Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jordan-Williams, Incorporated investgation team is doing there due diligence following up on a memo supporting partnership with KnowNet. Memo: From Ted Chapman- In fiscal 2020/2019,

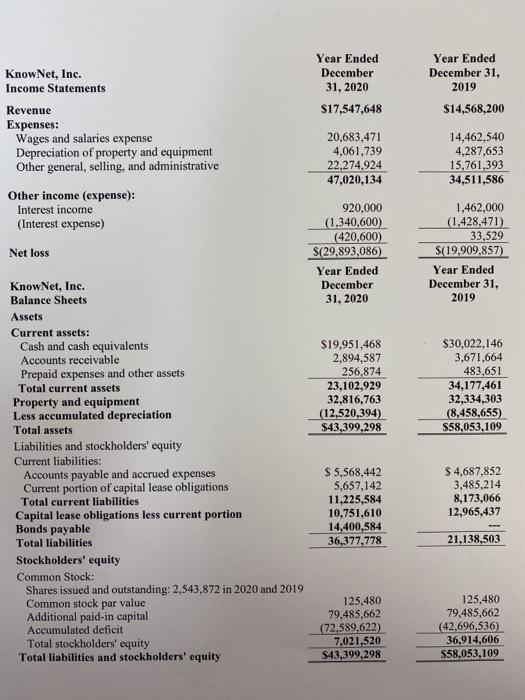

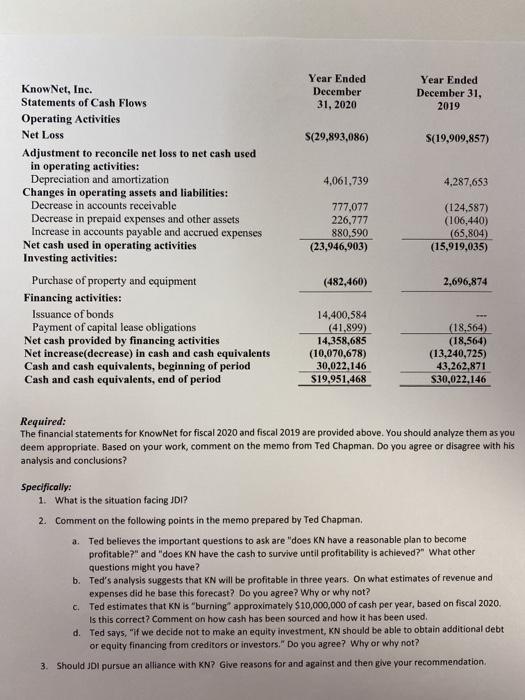

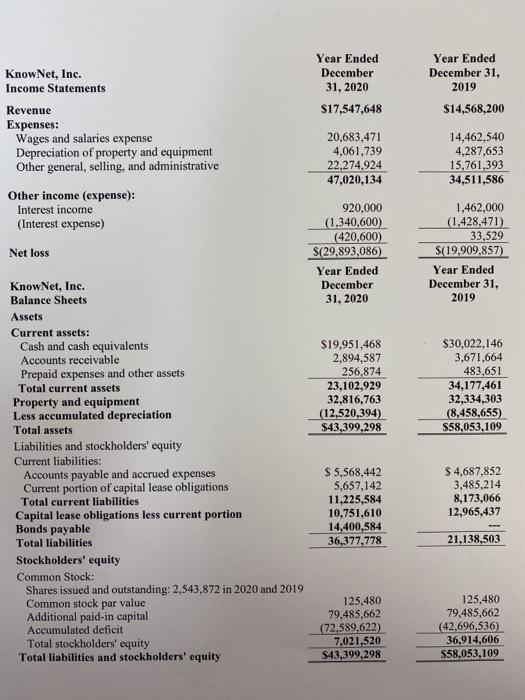

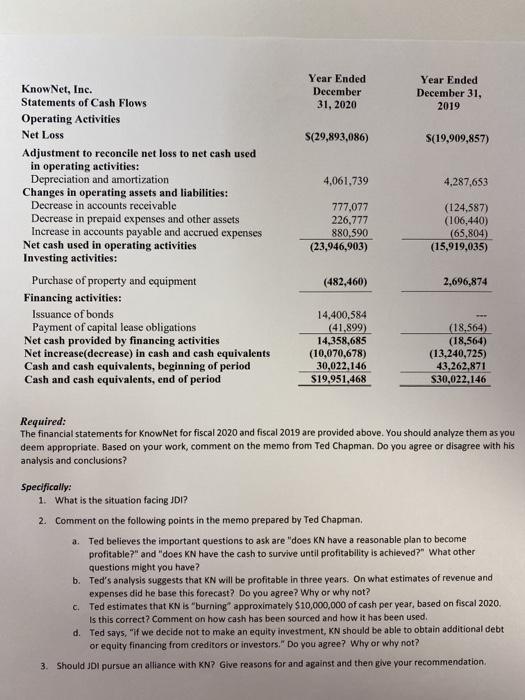

Jordan-Williams, Incorporated investgation team is doing there due diligence following up on a memo supporting partnership with KnowNet. Memo: From Ted Chapman- In fiscal 2020/2019, KnowNet (KN) suffered losses of $26,893,086/$19,909,857. In spite of these losses, the team recommends forming an alliance with KN. KN, like most companies is this space, is an early stage company and losses are not unexpected. The important questions to ask are "does KN have a reasonable plan to become profitable?" and "does KN have the cash to survive until profitability is achieved?" We believe the answer to both questions is yes. In 2020, operating expenses increased substantially resulting in an increased loss. However, per our discussions with executives at KN, the increased operating expenses are due in large part to a major advertising campaign and expansion of the sales force. The result is that KN achieved substantial brand recognition, and in 2020 revenue increased by 20 percent. The company believes that, now that it has achieved brand recognition goals, it can cut operating expenditures (including advertising and sales force salaries) back to level of 80 percent of the amiunts in fiscal 2019, or $27,609,269 (80% x 34,511,586). With current revenue at $17,547,648, and assuming an ongoing revenue growth rate of 20 percent, the company will be profitable in three years (i.e., at the end of fiscal 2023, revenue of $30,322,337 will exceed expenses of $27,609,269). Calcualtions of revenue estimate for year 3: revenue 2020 at $17,547,648, revenue in fiscal 2021 $21,057,178 (fiscal 2020 with 20% increase), revenue 2022 $25,268,614 (fiscal 2021 with 20% increase), and revenue 2023 $30,322,337 (fiscal 2022 with 20% increase). It appears to us that achieving profitability in three years is a very feasable goal. In the fourth quarter if fiscal 2020, the company signed contracts with four additional Fortune 500 clients to deliver services in 2021. The revenue from this prestigious group of clients, is, of course, not reflected in the financial statements for 2020. Also, keep in mind that out partnership with KN will provide incremental revenue to the company. Achieving profitability will only be possible if the company does not run out of cash. At the end of fiscal 2020, KN had approximately $20,000,000 in cas and cash equivalents. The net decrease in cash and cash equivalents in fiscal 2020 was $10,000,000. Thus, it appears that the company will be able to survive for at least two years through fiscal 2022. Assuming an annual decrease in cash of $10,000,000, we would need to make an equity investment of $10,000,000. At the end of year 3, as discussed above, KN will be profitable and likely able to fund itself. Furthermore, it would allow us to have a substantial say in the direction of KN, thus insuring that the company remains focused on our long-run needs in addition to the needs of its clients.

