Answered step by step

Verified Expert Solution

Question

1 Approved Answer

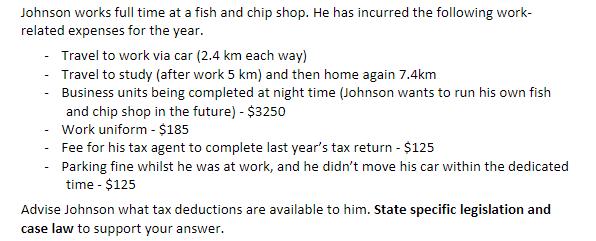

Johnson works full time at a fish and chip shop. He has incurred the following work- related expenses for the year. - Travel to

Johnson works full time at a fish and chip shop. He has incurred the following work- related expenses for the year. - Travel to work via car (2.4 km each way) Travel to study (after work 5 km) and then home again 7.4km Business units being completed at night time (Johnson wants to run his own fish and chip shop in the future) - $3250 Work uniform - $185 Fee for his tax agent to complete last year's tax return - $125 - Parking fine whilst he was at work, and he didn't move his car within the dedicated time - $125 Advise Johnson what tax deductions are available to him. State specific legislation and case law to support your answer.

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Advice to johnson Expense Deduction available Legislation Travel to work Deductible Sec81 ITA97 Travel to study Not Deductible TR 989 Business Units c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started