Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journak enteries and the second picture answee please. Thanks. Journal entries and thanks picture question please Practice Journal Entries: (prepare these entries on the following

journak enteries and the second picture answee please. Thanks.

Journal entries and thanks picture question please

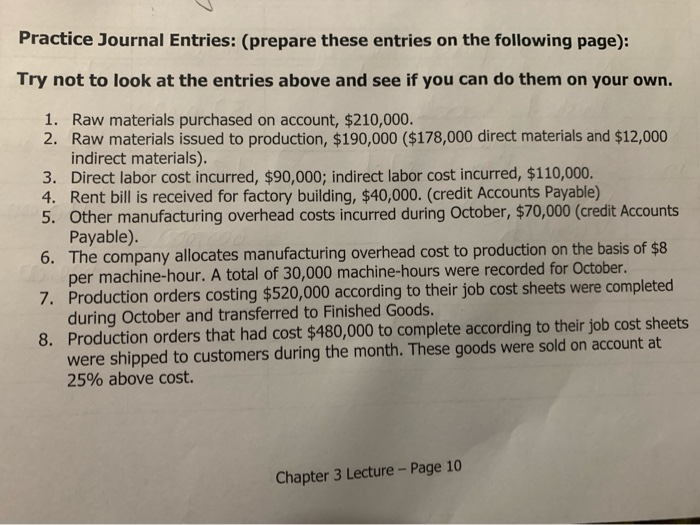

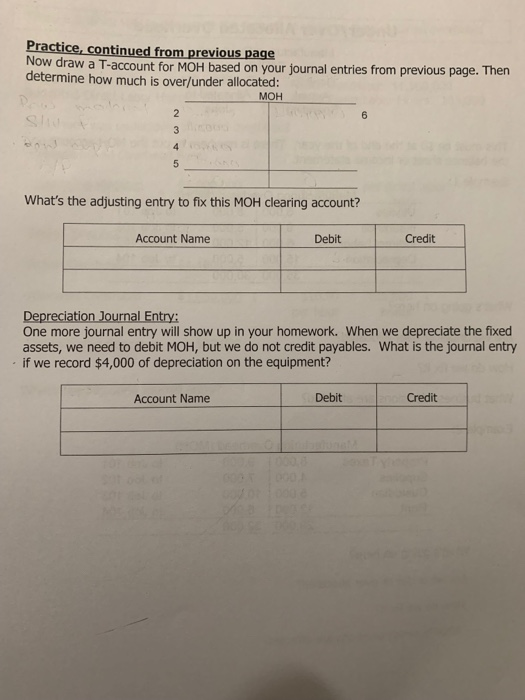

Practice Journal Entries: (prepare these entries on the following page): Try not to look at the entries above and see if you can do them on your own. 1. Raw materials purchased on account, $210,000. 2. Raw materials issued to production, $190,000 ($178,000 direct materials and $12,000 indirect materials). 3. Direct labor cost incurred, $90,000; indirect labor cost incurred, $110,000. 4. Rent bill is received for factory building, $40,000. (credit Accounts Payable) 5. Other manufacturing overhead costs incurred during October, $70,000 (credit Accounts Payable). 6. The company allocates manufacturing overhead cost to production on the basis of $8 per machine-hour. A total of 30,000 machine-hours were recorded for October. 7. Production orders costing $520,000 according to their job cost sheets were completed during October and transferred to Finished Goods. 8. Production orders that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These goods were sold on account at 25% above cost. Chapter 3 Lecture - Page 10 Practice, continued from previous page Now draw a T-account for MOH based on your journal entries from previous page. Then determine how much is over/under allocated: 5 S What's the adjusting entry to fix this MOH clearing account? Account Name Debit Credit Depreciation Journal Entry: One more journal entry will show up in your homework. When we depreciate the fixed assets, we need to debit MOH, but we do not credit payables. What is the journal entry if we record $4,000 of depreciation on the equipment? Account Name Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started