Year Ended December 31, 2020 $17,547,648 Year Ended December 31, 2019 $14,568,200 KnowNet, Inc. Income Statements Revenue Expenses: Wages and salaries expense Depreciation of property and equipment Other general, selling, and administrative Other income (expense): Interest income (Interest expense) 20,683,471 4,061,739 22,274,924 47,020,134 14,462,540 4,287,653 15,761,393 34,511,586 Net loss 920,000 (1,340,600) (420,600) S(29,893,086) Year Ended December 31, 2020 1,462,000 (1.428,471) 33,529 $(19,909,857) Year Ended December 31, 2019 $19,951,468 2.894,587 256,874 23,102,929 32,816,763 (12,520,394) $43,399,298 $30,022,146 3,671,664 483,651 34,177,461 32,334,303 (8,458,655) $58,053,109 KnowNet, Inc. Balance Sheets Assets Current assets: Cash and cash equivalents Accounts receivable Prepaid expenses and other assets Total current assets Property and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and accrued expenses Current portion of capital lease obligations Total current liabilities Capital lease obligations less current portion Bonds payable Total liabilities Stockholders' equity Common Stock: Shares issued and outstanding: 2,543.872 in 2020 and 2019 Common stock par value Additional paid-in capital Accumulated deficit tal stockholders' equity Total liabilities and stockholders' equity $ 5,568,442 5,657,142 11,225,584 10,751,610 14,400,584 36,377,778 $ 4,687,852 3,485,214 8,173,066 12,965,437 21,138,503 125,480 79,485,662 (72,589,622) 7,021,520 $43,399,298 125,480 79.485,662 (42,696,536) 36,914,606 558,053,109 Year Ended December 31, 2020 Year Ended December 31, 2019 S(29,893,086) S(19,909,857) 4,061,739 4,287,653 KnowNet, Inc. Statements of Cash Flows Operating Activities Net Loss Adjustment to reconcile net loss to net cash used in operating activities: Depreciation and amortization Changes in operating assets and liabilities: Decrease in accounts receivable Decrease in prepaid expenses and other assets Increase in accounts payable and accrued expenses Net cash used in operating activities Investing activities: Purchase of property and equipment Financing activities: Issuance of bonds Payment of capital lease obligations Net cash provided by financing activities Net increase(decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period 777,077 226,777 880,590 (23,946,903) (124,587) (106,440) (65,804) (15,919,035) (482,460) 2,696,874 14.400,584 (41.899) 14,358,685 (10,070,678) 30,022,146 $19.951,468 (18.564) (18,564) (13,240,725) 43,262,871 S30,022,146 Required: The financial statements for KnowNet for fiscal 2020 and fiscal 2019 are provided above. You should analyze them as you deem appropriate. Based on your work, comment on the memo from Ted Chapman. Do you agree or disagree with his analysis and conclusions? Specifically: 1. What is the situation facing JDI? 2. Comment on the following points in the memo prepared by Ted Chapman. a. Ted believes the important questions to ask are "does KN have a reasonable plan to become profitable?" and "does KN have the cash to survive until profitability is achieved?" What other questions might you have? b. Ted's analysis suggests that KN will be profitable in three years. On what estimates of revenue and expenses did he base this forecast? Do you agree? Why or why not? c. Ted estimates that KN is "burning" approximately $10,000,000 of cash per year, based on fiscal 2020. Is this correct? Comment on how cash has been sourced and how it has been used d. Ted says, "If we decide not to make an equity investment, KN should be able to obtain additional debt or equity financing from creditors or investors." Do you agree? Why or why not? 3. Should JDI pursue an alliance with KN? Give reasons for and against and then give your recommendation, Year Ended December 31, 2020 $17,547,648 Year Ended December 31, 2019 $14,568,200 KnowNet, Inc. Income Statements Revenue Expenses: Wages and salaries expense Depreciation of property and equipment Other general, selling, and administrative Other income (expense): Interest income (Interest