Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jose Aldo, age 66, earned $38,500 from his part-time job at Canadian United. In addition, he received $24,100 during the year from CPP &

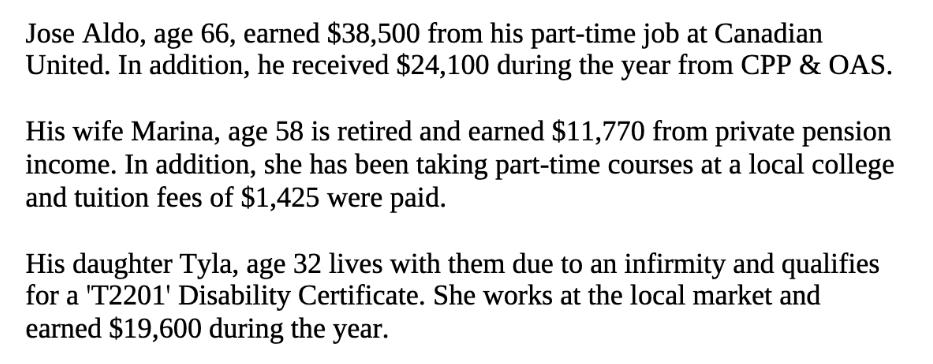

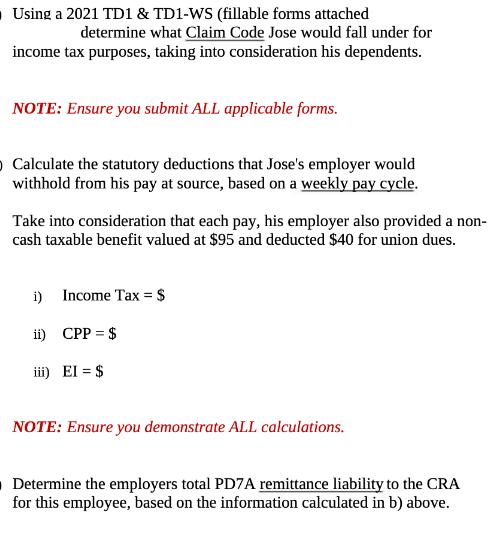

Jose Aldo, age 66, earned $38,500 from his part-time job at Canadian United. In addition, he received $24,100 during the year from CPP & OAS. His wife Marina, age 58 is retired and earned $11,770 from private pension income. In addition, she has been taking part-time courses at a local college and tuition fees of $1,425 were paid. His daughter Tyla, age 32 lives with them due to an infirmity and qualifies for a 'T2201' Disability Certificate. She works at the local market and earned $19,600 during the year. Using a 2021 TD1 & TD1-WS (fillable forms attached determine what Claim Code Jose would fall under for income tax purposes, taking into consideration his dependents. NOTE: Ensure you submit ALL applicable forms. O Calculate the statutory deductions that Jose's employer would withhold from his pay at source, based on a weekly pay cycle. Take into consideration that each pay, his employer also provided a non- cash taxable benefit valued at $95 and deducted $40 for union dues. i) Income Tax = $ ii) CPP = $ iii) EI = $ NOTE: Ensure you demonstrate ALL calculations. O Determine the employers total PD7A remittance liability to the CRA for this employee, based on the information calculated in b) above.

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Determine Jose Aldos Claim Code statutory deductions and the employers total PD7A remittance liability Claim Code for Jose Aldo Jose is earning employ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started