorable (F) or unfavorable (U). 2. The variable manufacturing overhead spending variance is 3. The fixed manufacturing overhead spending variance is 4. The variable manufacturing overthead efficiency variance is 5. The production-volume variance is