expense) 20,683,471 4,061,739 22,274,924 47,020,134 14,462,540 4,287,653 15,761,393 34,511,586 Net loss 920,000 (1,340,600) (420,600) S(29,893,086) Year Ended December 31, 2020 1,462,000 (1.428,471) 33,529 $(19,909,857) Year Ended December 31, 2019 $19,951,468 2.894,587 256,874 23,102,929 32,816,763 (12,520,394) $43,399,298 $30,022,146 3,671,664 483,651 34,177,461 32,334,303 (8,458,655) $58,053,109 KnowNet, Inc. Balance Sheets Assets Current assets: Cash and cash equivalents Accounts receivable Prepaid expenses and other assets Total current assets Property and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and accrued expenses Current portion of capital lease obligations Total current liabilities Capital lease obligations less current portion Bonds payable Total liabilities Stockholders' equity Common Stock: Shares issued and outstanding: 2,543.872 in 2020 and 2019 Common stock par value Additional paid-in capital Accumulated deficit tal stockholders' equity Total liabilities and stockholders' equity $ 5,568,442 5,657,142 11,225,584 10,751,610 14,400,584 36,377,778 $ 4,687,852 3,485,214 8,173,066 12,965,437 21,138,503 125,480 79,485,662 (72,589,622) 7,021,520 $43,399,298 125,480 79.485,662 (42,696,536) 36,914,606 558,053,109 Year Ended December 31, 2020 Year Ended December 31, 2019 S(29,893,086) S(19,909,857) 4,061,739 4,287,653 KnowNet, Inc. Statements of Cash Flows Operating Activities Net Loss Adjustment to reconcile net loss to net cash used in operating activities: Depreciation and amortization Changes in operating assets and liabilities: Decrease in accounts receivable Decrease in prepaid expenses and other assets Increase in accounts payable and accrued expenses Net cash used in operating activities Investing activities: Purchase of property and equipment Financing activities: Issuance of bonds Payment of capital lease obligations Net cash provided by financing activities Net increase(decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period 777,077 226,777 880,590 (23,946,903) (124,587) (106,440) (65,804) (15,919,035) (482,460) 2,696,874 14.400,584 (41.899) 14,358,685 (10,070,678) 30,022,146 $19.951,468 (18.564) (18,564) (13,240,725) 43,262,871 S30,022,146 Required: The financial statements for KnowNet for fiscal 2020 and fiscal 2019 are provided above. You should analyze them as you deem appropriate. Based on your work, comment on the memo from Ted Chapman. Do you agree or disagree with his analysis and conclusions? Specifically: 1. What is the situation facing JDI? 2. Comment on the following points in the memo prepared by Ted Chapman. a. Ted believes the important questions to ask are "does KN have a reasonable plan to become profitable?" and "does KN have the cash to survive until profitability is achieved?" What other questions might you have? b. Ted's analysis suggests that KN will be profitable in three years. On what estimates of revenue and expenses did he base this forecast? Do you agree? Why or why not? c. Ted estimates that KN is "burning" approximately $10,000,000 of cash per year, based on fiscal 2020. Is this correct? Comment on how cash has been sourced and how it has been used d. Ted says, "If we decide not to make an equity investment, KN should be able to obtain additional debt or equity financing from creditors or investors." Do you agree? Why or why not? 3. Should JDI pursue an alliance with KN? Give reasons for and against and then give your recommendation Required: You should analyze the data as yoy deem appropriate and based on your findings do you agree or disagree with Ted Chapmans analysis and conclusions in his memo? What is the situation facing JWI? Should JWI pursue an alliance with KN? Ehat other questions should Ted believe are important besides resonable plan to become profitable and enough cash to survive? Teds analysis suggests that KN will be profitable in three years, on what estimates of revenue and expenses did he base his forecast ( agree or disagree)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started