Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jones Manufacturing Inc. sponsored a defined benefit pension plan effective 1 January 20X7. The company uses the projected unit credit actuarial cost method for

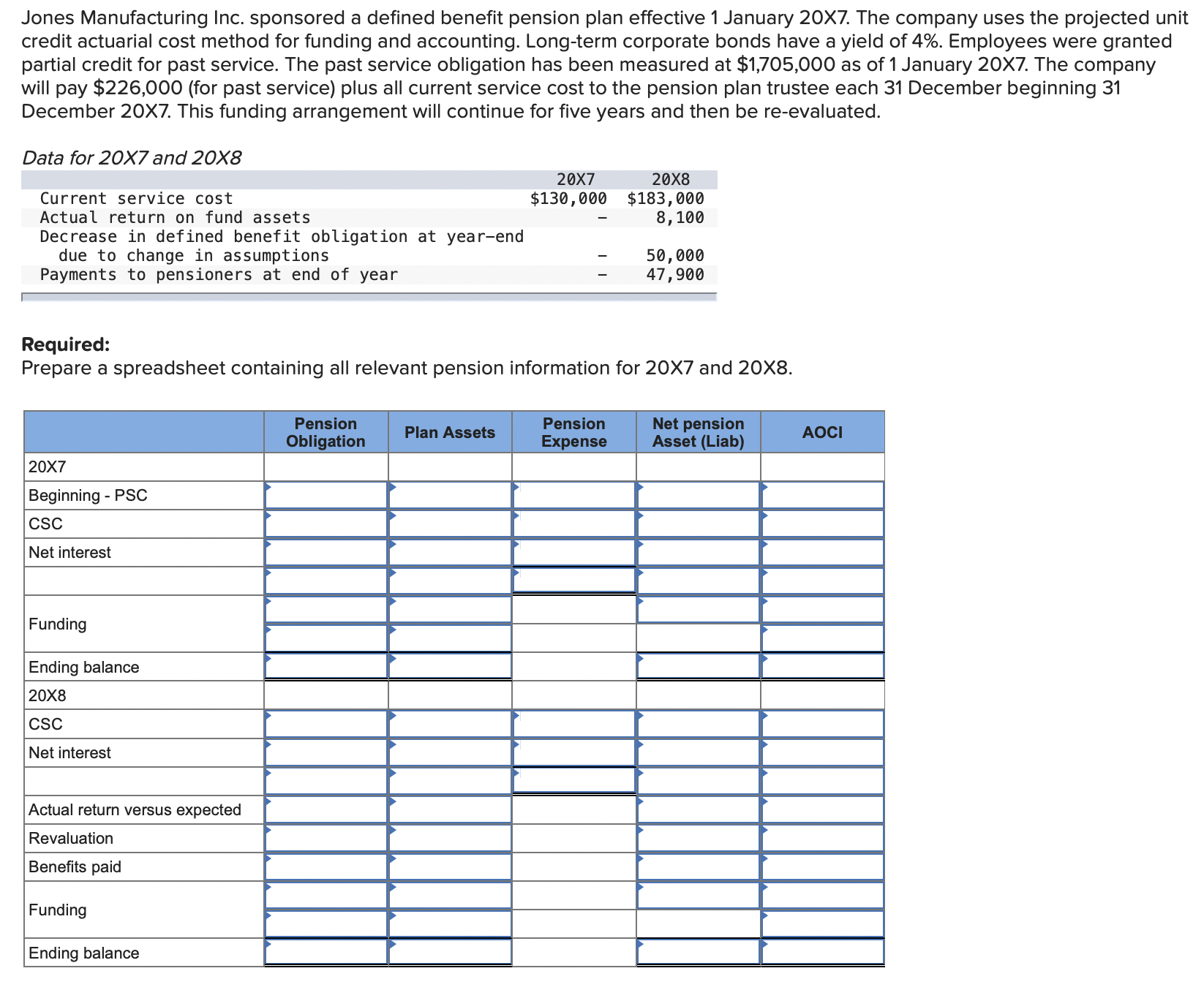

Jones Manufacturing Inc. sponsored a defined benefit pension plan effective 1 January 20X7. The company uses the projected unit credit actuarial cost method for funding and accounting. Long-term corporate bonds have a yield of 4%. Employees were granted partial credit for past service. The past service obligation has been measured at $1,705,000 as of 1 January 20X7. The company will pay $226,000 (for past service) plus all current service cost to the pension plan trustee each 31 December beginning 31 December 20X7. This funding arrangement will continue for five years and then be re-evaluated. Data for 20X7 and 20X8 Current service cost Actual return on fund assets Decrease in defined benefit obligation at year-end due to change in assumptions Payments to pensioners at end of year 20X7 $130,000 20X8 $183,000 8,100 50,000 47,900 Required: Prepare a spreadsheet containing all relevant pension information for 20X7 and 20X8. 20X7 Beginning. - PSC CSC Net interest Funding Ending balance 20X8 CSC Net interest Actual return versus expected Revaluation Benefits paid Funding Ending balance Pension Obligation Plan Assets Pension Expense Net pension Asset (Liab) AOCI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started