Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnston Adhesives Company makes three widely used industrial adhesives: A101, A204, and B216. Sales and production information for each of the three adhesives are

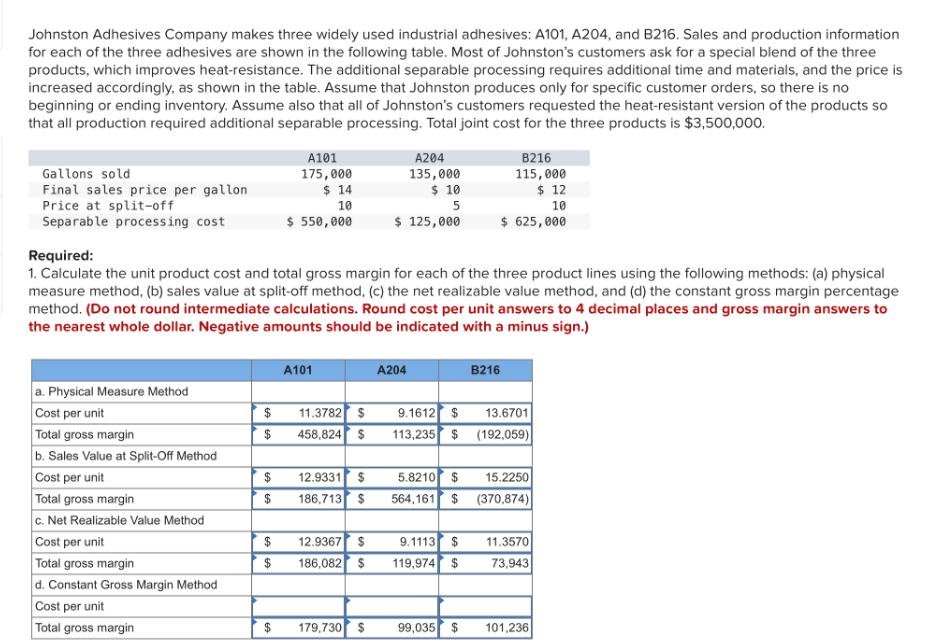

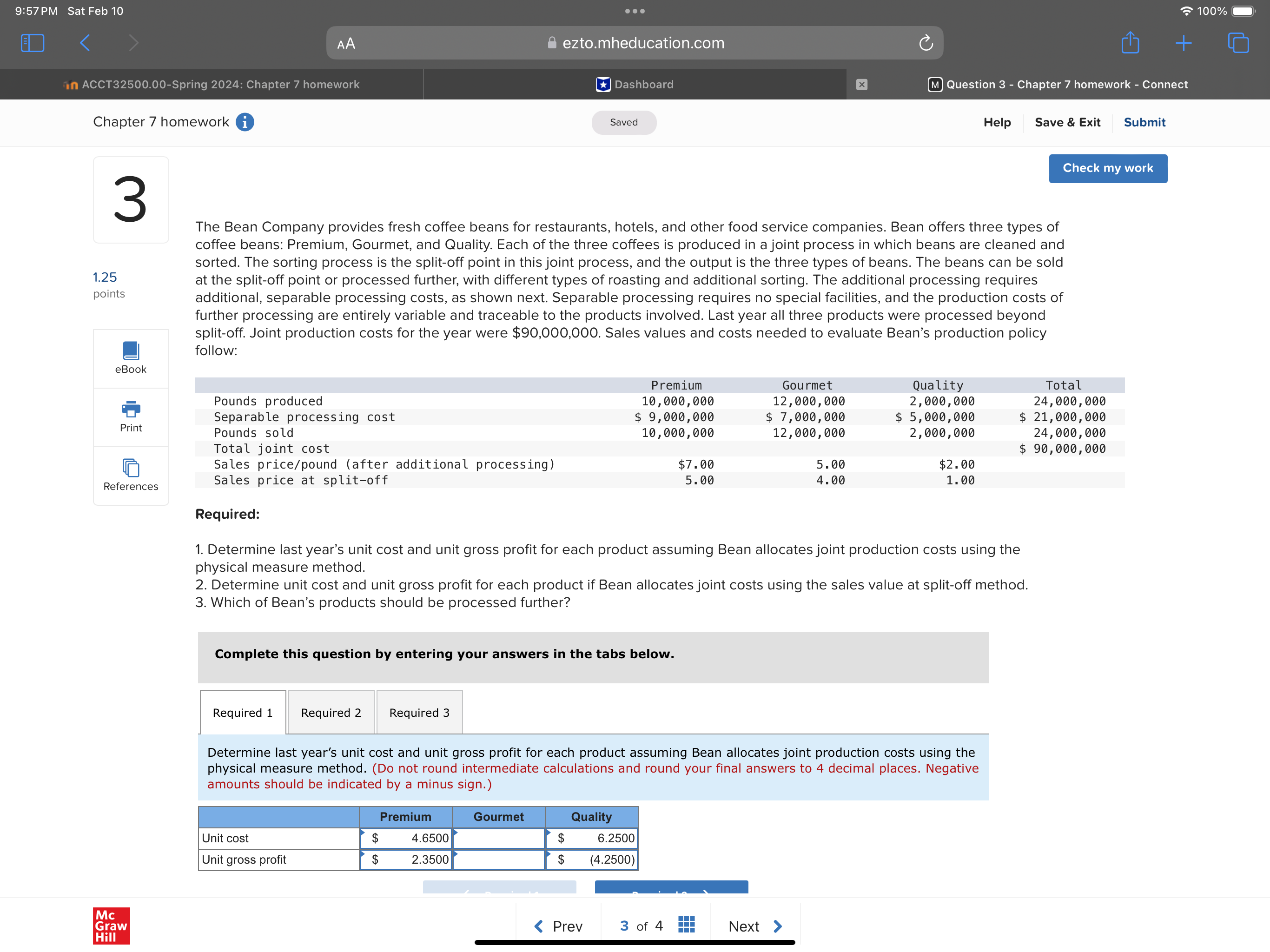

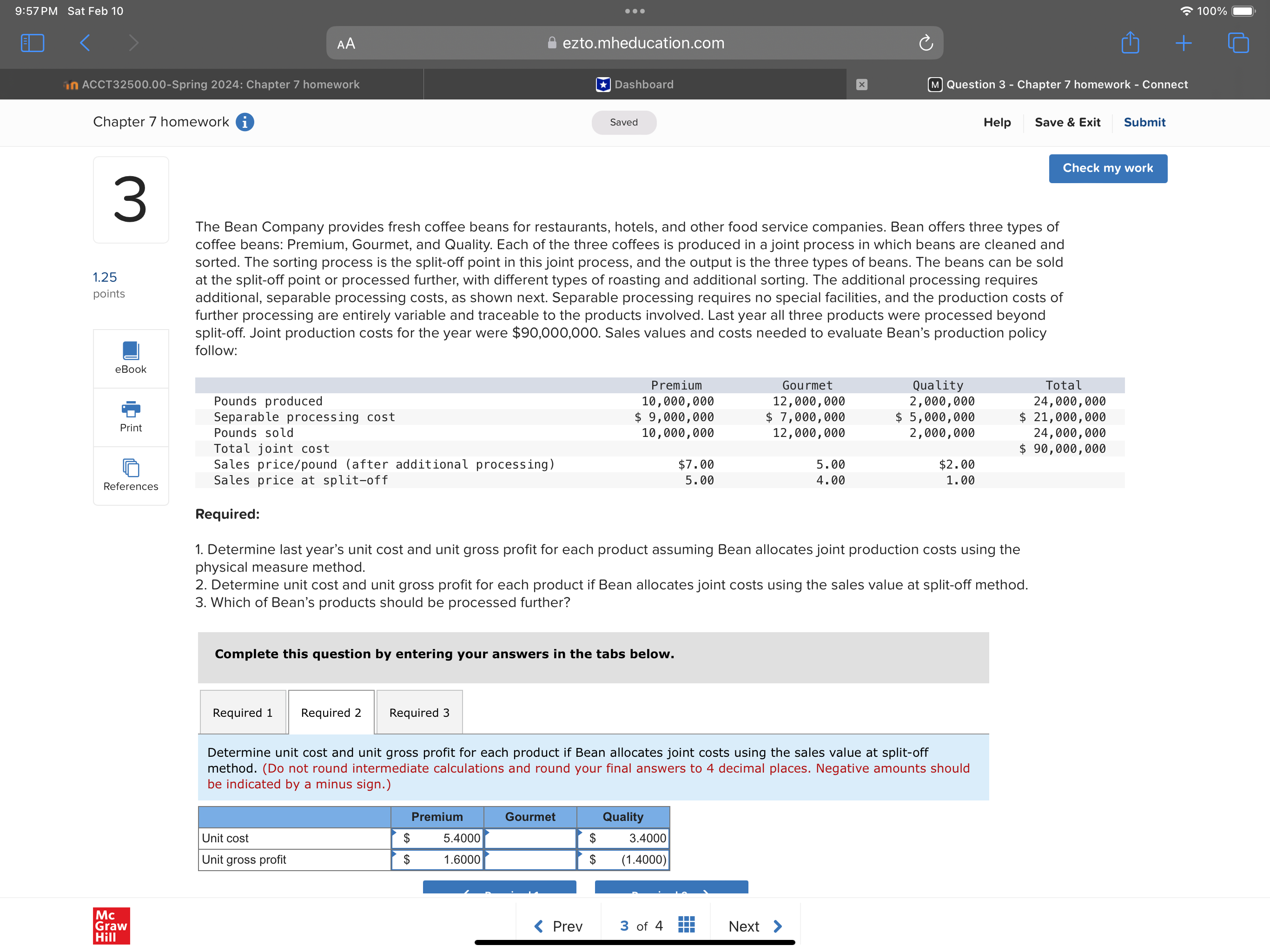

Johnston Adhesives Company makes three widely used industrial adhesives: A101, A204, and B216. Sales and production information for each of the three adhesives are shown in the following table. Most of Johnston's customers ask for a special blend of the three products, which improves heat-resistance. The additional separable processing requires additional time and materials, and the price is increased accordingly, as shown in the table. Assume that Johnston produces only for specific customer orders, so there is no beginning or ending inventory. Assume also that all of Johnston's customers requested the heat-resistant version of the products so that all production required additional separable processing. Total joint cost for the three products is $3,500,000. Gallons sold Final sales price per gallon Price at split-off A101 175,000 $ 14 10 A204 135,000 $ 10 5 B216 115,000 $ 12 10 Separable processing cost $ 550,000 $ 125,000 $ 625,000 Required: 1. Calculate the unit product cost and total gross margin for each of the three product lines using the following methods: (a) physical measure method, (b) sales value at split-off method, (c) the net realizable value method, and (d) the constant gross margin percentage method. (Do not round intermediate calculations. Round cost per unit answers to 4 decimal places and gross margin answers to