Joshua & White Technology: December 31 Balance Sheets (Thousands of Dollars) 2021 2020 Assets Cash $ 18,900 $ 18,000 Short-term investments 4,151 3,040 Accounts receivable

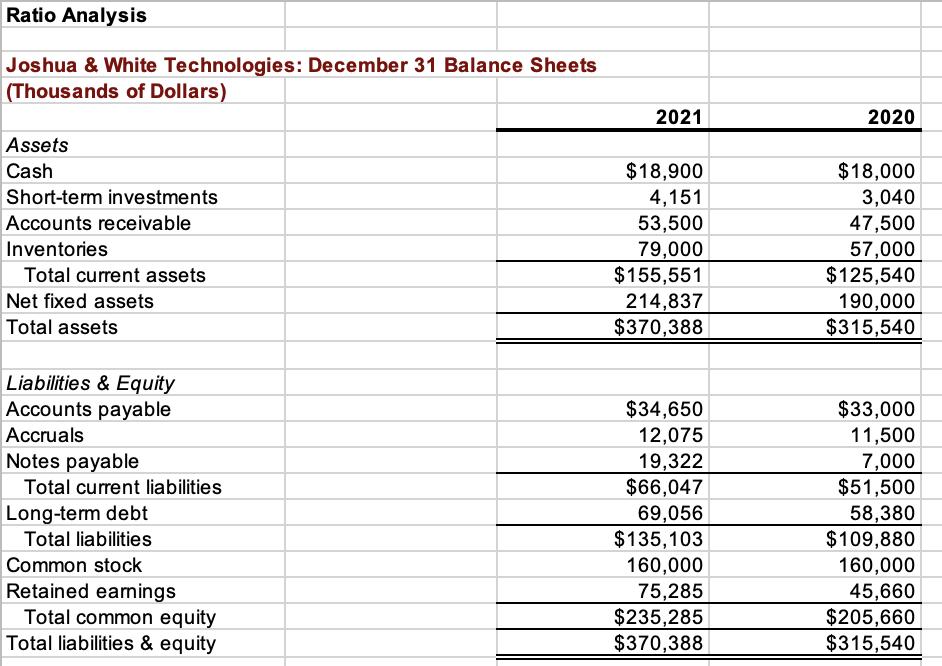

| Joshua & White Technology: December 31 Balance Sheets | ||||||

| (Thousands of Dollars) | ||||||

| 2021 | 2020 | |||||

| Assets | ||||||

| Cash | $ | 18,900 | $ | 18,000 | ||

| Short-term investments | 4,151 | 3,040 | ||||

| Accounts receivable | 53,500 | 47,500 | ||||

| Inventories | 79,000 | 57,000 | ||||

| Total current assets | $ | 155,551 | $ | 125,540 | ||

| Net fixed assets | 214,837 | 190,000 | ||||

| Total assets | $ | 370,388 | $ | 315,540 | ||

| Liabilities & Equity | ||||||

| Accounts payable | $ | 34,650 | $ | 33,000 | ||

| Accruals | 12,075 | 11,500 | ||||

| Notes payable | 19,322 | 7,000 | ||||

| Total current liabilities | $ | 66,047 | $ | 51,500 | ||

| Long-term debt | 69,056 | 58,380 | ||||

| Total liabilities | $ | 135,103 | $ | 109,880 | ||

