Answered step by step

Verified Expert Solution

Question

1 Approved Answer

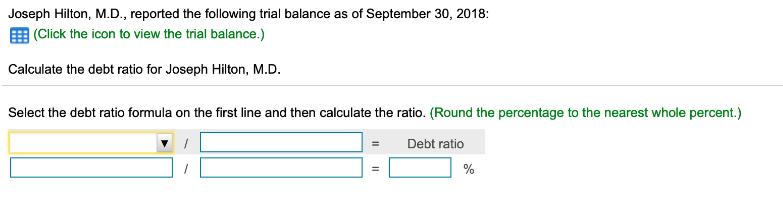

Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: (Click the icon to view the trial balance.) Calculate the debt

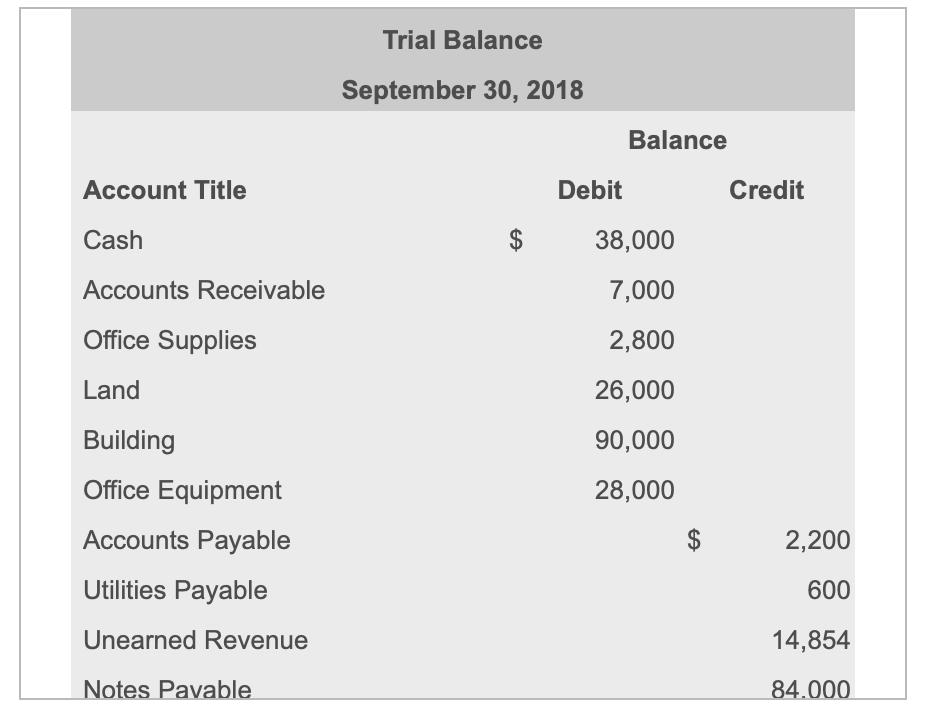

Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Trial Balance September 30, 2018 Balance Account Title Debit Credit Cash 38,000 Accounts Receivable 7,000 Office Supplies 2,800 Land 26,000 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Pavable 84.000 %24 %24 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Payable 84,000 Common Stock 140,000 Dividends 56,000 Service Revenue 31,146 Salaries Expense 23,700 Utilities Expense 1,000 300 Advertising Expense $ 272,800 $ 272,800 Total %24 %24 Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: E (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Average total assets Average total equity Average total liabilities Net income Total assets Total equity Total liabilities Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Trial Balance September 30, 2018 Balance Account Title Debit Credit Cash 38,000 Accounts Receivable 7,000 Office Supplies 2,800 Land 26,000 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Pavable 84.000 %24 %24 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Payable 84,000 Common Stock 140,000 Dividends 56,000 Service Revenue 31,146 Salaries Expense 23,700 Utilities Expense 1,000 300 Advertising Expense $ 272,800 $ 272,800 Total %24 %24 Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: E (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Average total assets Average total equity Average total liabilities Net income Total assets Total equity Total liabilities Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Trial Balance September 30, 2018 Balance Account Title Debit Credit Cash 38,000 Accounts Receivable 7,000 Office Supplies 2,800 Land 26,000 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Pavable 84.000 %24 %24 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Payable 84,000 Common Stock 140,000 Dividends 56,000 Service Revenue 31,146 Salaries Expense 23,700 Utilities Expense 1,000 300 Advertising Expense $ 272,800 $ 272,800 Total %24 %24 Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: E (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Average total assets Average total equity Average total liabilities Net income Total assets Total equity Total liabilities Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Trial Balance September 30, 2018 Balance Account Title Debit Credit Cash 38,000 Accounts Receivable 7,000 Office Supplies 2,800 Land 26,000 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Pavable 84.000 %24 %24 Building 90,000 Office Equipment 28,000 Accounts Payable 2,200 Utilities Payable 600 Unearned Revenue 14,854 Notes Payable 84,000 Common Stock 140,000 Dividends 56,000 Service Revenue 31,146 Salaries Expense 23,700 Utilities Expense 1,000 300 Advertising Expense $ 272,800 $ 272,800 Total %24 %24 Joseph Hilton, M.D., reported the following trial balance as of September 30, 2018: E (Click the icon to view the trial balance.) Calculate the debt ratio for Joseph Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Debt ratio % Average total assets Average total equity Average total liabilities Net income Total assets Total equity Total liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Debt ratio total liabilitiestotal assets ASSETS Amount CASH 3800000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started