the nearest whole dollar. Negative amounts should be indicated with a minus sign.) A101 A204 B216 a. Physical Measure Method Cost per unit 11.3782 $ Total gross margin $ 458,824 $ 9.1612 $ 13.6701 113,235 $ (192,059) b. Sales Value at Split-Off Method Cost per unit $ 12.9331 $ Total gross margin $ 186,713 $ 5.8210 $ 564,161 $ 15.2250 (370,874) c. Net Realizable Value Method Cost per unit $ 12.9367 $ Total gross margin $ 186,082 $ 9.1113 $ 119,974 $ 11.3570 73,943 d. Constant Gross Margin Method Cost per unit Total gross margin $ 179,730 $ 99,035 $ 101,236 9:57 PM Sat Feb 10 AA in ACCT32500.00-Spring 2024: Chapter 7 homework Chapter 7 homework i ... ezto.mheducation.com Dashboard Saved + (M) Question 3 - Chapter 7 homework - Connect 100% Help Save & Exit Submit Check my work 1.25 3 points The Bean Company provides fresh coffee beans for restaurants, hotels, and other food service companies. Bean offers three types of coffee beans: Premium, Gourmet, and Quality. Each of the three coffees is produced in a joint process in which beans are cleaned and sorted. The sorting process is the split-off point in this joint process, and the output is the three types of beans. The beans can be sold at the split-off point or processed further, with different types of roasting and additional sorting. The additional processing requires additional, separable processing costs, as shown next. Separable processing requires no special facilities, and the production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $90,000,000. Sales values and costs needed to evaluate Bean's production policy follow: eBook Pounds produced Separable processing cost Print Pounds sold Total joint cost Sales