Question

Jones and Parker have been partners for over ten years operating in the retail food business. On December 31,2019 the partners decided to dissolve the

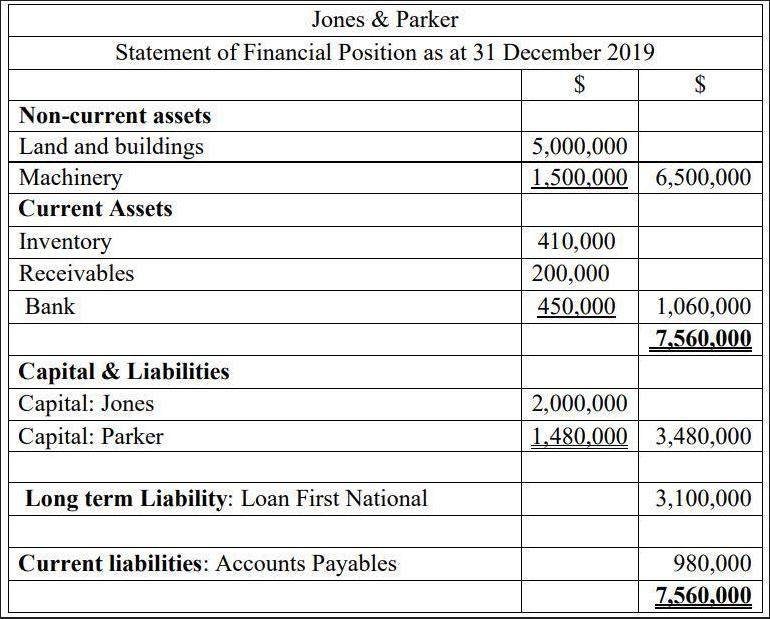

Jones and Parker have been partners for over ten years operating in the retail food business. On December 31,2019 the partners decided to dissolve the partnership. The following is the statement of financial position of Jones and Parker who share profits in the ratio 3: 2, respectively and who did not maintain current accounts.

The partnership was dissolved as follows:

1. Jones took machinery at book value of $800,000 and Parker took all the inventory at book value.

2. The remaining machines were sold for $900,000 cash

3. Land and buildings were sold for $11,200,000

4. The receivables realised $180,000

5. The bank loan was paid off in full and the payables were settled at $900,000

6. The bank account was closed out to the partners capital accounts to close the business .

REQUIRED:

The following accounts to give effect to the dissolution:

(1) The realisation account

(2) The bank and Capital accounts

Jones & Parker Statement of Financial Position as at 31 December 2019 $ Non-current assets Land and buildings Machinery Current Assets Inventory Receivables Bank Capital & Liabilities Capital: Jones Capital: Parker Long term Liability: Loan First National Current liabilities: Accounts Payables $ 5,000,000 1,500,000 6,500,000 410,000 200,000 450,000 1,060,000 7.560.000 2,000,000 1,480,000 3,480,000 3,100,000 980,000 7,560,000

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started