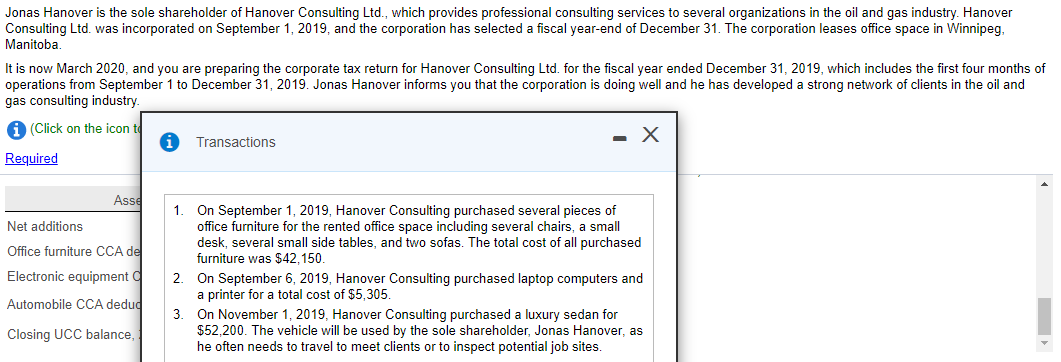

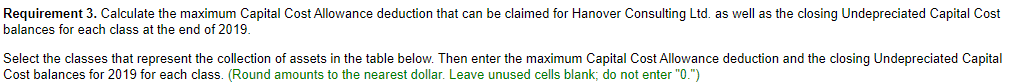

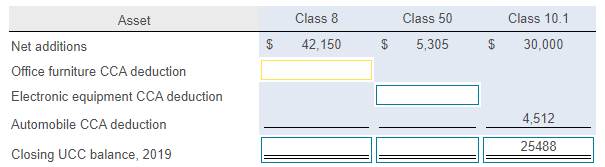

Jonas Hanover is the sole shareholder of Hanover Consulting Ltd., which provides professional consulting services to several organizations in the oil and gas industry. Hanover Consulting Ltd. was incorporated on September 1, 2019, and the corporation has selected a fiscal year-end of December 31. The corporation leases office space in Winnipeg, Manitoba. It is now March 2020, and you are preparing the corporate tax return for Hanover Consulting Ltd. for the fiscal year ended December 31, 2019, which includes the first four months of operations from September 1 to December 31, 2019. Jonas Hanover informs you that the corporation is doing well and he has developed a strong network of clients in the oil and gas consulting industry. (Click on the icon to - X Transactions Required Asse Net additions Office furniture CCA de Electronic equipment a 1. On September 1, 2019, Hanover Consulting purchased several pieces of office furniture for the rented office space including several chairs, a small desk, several small side tables, and two sofas. The total cost of all purchased furniture was $42,150 2. On September 6, 2019, Hanover Consulting purchased laptop computers and a printer for a total cost of $5,305. 3 On November 1, 2019, Hanover Consulting purchased a luxury sedan for $52,200. The vehicle will be used by the sole shareholder, Jonas Hanover, as he often needs to travel to meet clients or to inspect potential job sites. Automobile CCA dedud Closing UCC balance, Requirement 3. Calculate the maximum Capital Cost Allowance deduction that can be claimed for Hanover Consulting Ltd. as well as the closing Undepreciated Capital Cost balances for each class at the end of 2019. Select the classes that represent the collection of assets in the table below. Then enter the maximum Capital Cost Allowance deduction and the closing Undepreciated Capital Cost balances for 2019 for each class. (Round amounts to the nearest dollar. Leave unused cells blank; do not enter "0.") Class 8 Class 50 Class 10.1 30,000 42,150 $ 5,305 Asset Net additions Office furniture CCA deduction Electronic equipment CCA deduction Automobile CCA deduction III 4,512 25488 Closing UCC balance, 2019 Jonas Hanover is the sole shareholder of Hanover Consulting Ltd., which provides professional consulting services to several organizations in the oil and gas industry. Hanover Consulting Ltd. was incorporated on September 1, 2019, and the corporation has selected a fiscal year-end of December 31. The corporation leases office space in Winnipeg, Manitoba. It is now March 2020, and you are preparing the corporate tax return for Hanover Consulting Ltd. for the fiscal year ended December 31, 2019, which includes the first four months of operations from September 1 to December 31, 2019. Jonas Hanover informs you that the corporation is doing well and he has developed a strong network of clients in the oil and gas consulting industry. (Click on the icon to - X Transactions Required Asse Net additions Office furniture CCA de Electronic equipment a 1. On September 1, 2019, Hanover Consulting purchased several pieces of office furniture for the rented office space including several chairs, a small desk, several small side tables, and two sofas. The total cost of all purchased furniture was $42,150 2. On September 6, 2019, Hanover Consulting purchased laptop computers and a printer for a total cost of $5,305. 3 On November 1, 2019, Hanover Consulting purchased a luxury sedan for $52,200. The vehicle will be used by the sole shareholder, Jonas Hanover, as he often needs to travel to meet clients or to inspect potential job sites. Automobile CCA dedud Closing UCC balance, Requirement 3. Calculate the maximum Capital Cost Allowance deduction that can be claimed for Hanover Consulting Ltd. as well as the closing Undepreciated Capital Cost balances for each class at the end of 2019. Select the classes that represent the collection of assets in the table below. Then enter the maximum Capital Cost Allowance deduction and the closing Undepreciated Capital Cost balances for 2019 for each class. (Round amounts to the nearest dollar. Leave unused cells blank; do not enter "0.") Class 8 Class 50 Class 10.1 30,000 42,150 $ 5,305 Asset Net additions Office furniture CCA deduction Electronic equipment CCA deduction Automobile CCA deduction III 4,512 25488 Closing UCC balance, 2019