price/pound (after additional processing) Sales price at split-off References Required: Mc Graw Hill Premium 10,000,000 Gourmet 12,000,000 Quality 2,000,000 $ 9,000,000 10,000,000 $ 7,000,000 12,000,000 $ 5,000,000 2,000,000 $7.00 5.00 5.00 4.00 $2.00 1.00 Total 24,000,000 $ 21,000,000 24,000,000 $ 90,000,000 1. Determine last year's unit cost and unit gross profit for each product assuming Bean allocates joint production costs using the physical measure method. 2. Determine unit cost and unit gross profit for each product if Bean allocates joint costs using the sales value at split-off method. 3. Which of Bean's products should be processed further? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine last year's unit cost and unit gross profit for each product assuming Bean allocates joint production costs using the physical measure method. (Do not round intermediate calculations and round your final answers to 4 decimal places. Negative amounts should be indicated by a minus sign.) Premium Gourmet Quality Unit cost $ 4.6500 $ 6.2500 Unit gross profit $ 2.3500 $ (4.2500) < Prev 3 of 4 Next 9:57 PM Sat Feb 10 AA in ACCT32500.00-Spring 2024: Chapter 7 homework Chapter 7 homework i ... ezto.mheducation.com Dashboard Saved + (M) Question 3 - Chapter 7 homework - Connect 100% Help Save & Exit Submit Check my work 1.25 3 points The Bean Company provides fresh coffee beans for restaurants, hotels, and other food service companies. Bean offers three types of coffee beans: Premium, Gourmet, and Quality. Each of the three coffees is produced in a joint process in which beans are cleaned and sorted. The sorting process is the split-off point in this joint process, and the