| Common stock | 160,000 | 160,000 | ||||

| Retained earnings | 75,285 | 45,660 | ||||

| Total common equity | $ | 235,285 | $ | 205,660 | ||

| Total liabilities & equity | $ | 370,388 | $ | 315,540 | ||

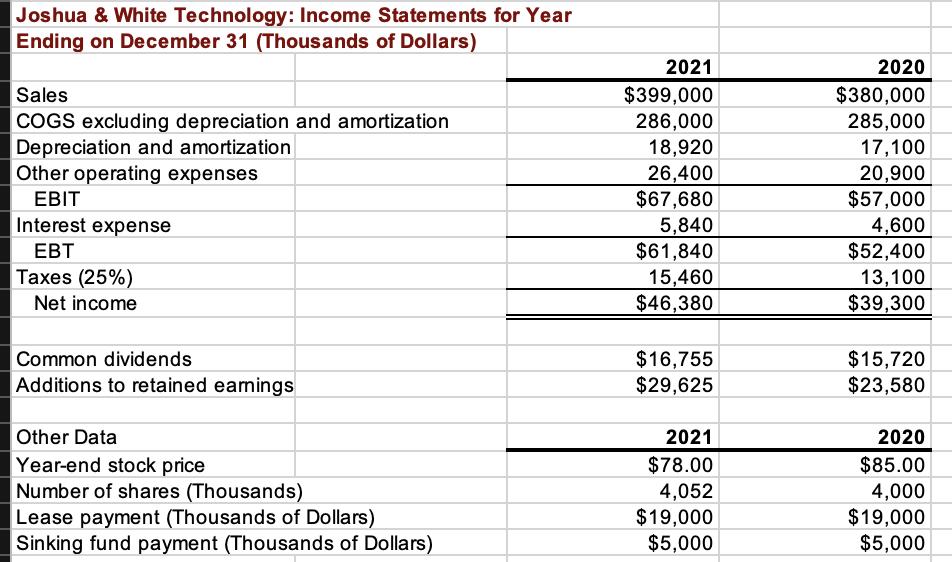

| Joshua & White Technology: Income Statements for Year | ||||||

| Ending on December 31 (Thousands of Dollars) | ||||||

| 2021 | 2020 | |||||

| Sales | $ | 399,000 | $ | 380,000 | ||

| COGS excluding depreciation and amortization | 286,000 | 285,000 | ||||

| Depreciation and amortization | 18,920 | 17,100 | ||||

| Other operating expenses | 26,400 | 20,900 | ||||

| EBIT | $ | 67,680 | $ | 57,000 | ||

| Interest expense | 5,840 | 4,600 | ||||

| EBT | $ | 61,840 | $ | 52,400 | ||

| Taxes (25%) | 15,460 | 13,100 | ||||

| Net income | $ | 46,380 | $ | 39,300 | ||

| Common dividends | $ | 16,755 | $ | 15,720 | ||

| Additions to retained earnings | $ | 29,625 | $ | 23,580 | ||

| Other Data | 2021 | 2020 | ||||

| Year-end stock price | $ | 78.00 | $ | 85.00 | ||

