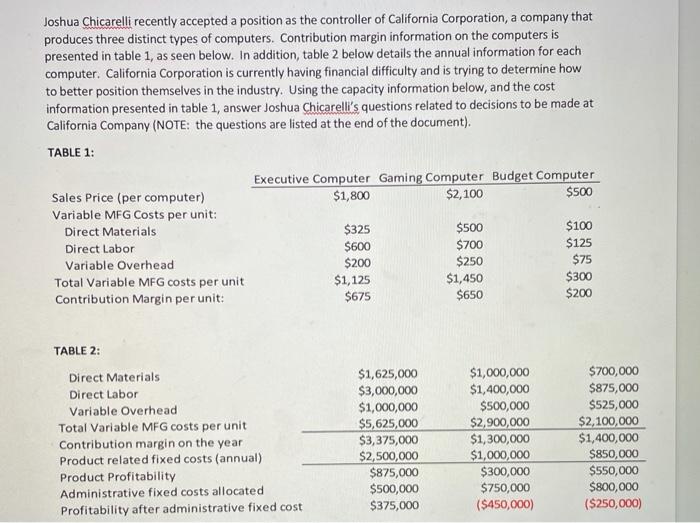

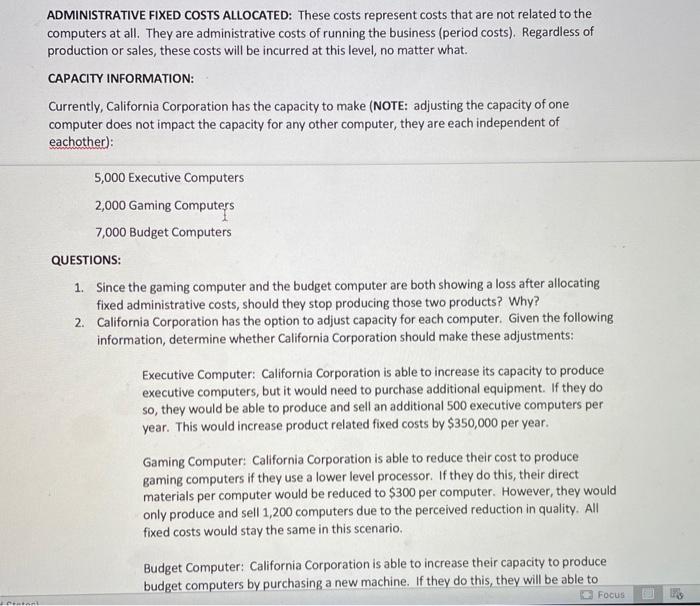

Joshua Chicarelli recently accepted a position as the controller of California Corporation, a company that produces three distinct types of computers. Contribution margin information on the computers is presented in table 1, as seen below. In addition, table 2 below details the annual information for each computer. California Corporation is currently having financial difficulty and is trying to determine how to better position themselves in the industry. Using the capacity information below, and the cost information presented in table 1, answer Joshua Chicarelli's questions related to decisions to be made at California Company (NOTE: the questions are listed at the end of the document). TABLE 1: Executive Computer Gaming Computer Budget Computer Sales Price (per computer) $1,800 $2,100 $500 Variable MFG Costs per unit: Direct Materials $325 $500 $100 Direct Labor $600 $700 $125 Variable Overhead $200 $250 $75 Total Variable MFG costs per unit $1,125 $1,450 $300 Contribution Margin per unit: $675 $650 $200 TABLE 2: Direct Materials Direct Labor Variable Overhead Total Variable MFG costs per unit Contribution margin on the year Product related fixed costs (annual) Product Profitability Administrative fixed costs allocated Profitability after administrative fixed cost $1,625,000 $3,000,000 $1,000,000 $5,625,000 $3,375,000 $2,500,000 $875,000 $500,000 $375,000 $1,000,000 $1,400,000 $500,000 $2,900,000 $1,300,000 $1,000,000 $300,000 $750,000 ($450,000) $700,000 $875,000 $525,000 $2,100,000 $1,400,000 $850,000 $550,000 $800,000 ($250,000) ADMINISTRATIVE FIXED COSTS ALLOCATED: These costs represent costs that are not related to the computers at all. They are administrative costs of running the business (period costs). Regardless of production or sales, these costs will be incurred at this level, no matter what. CAPACITY INFORMATION: Currently, California Corporation has the capacity to make (NOTE: adjusting the capacity of one computer does not impact the capacity for any other computer, they are each independent of eachother) 5,000 Executive Computers 2,000 Gaming Computers 7,000 Budget Computers QUESTIONS: 1. Since the gaming computer and the budget computer are both showing a loss after allocating fixed administrative costs, should they stop producing those two products? Why? 2. California Corporation has the option to adjust capacity for each computer. Given the following information, determine whether California Corporation should make these adjustments: Executive Computer: California Corporation is able to increase its capacity to produce executive computers, but it would need to purchase additional equipment. If they do so, they would be able to produce and sell an additional 500 executive computers per year. This would increase product related fixed costs by $350,000 per year. Gaming Computer: California Corporation is able to reduce their cost to produce gaming computers if they use a lower level processor. If they do this, their direct materials per computer would be reduced to $300 per computer. However, they would only produce and sell 1,200 computers due to the perceived reduction in quality. All fixed costs would stay the same in this scenario. Budget Computer: California Corporation is able to increase their capacity to produce budget computers by purchasing a new machine. If they do this, they will be able to D Focus Aa8bccbdte Title Normal No Spacing = == =" by , Heading 1 Heading 2 Executive Computer: California Corporation is able to increase its capacity to produce executive computers, but it would need to purchase additional equipment. If they do so, they would be able to produce and sell an additional 500 executive computers per year. This would increase product related fixed costs by $350,000 per year. Gaming Computer: California Corporation is able to reduce their cost to produce gaming computers if they use a lower level processor. If they do this, their direct materials per computer would be reduced to $300 per computer. However, they would only produce and sell 1,200 computers due to the perceived reduction in quality. All fixed costs would stay the same in this scenario. Budget Computer: California Corporation is able to increase their capacity to produce budget computrs by purchasing a new machine. If they do this, they will be able to produce and sell an additional 1,000 budget computers. This would increase their product related fixed costs by $50,000 per year. What to do Contribution margin= sales price- variable costs Tells me how much profit I keep from every sale to cover fixed costs. If I sell 500 executive computers, I will generate an extra 337,500 in contribution margin (500 computers * 675 per computer) It's going to cost me $350,000 to do this. If I do it, I will make an extra 337,500