Question

JOHNSON (PTY) LTD is a South Africa entity engaged in the distribution of household products through its chain stores through the country. The company purchase

JOHNSON (PTY) LTD is a South Africa entity engaged in the distribution of household products through its chain stores through the country. The company purchase all its products from suppliers who are registered vendors. The sales composition costs of the follows: (i) 75% standard rated taxable supplies, (ii) 10% zero-rated supplies, and (iii) 15% exempt supplies.

The company purchased a second-hand scanning equipment at a total cost of R 1 200 000 from a non-registered vendor. The scanning equipment will be used in the centralised distribution warehouse to keep track of and update the inventory records for the chain stores. The market value of the scanning equipment was R 1 000 000.

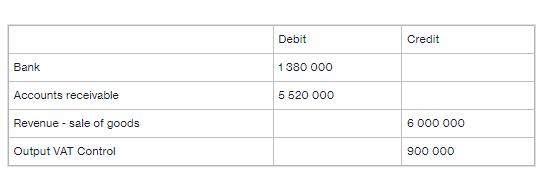

On 30 June 2022 the company sold goods to one of its customers, Xtrail (Pty) Ltd, that will sell the products in the rural areas - a market that the company has not yet established it footprint. The company sold goods with an invoice value of R 6 000 000 (excluding VAT) in terms of an agreement which required a deposit of 20% and the balance will be settled six months after the date of sale. No interest is charged on this transaction. The estimated market effective interest rate amounts to 8%. The accountant recorded the following transaction at the date the goods were sold:

You are required to:

- Review the transaction recorded by the accountant for the sale of goods to Xtrail (Pty) Ltd; and discuss whether it complies with the accounting standards.

Bank Accounts receivable Revenue - sale of goods Output VAT Control Debit 1380 000 5 520 000 Credit 6 000 000 900 000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

the transaction recorded by the accountant for the sale of goods to Xtrail Pty Ltd and discuss whether it complies with accounting standards Transacti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started