Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jotta & Co Itd (Jotta) began trading as a family run business 30 years ago and operates a chain of do it yourself (DIY)

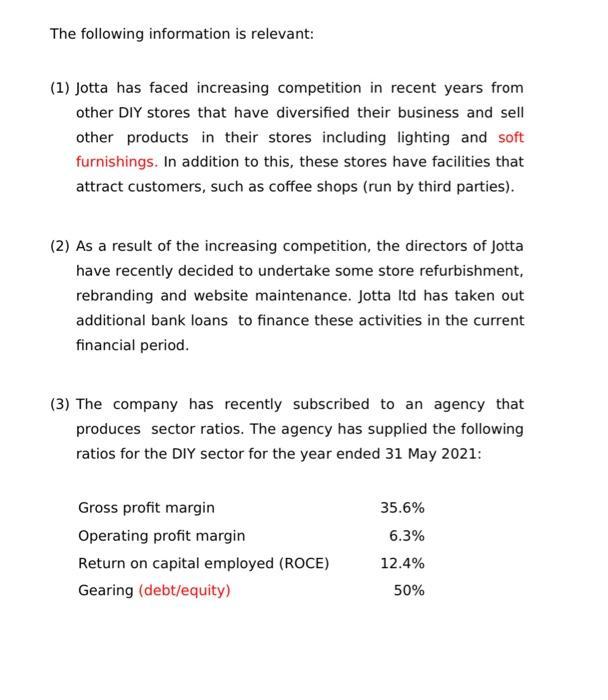

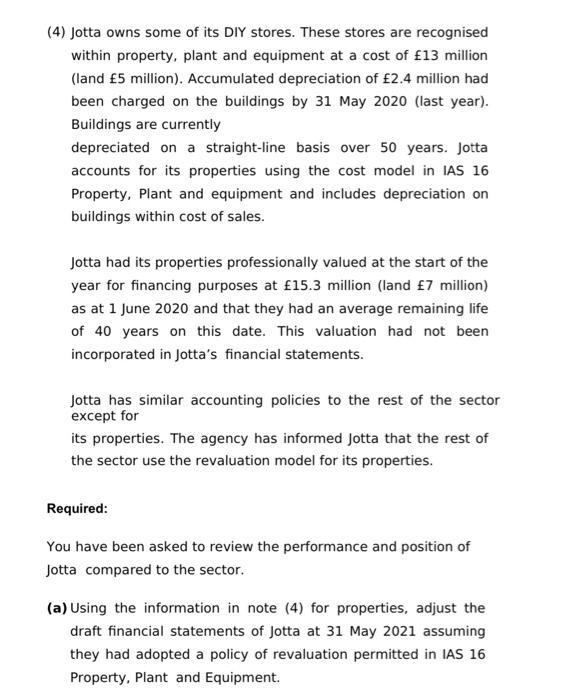

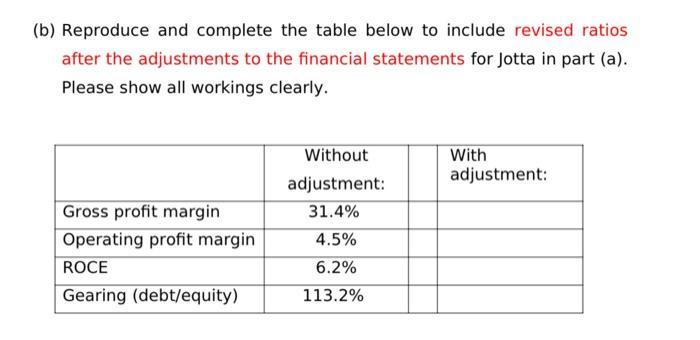

Jotta & Co Itd (Jotta) began trading as a family run business 30 years ago and operates a chain of do it yourself (DIY) stores. Jotta's management has not changed since it began, and its stores maintain a traditional DIY store layout. Customers can purchase DIY items such as decorating, plumbing and electrical equipment. Jotta sells its DIY items to both wholesale and retail customers and has a higher proportion of wholesale sales than the rest of the sector. Extracts from the financial statements of Jotta for the year ended 31 May 2021 are shown below: Statement of profit or loss extract Revenue 28,101,500 Cost of sales 19,273,795 8,827,705 Gross profit Operating expenses -7,550,062 Profit from operations 1.277,643 Statement of financial position extract Total equity 9,713,698 Non-current liabilities Bank loan 11,000,000 The following information is relevant: (1) Jotta has faced increasing competition in recent years from other DIY stores that have diversified their business and sell other products in their stores including lighting and soft furnishings. In addition to this, these stores have facilities that attract customers, such as coffee shops (run by third parties). (2) As a result of the increasing competition, the directors of Jotta have recently decided to undertake some store refurbishment, rebranding and website maintenance. Jotta Itd has taken out additional bank loans to finance these activities in the current financial period. (3) The company has recently subscribed to an agency that produces sector ratios. The agency has supplied the following ratios for the DIY sector for the year ended 31 May 2021: Gross profit margin 35.6% Operating profit margin 6.3% Return on capital employed (ROCE) 12.4% Gearing (debt/equity) 50% (4) Jotta owns some of its DIY stores. These stores are recognised within property, plant and equipment at a cost of 13 million (land 5 million). Accumulated depreciation of 2.4 million had been charged on the buildings by 31 May 2020 (last year). Buildings are currently depreciated on a straight-line basis over 50 years. Jotta accounts for its properties using the cost model in IAS 16 Property, Plant and equipment and includes depreciation on buildings within cost of sales. Jotta had its properties professionally valued at the start of the year for financing purposes at 15.3 million (land 7 million) as at 1 June 2020 and that they had an average remaining life of 40 years on this date. This valuation had not been incorporated in Jotta's financial statements. Jotta has similar accounting policies to the rest of the sector except for its properties. The agency has informed Jotta that the rest of the sector use the revaluation model for its properties. Required: You have been asked to review the performance and position of Jotta compared to the sector. (a) Using the information in note (4) for properties, adjust the draft financial statements of Jotta at 31 May 2021 assuming they had adopted a policy of revaluation permitted in IAS 16 Property, Plant and Equipment. (b) Reproduce and complete the table below to include revised ratios after the adjustments to the financial statements for Jotta in part (a). Please show all workings clearly. Without With adjustment: adjustment: Gross profit margin 31.4% Operating profit margin 4.5% ROCE 6.2% Gearing (debt/equity) 113.2%

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Revaluation Model under IAS 16 Under this model all the assets belonging to an asset class are revalued on the revaluation date together instead of revaluation being done on a single asset from the as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started