Answered step by step

Verified Expert Solution

Question

1 Approved Answer

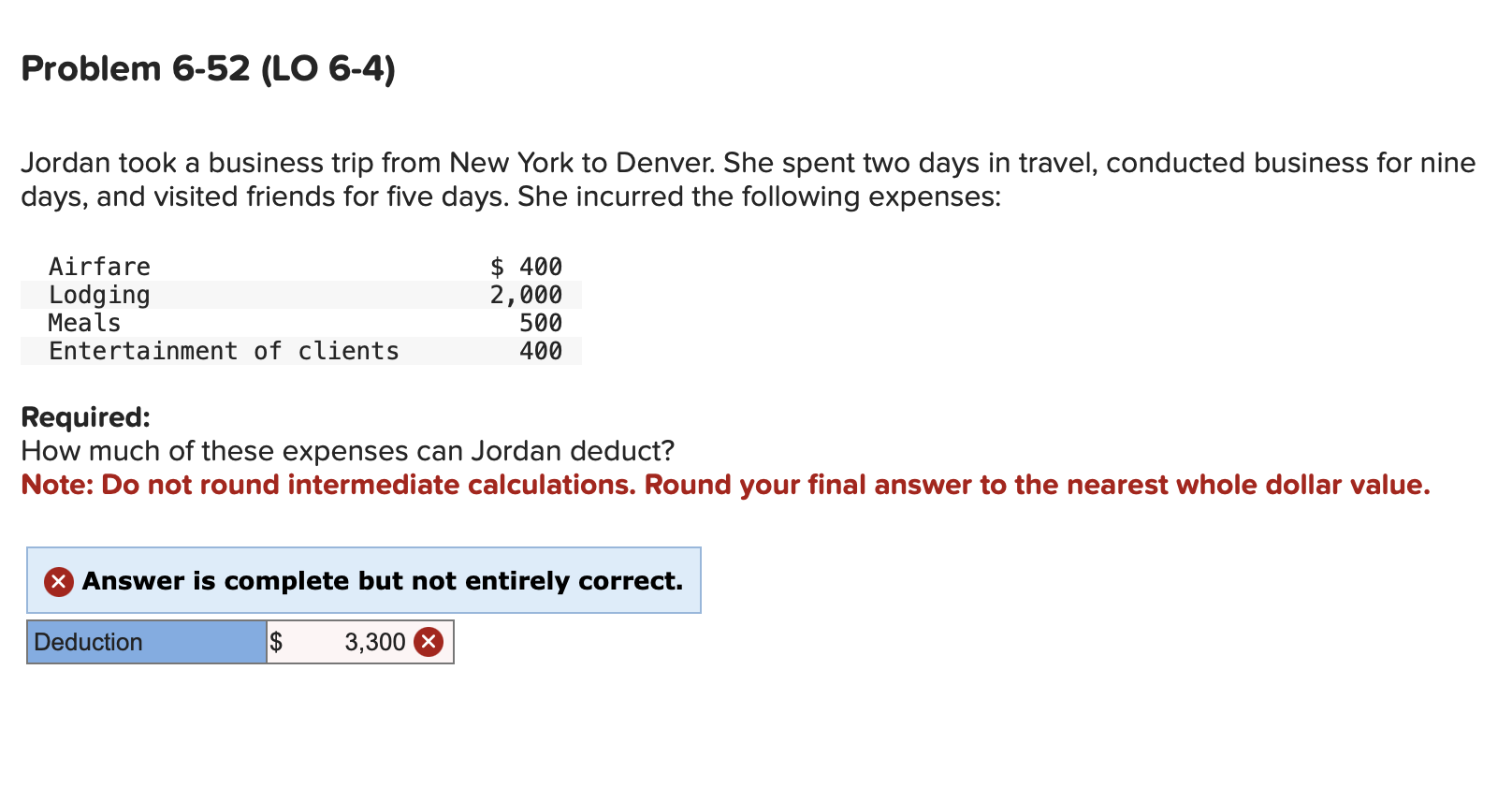

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for

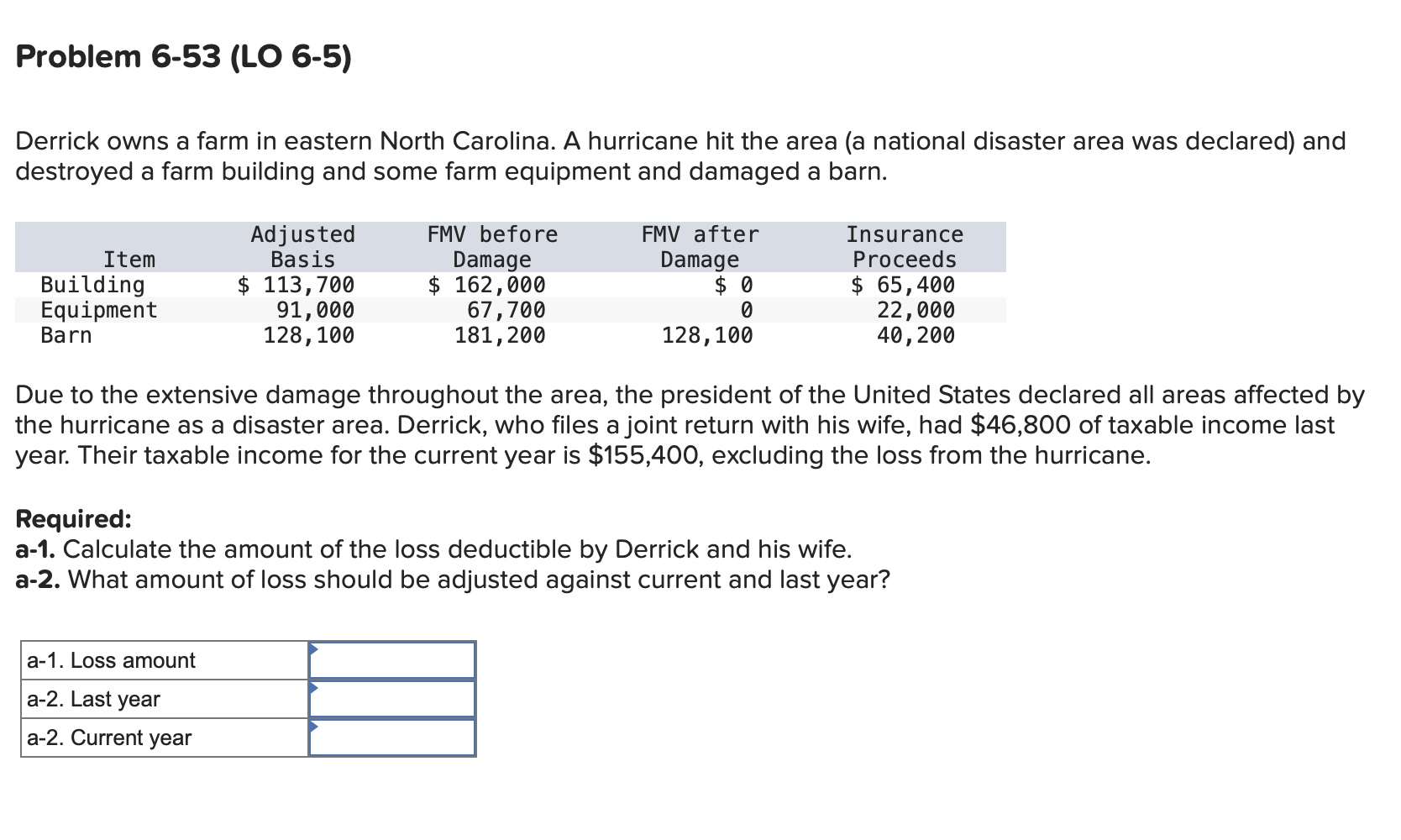

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses: Required: How much of these expenses can Jordan deduct? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value. Answer is complete but not entirely correct. Derrick owns a farm in eastern North Carolina. A hurricane hit the area (a national disaster area was declared) and destroyed a farm building and some farm equipment and damaged a barn. Due to the extensive damage throughout the area, the president of the United States declared all areas affected by the hurricane as a disaster area. Derrick, who files a joint return with his wife, had $46,800 of taxable income last year. Their taxable income for the current year is $155,400, excluding the loss from the hurricane. Required: a-1. Calculate the amount of the loss deductible by Derrick and his wife. a-2. What amount of loss should be adjusted against current and last year

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses: Required: How much of these expenses can Jordan deduct? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value. Answer is complete but not entirely correct. Derrick owns a farm in eastern North Carolina. A hurricane hit the area (a national disaster area was declared) and destroyed a farm building and some farm equipment and damaged a barn. Due to the extensive damage throughout the area, the president of the United States declared all areas affected by the hurricane as a disaster area. Derrick, who files a joint return with his wife, had $46,800 of taxable income last year. Their taxable income for the current year is $155,400, excluding the loss from the hurricane. Required: a-1. Calculate the amount of the loss deductible by Derrick and his wife. a-2. What amount of loss should be adjusted against current and last year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started