Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jonathan, an elderly retired accountant, has amassed a large fortune over the course of his life, as a result of his distinguished career and

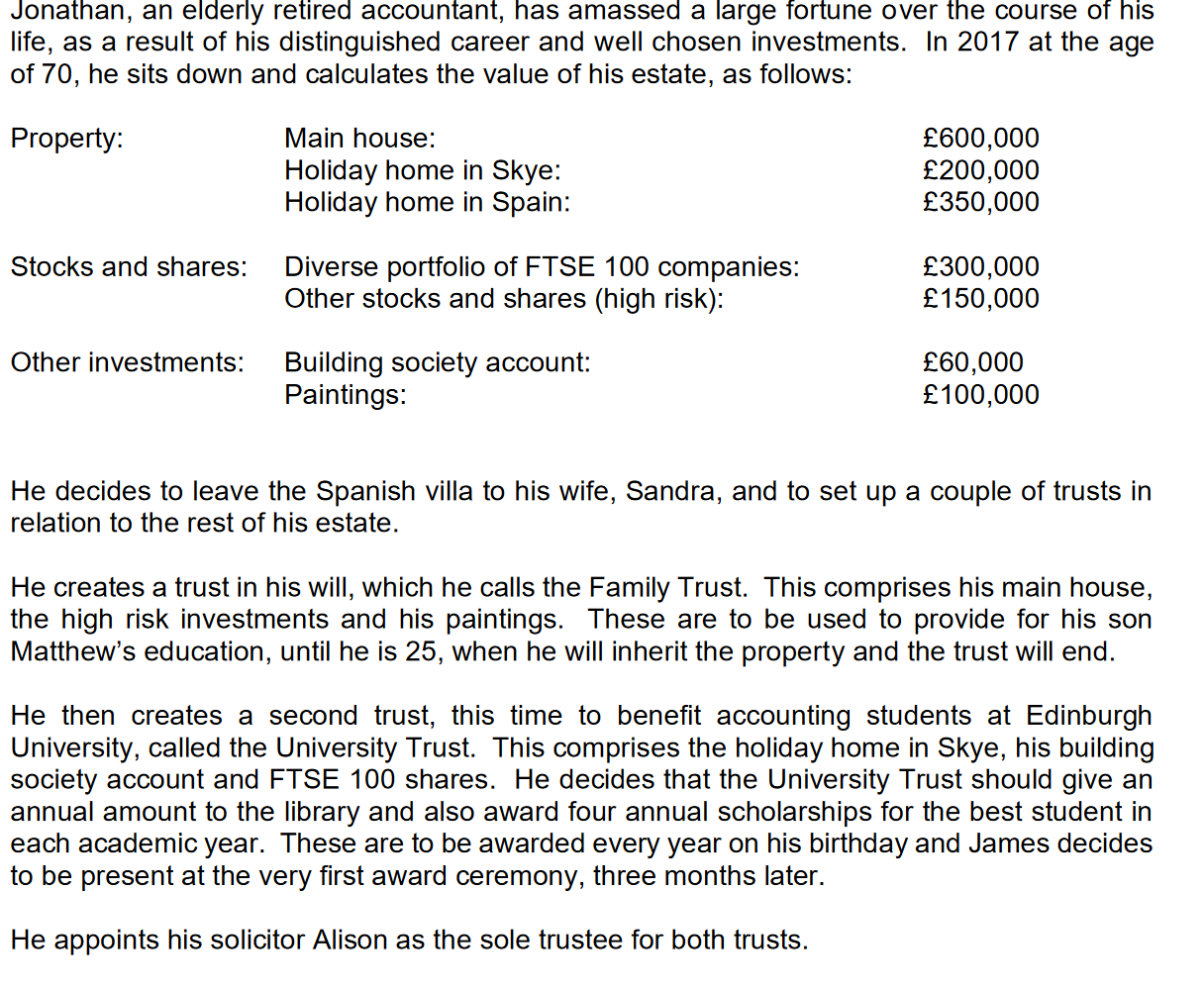

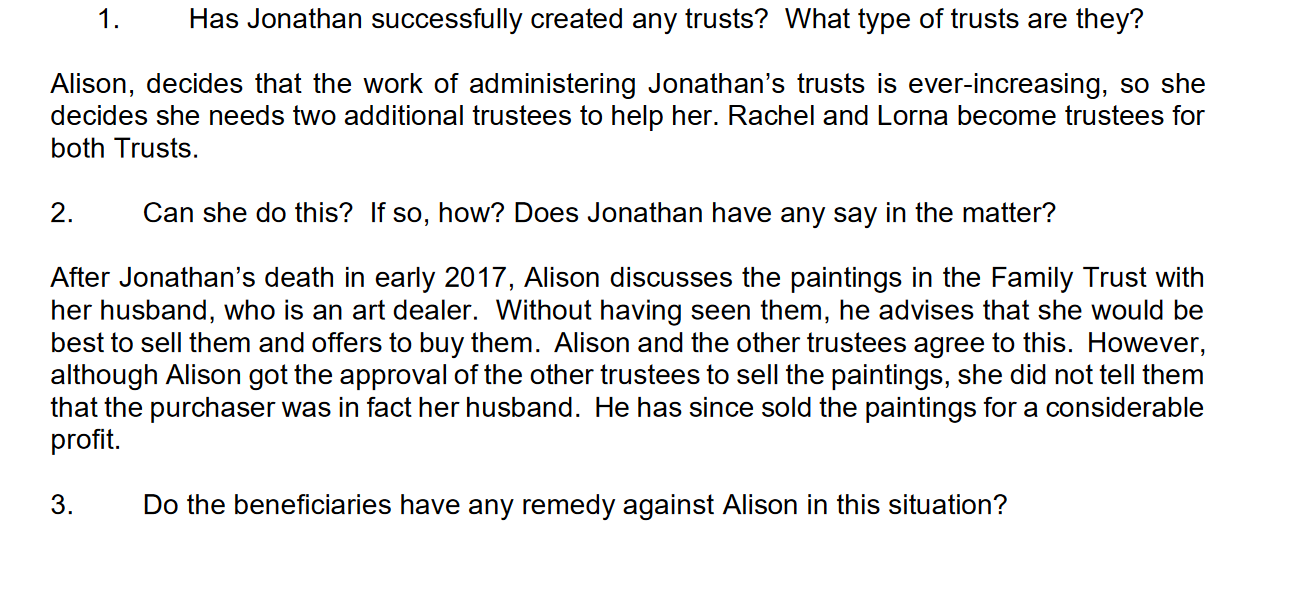

Jonathan, an elderly retired accountant, has amassed a large fortune over the course of his life, as a result of his distinguished career and well chosen investments. In 2017 at the age of 70, he sits down and calculates the value of his estate, as follows: Property: Main house: 600,000 Holiday home in Skye: 200,000 Holiday home in Spain: 350,000 Stocks and shares: Diverse portfolio of FTSE 100 companies: Other stocks and shares (high risk): 300,000 150,000 Other investments: Building society account: Paintings: 60,000 100,000 He decides to leave the Spanish villa to his wife, Sandra, and to set up a couple of trusts in relation to the rest of his estate. He creates a trust in his will, which he calls the Family Trust. This comprises his main house, the high risk investments and his paintings. These are to be used to provide for his son Matthew's education, until he is 25, when he will inherit the property and the trust will end. He then creates a second trust, this time to benefit accounting students at Edinburgh University, called the University Trust. This comprises the holiday home in Skye, his building society account and FTSE 100 shares. He decides that the University Trust should give an annual amount to the library and also award four annual scholarships for the best student in each academic year. These are to be awarded every year on his birthday and James decides to be present at the very first award ceremony, three months later. He appoints his solicitor Alison as the sole trustee for both trusts. 1. Has Jonathan successfully created any trusts? What type of trusts are they? Alison, decides that the work of administering Jonathan's trusts is ever-increasing, so she decides she needs two additional trustees to help her. Rachel and Lorna become trustees for both Trusts. 2. Can she do this? If so, how? Does Jonathan have any say in the matter? After Jonathan's death in early 2017, Alison discusses the paintings in the Family Trust with her husband, who is an art dealer. Without having seen them, he advises that she would be best to sell them and offers to buy them. Alison and the other trustees agree to this. However, although Alison got the approval of the other trustees to sell the paintings, she did not tell them that the purchaser was in fact her husband. He has since sold the paintings for a considerable profit. 3. Do the beneficiaries have any remedy against Alison in this situation?

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes Jonathan has successfully created two trusts The Family Trust is a discretionary trust as it a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started