Answered step by step

Verified Expert Solution

Question

1 Approved Answer

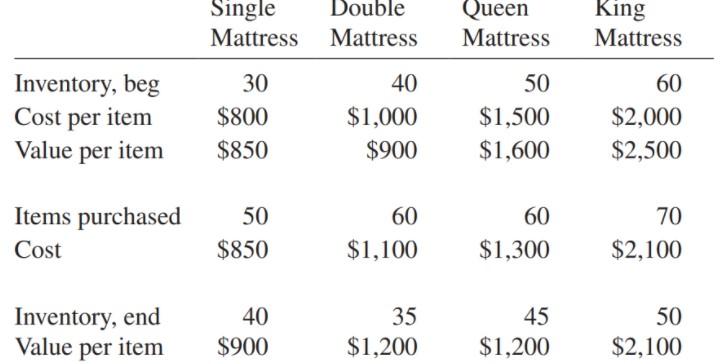

Jones owns and operates a retail mattress store. At the beginning and end of the year, he had the following on hand: Assume net realizable

Jones owns and operates a retail mattress store. At the beginning and end of the year, he had the following on hand:

Assume net realizable is the same as value and the normal profit margin is 10%. a. What is the amount of ending inventory for tax purposes under FIFO and lower of cost or market? b. What is cost of goods sold? 2. Use the same facts as in Exercise 1, except use the LIFO method.

Single Mattress Double Mattress Queen Mattress King Mattress Inventory, beg Cost per item Value per item 30 $800 $850 40 $1,000 $900 50 $1,500 $1,600 60 $2,000 $2,500 60 Items purchased Cost 50 $850 60 $1,300 70 $2,100 $1,100 35 Inventory, end Value per item 40 $900 45 $1,200 50 $2,100 $1,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started