Answered step by step

Verified Expert Solution

Question

1 Approved Answer

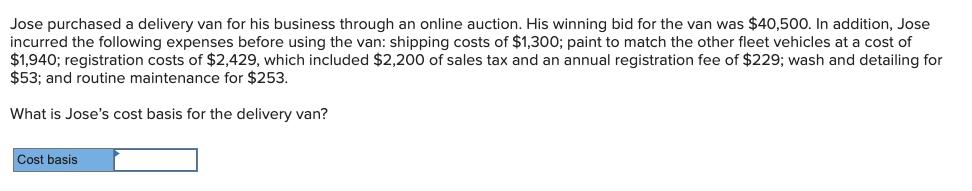

Jose purchased a delivery van for his business through an online auction. His winning bid for the van was $40,500. In addition, Jose incurred

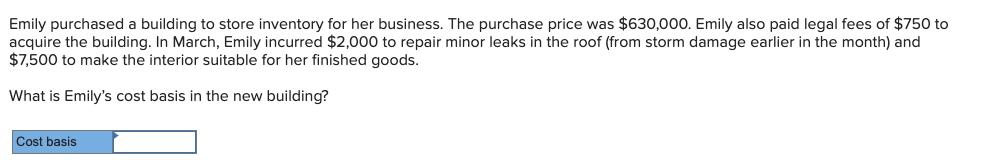

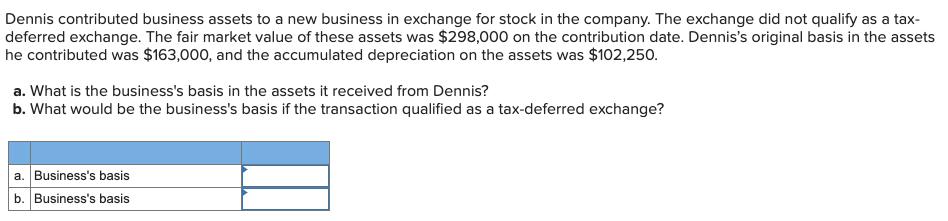

Jose purchased a delivery van for his business through an online auction. His winning bid for the van was $40,500. In addition, Jose incurred the following expenses before using the van: shipping costs of $1,300; paint to match the other fleet vehicles at a cost of $1,940; registration costs of $2,429, which included $2,200 of sales tax and an annual registration fee of $229; wash and detailing for $53; and routine maintenance for $253. What is Jose's cost basis for the delivery van? Cost basis Emily purchased a building to store inventory for her business. The purchase price was $630,000. Emily also paid legal fees of $750 to acquire the building. In March, Emily incurred $2,000 to repair minor leaks in the roof (from storm damage earlier in the month) and $7,500 to make the interior suitable for her finished goods. What is Emily's cost basis in the new building? Cost basis Dennis contributed business assets to a new business in exchange for stock in the company. The exchange did not qualify as a tax- deferred exchange. The fair market value of these assets was $298,000 on the contribution date. Dennis's original basis in the assets he contributed was $163,000, and the accumulated depreciation on the assets was $102,250. a. What is the business's basis in the assets it received from Dennis? b. What would be the business's basis if the transaction qualified as a tax-deferred exchange? a. Business's basis b. Business's basis

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answers Cost Basis Cost basis is the original value of an asset for tax purposes Cost basis is the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started