| Number of shares (Thousands) | 4,052 | 4,000 | ||||

| Lease payment (Thousands of Dollars) | $ | 19,000 | $ | 19,000 | ||

| Sinking fund payment (Thousands of Dollars) | $ | 5,000 | $ | 5,000 | ||

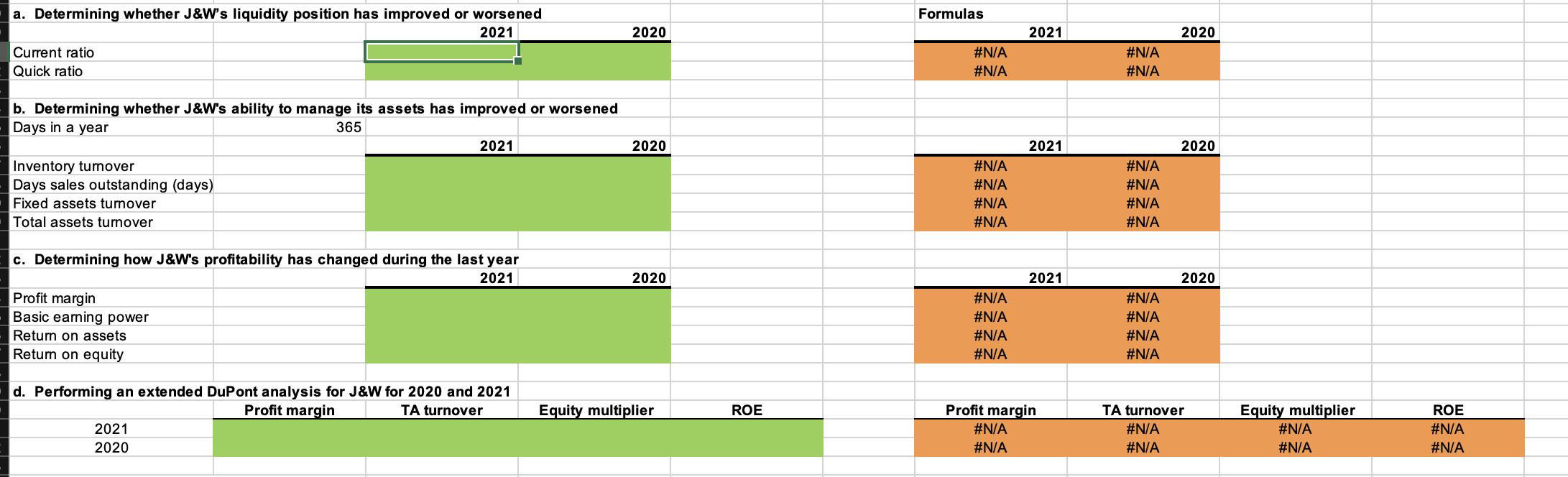

Ratio Analysis Joshua & White Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained eamings Total common equity Total liabilities & equity 2021 $18,900 4,151 53,500 79,000 $155,551 214,837 $370,388 $34,650 12,075 19,322 $66,047 69,056 $135,103 160,000 75,285 $235,285 $370,388 2020 $18,000 3,040 47,500 57,000 $125,540 190,000 $315,540 $33,000 11,500 7,000 $51,500 58,380 $109,880 160,000 45,660 $205,660 $315,540

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

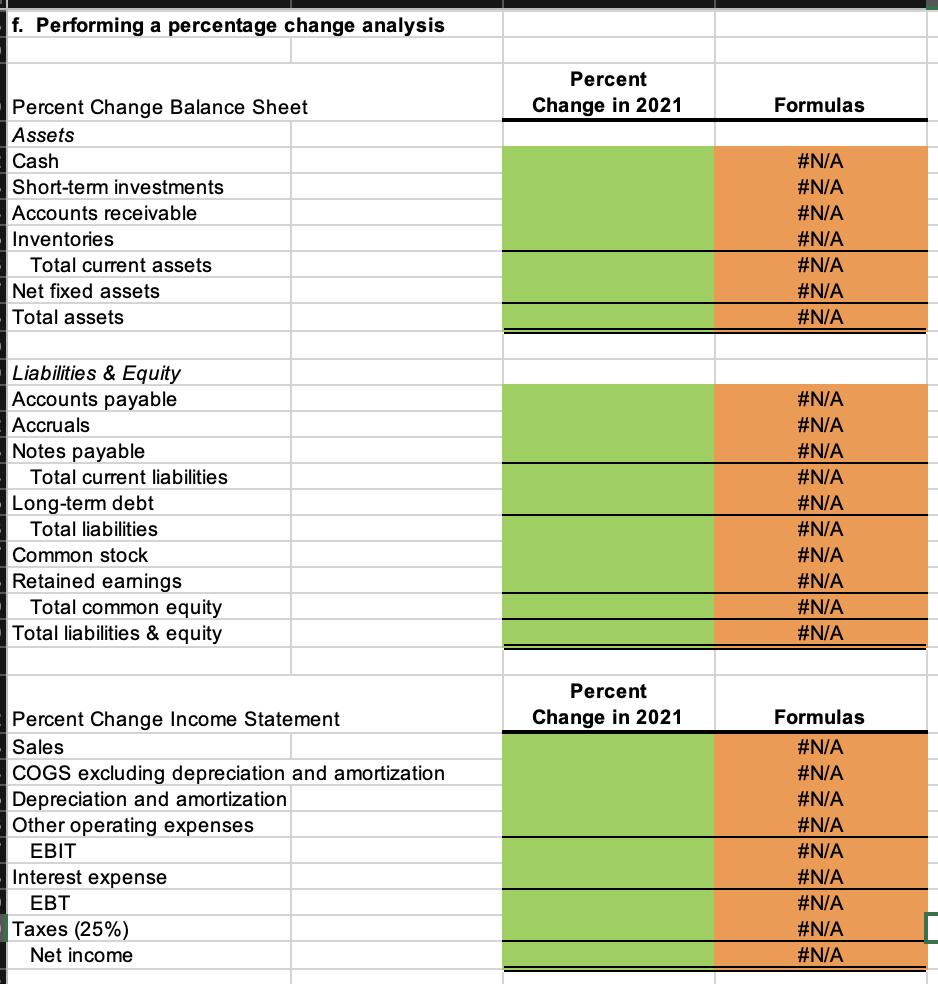

Answer i We have to do a financial statement analysis of Joshua and White The following table includes the Formula for all the ratios asked in the question Based on the below table we will calculate t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started