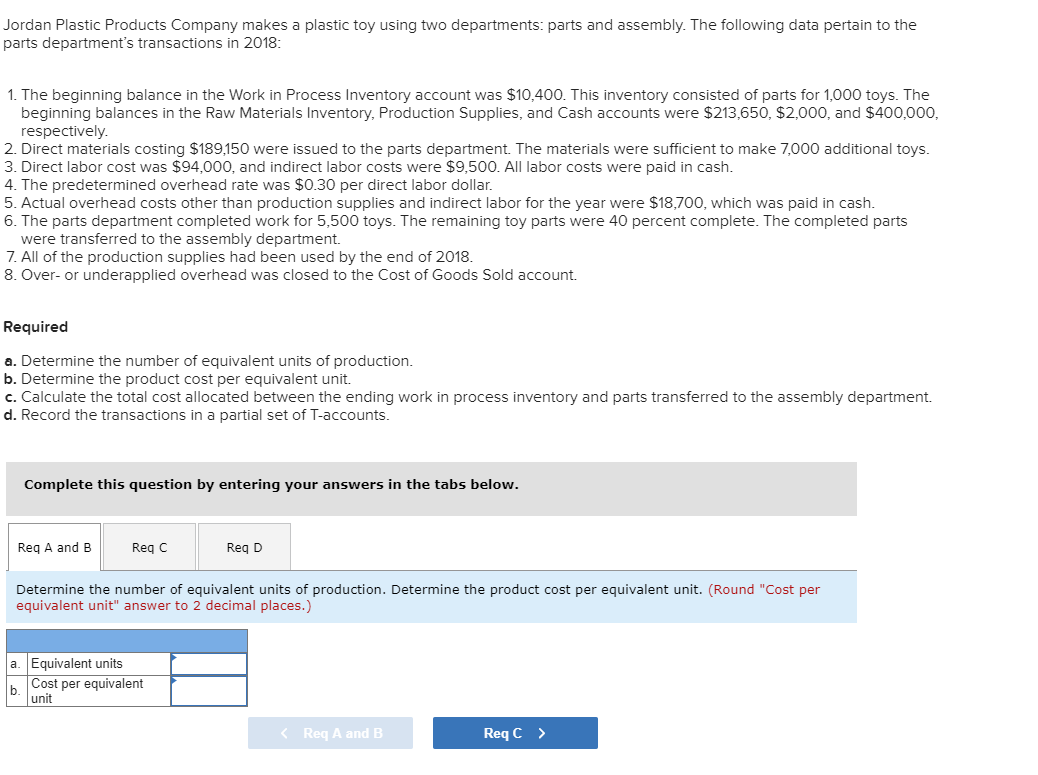

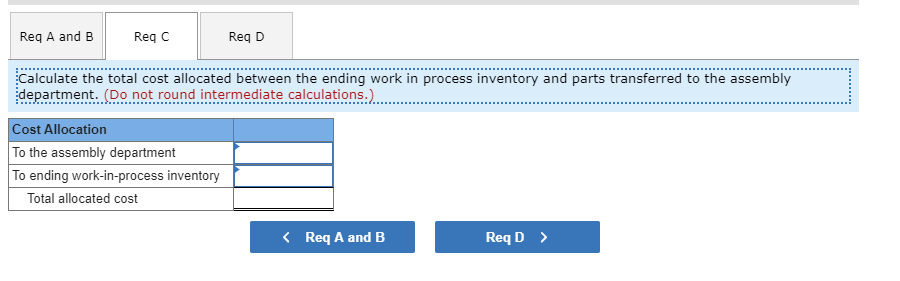

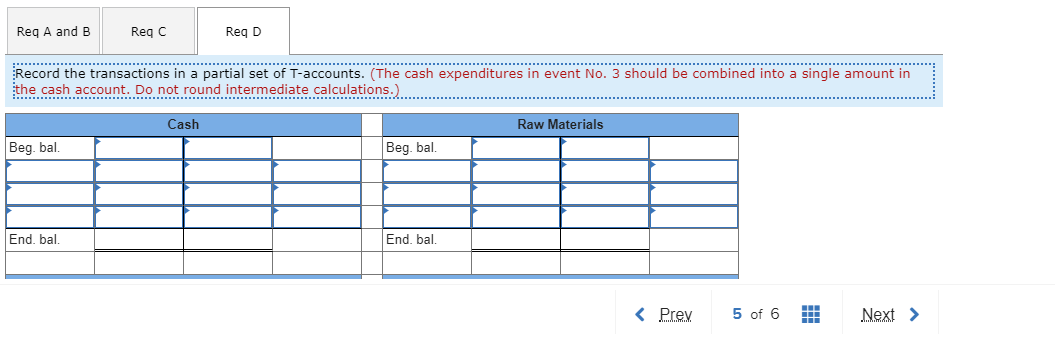

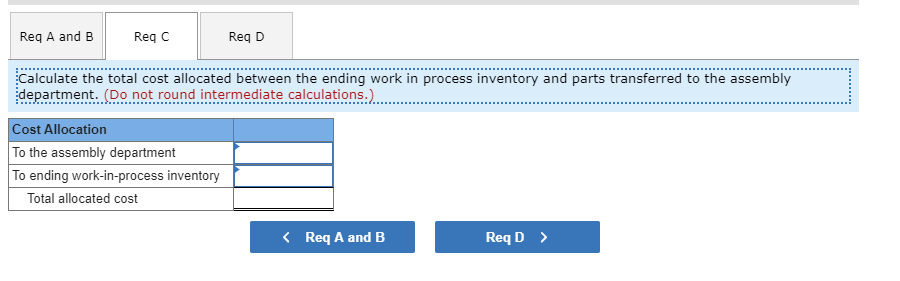

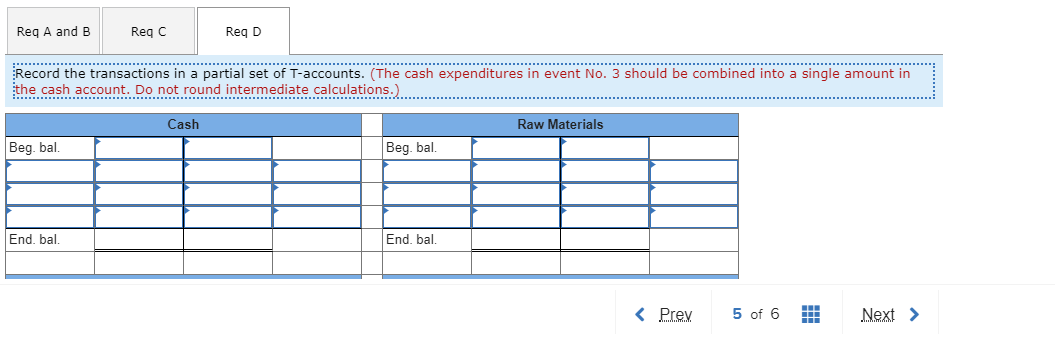

Jordan Plastic Products Company makes a plastic toy using two departments: parts and assembly. The following data pertain to the parts department's transactions in 2018: 1. The beginning balance in the Work in Process Inventory account was $10,400. This inventory consisted of parts for 1,000 toys. The beginning balances in the Raw Materials Inventory, Production Supplies, and Cash accounts were $213,650, $2,000, and $400,000, respectively. 2. Direct materials costing $189,150 were issued to the parts department. The materials were sufficient to make 7,000 additional toys. 3. Direct labor cost was $94,000, and indirect labor costs were $9,500. All labor costs were paid in cash. 4. The predetermined overhead rate was $0.30 per direct labor dollar. 5. Actual overhead costs other than production supplies and indirect labor for the year were $18,700, which was paid in cash. 6. The parts department completed work for 5,500 toys. The remaining toy parts were 40 percent complete. The completed parts were transferred to the assembly department. 7. All of the production supplies had been used by the end of 2018. 8. Over- or underapplied overhead was closed to the Cost of Goods Sold account. Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly department. d. Record the transactions in a partial set of T-accounts. Complete this question by entering your answers in the tabs below. Req A and B Reqc Reg D Determine the number of equivalent units of production. Determine the product cost per equivalent unit. (Round "Cost per equivalent unit" answer to 2 decimal places.) a. Equivalent units Cost per equivalent b unit Req A and B Reqc Reg D Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly department. (Do not round intermediate calculations.). Cost Allocation To the assembly department To ending work-in-process inventory Total allocated cost Req A and B Reqc Reg D Record the transactions in a partial set of T-accounts. (The cash expenditures in event No. 3 should be combined into a single amount in the cash account. Do not round intermediate calculations.) Cash Raw Materials Beg. bal. Beg. bal. End, bal. End. bal