output is the three types of beans. The beans can be sold at the split-off point or processed further, with different types of roasting and additional sorting. The additional processing requires additional, separable processing costs, as shown next. Separable processing requires no special facilities, and the production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $90,000,000. Sales values and costs needed to evaluate Bean's production policy follow: eBook Pounds produced Separable processing cost Print Pounds sold Total joint cost Sales price/pound (after additional processing) Sales price at split-off References Required: Mc Graw Hill Premium 10,000,000 Gourmet 12,000,000 Quality 2,000,000 $ 9,000,000 10,000,000 $ 7,000,000 12,000,000 $ 5,000,000 2,000,000 $7.00 5.00 5.00 4.00 $2.00 1.00 Total 24,000,000 $ 21,000,000 24,000,000 $ 90,000,000 1. Determine last year's unit cost and unit gross profit for each product assuming Bean allocates joint production costs using the physical measure method. 2. Determine unit cost and unit gross profit for each product if Bean allocates joint costs using the sales value at split-off method. 3. Which of Bean's products should be processed further? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine unit cost and unit gross profit for each product if Bean allocates joint costs using the sales value at split-off method. (Do not round intermediate calculations and round your final answers to 4 decimal places. Negative amounts should be indicated by a minus sign.) Premium Gourmet Quality Unit cost $ 5.4000 $ 3.4000 Unit gross profit $ 1.6000 $ (1.4000) < Prev 3 of 4 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started