Answered step by step

Verified Expert Solution

Question

1 Approved Answer

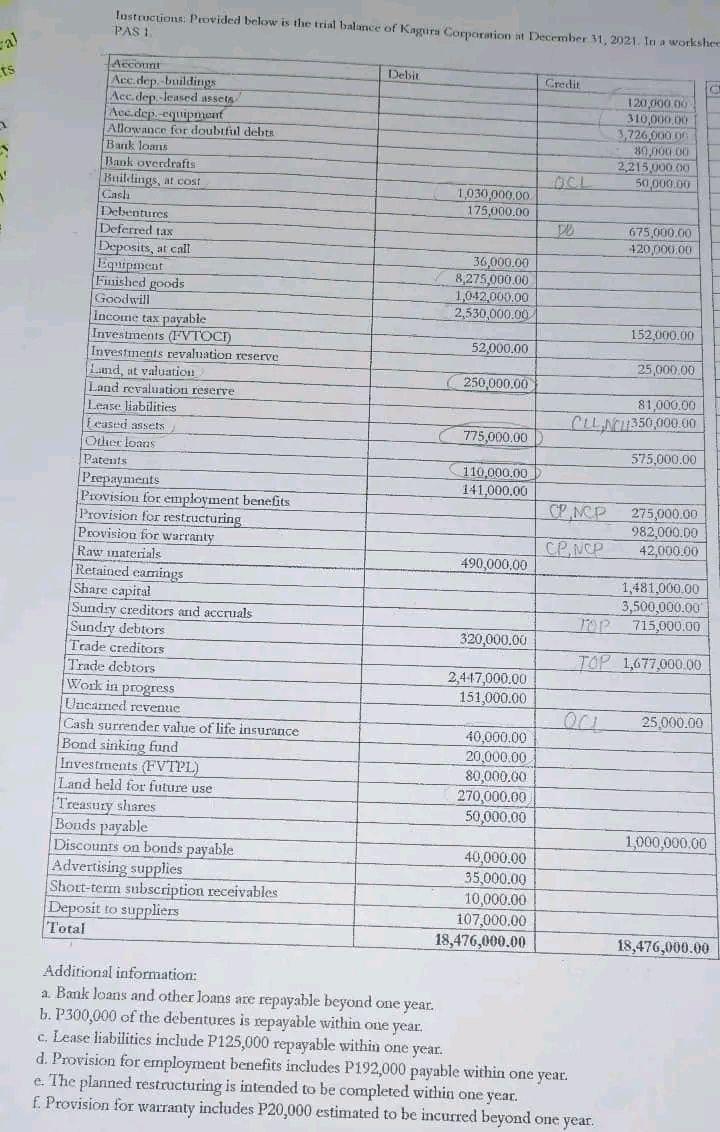

Provision for warranty - 42,000 Provision for warranty includes P20,000 estimated to be incurred beyond one year. How much will be the current liability? al

Provision for warranty - 42,000

Provision for warranty includes P20,000 estimated to be incurred beyond one year. How much will be the current liability?

al ts a S Instructions. Provided below is the trial balance of Kagura Corporation at December 31, 2021. In a workshee PAS 1. Account Acc.dep.-buildings Acc.dep-leased assets Acc.dep.-equipment Allowance for doubtful debts Bank loans Bank overdrafts Buildings, at cost Cash Debentures Deferred tax Deposits, at call Equipment Finished goods Goodwill Income tax payable Investments (FVTOCE) Investments revaluation reserve Land, at valuation Land revaluation reserve Lease liabilities Feased assets Other loans Patents Prepayments Provision for employment benefits Provision for restructuring Provision for warranty Raw materials Retained earnings Share capital Sundry creditors and accruals Sundry debtors Trade creditors Trade debtors Work in progress Uncamed revenue Cash surrender value of life insurance Bond sinking fund Investments (FVTPL) Land held for future use Treasury shares Bouds payable Discounts on bonds payable Advertising supplies Short-term subscription receivables Deposit to suppliers Total Debit 1,030,000.00. 175,000.00 36,000.00 8,275,000.00 1,042,000.00 2,530,000.00 52,000.00 250,000.00 775,000.00 110,000.00 141,000.00 490,000,00 320,000.00 2,417,000.00 151,000.00 40,000.00 20,000.00 80,000.00 270,000.00 50,000.00 40,000.00 35,000.00 10,000.00 107,000.00 18,476,000.00 Credit OCL CP NCP CP, NCP 120,000.00 310,000.00 3,726,000.00 80,000.00 2,215,000.00 50,000.00 Additional information: a. Bank loans and other loans are repayable beyond one year. b. P300,000 of the debentures is repayable within one year. c. Lease liabilities include P125,000 repayable within one year. d. Provision for employment benefits includes P192,000 payable within one year. e. The planned restructuring is intended to be completed within one year. f. Provision for warranty includes P20,000 estimated to be incurred beyond one year. 675,000.00 420,000.00 152,000.00 81,000.00 CLL NC350,000.00 25,000.00 575,000.00 275,000.00 982,000.00 42,000.00 1,481,000.00 3,500,000.00 TOP 715,000.00 TOP 1,677,000.00 19 25,000.00 1,000,000.00 18,476,000.00 al ts a S Instructions. Provided below is the trial balance of Kagura Corporation at December 31, 2021. In a workshee PAS 1. Account Acc.dep.-buildings Acc.dep-leased assets Acc.dep.-equipment Allowance for doubtful debts Bank loans Bank overdrafts Buildings, at cost Cash Debentures Deferred tax Deposits, at call Equipment Finished goods Goodwill Income tax payable Investments (FVTOCE) Investments revaluation reserve Land, at valuation Land revaluation reserve Lease liabilities Feased assets Other loans Patents Prepayments Provision for employment benefits Provision for restructuring Provision for warranty Raw materials Retained earnings Share capital Sundry creditors and accruals Sundry debtors Trade creditors Trade debtors Work in progress Uncamed revenue Cash surrender value of life insurance Bond sinking fund Investments (FVTPL) Land held for future use Treasury shares Bouds payable Discounts on bonds payable Advertising supplies Short-term subscription receivables Deposit to suppliers Total Debit 1,030,000.00. 175,000.00 36,000.00 8,275,000.00 1,042,000.00 2,530,000.00 52,000.00 250,000.00 775,000.00 110,000.00 141,000.00 490,000,00 320,000.00 2,417,000.00 151,000.00 40,000.00 20,000.00 80,000.00 270,000.00 50,000.00 40,000.00 35,000.00 10,000.00 107,000.00 18,476,000.00 Credit OCL CP NCP CP, NCP 120,000.00 310,000.00 3,726,000.00 80,000.00 2,215,000.00 50,000.00 Additional information: a. Bank loans and other loans are repayable beyond one year. b. P300,000 of the debentures is repayable within one year. c. Lease liabilities include P125,000 repayable within one year. d. Provision for employment benefits includes P192,000 payable within one year. e. The planned restructuring is intended to be completed within one year. f. Provision for warranty includes P20,000 estimated to be incurred beyond one year. 675,000.00 420,000.00 152,000.00 81,000.00 CLL NC350,000.00 25,000.00 575,000.00 275,000.00 982,000.00 42,000.00 1,481,000.00 3,500,000.00 TOP 715,000.00 TOP 1,677,000.00 19 25,000.00 1,000,000.00 18,476,000.00

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Introduction Current liabilities are those liabilities and obligations ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started