Question

Jonns manufacturing company has recently realized that payroll checks are not being deposited uniformly by employees. For this reason, they are considering establishing a zero-balance

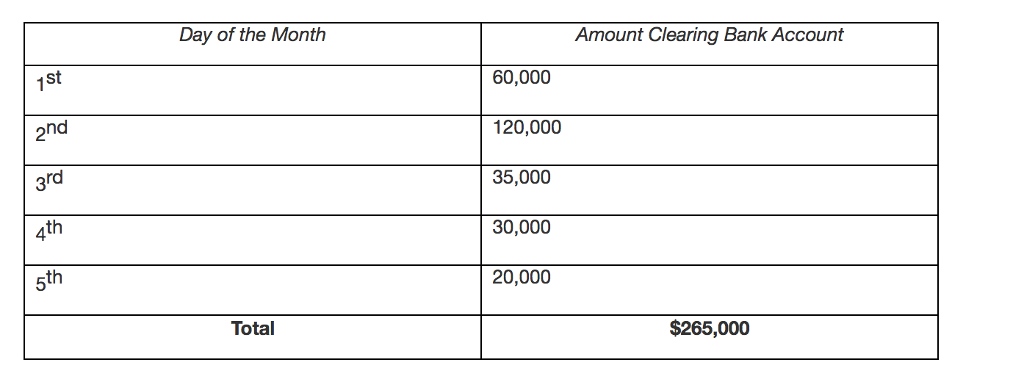

Jonns manufacturing company has recently realized that payroll checks are not being deposited uniformly by employees. For this reason, they are considering establishing a zero-balance payroll account system. The company pays employees monthly on the last day of each month. The current payroll system is to deposit the entire amount payable the last day of the month into the payroll checking account. The average payroll is $265,000 per month on average. In reviewing the time for the checks to clear the payroll account, they realize an opportunity exists to earn interest during the "float" period until the payroll checks clear. The following chart provides the typical pattern of payroll checks clearing your bank account:

You believe your company can earn an interest rate of 4.5% on any funds released from the payroll account using a zero-balance system. (note: for purposes of this exercise, assume a 365 day year and deposits can be made or checks cashed 365 days per year). Your team has been assigned to determine the pretax return the company would attain annually should the zero balance system be implemented. Postl your teams solution no later than 2 pm Friday afternoon.

Day of the Month Amount Clearing Bank Account 60,000 120,000 35,000 30,000 20,000 st 2 nd rd 3 4th 5th Total $265,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started