Answered step by step

Verified Expert Solution

Question

1 Approved Answer

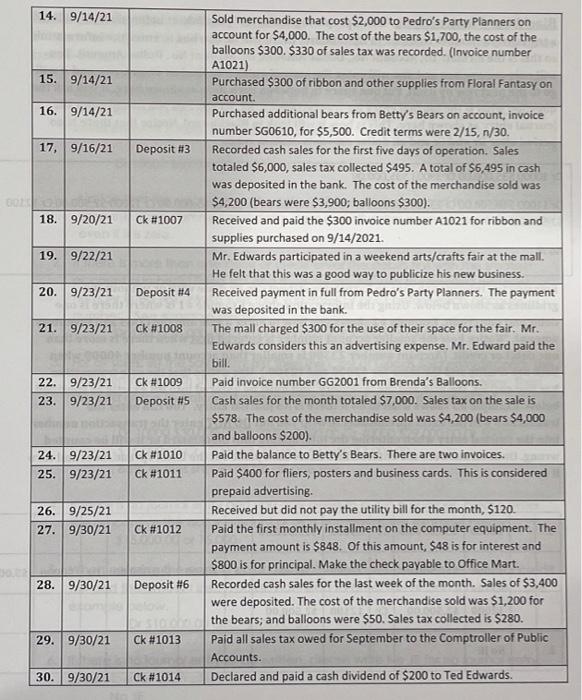

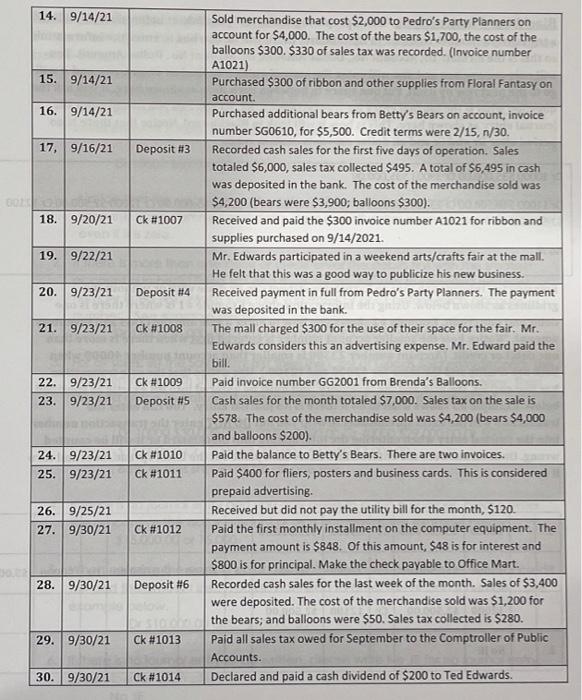

journal entries 14. 9/14/21 15. 9/14/21 16. 9/14/21 17, 9/16/21 Deposit #3 DO 18. 9/20/21 Ck #1007 19. 9/22/21 20. 9/23/21 Deposit #4 21. 9/23/21

journal entries

14. 9/14/21 15. 9/14/21 16. 9/14/21 17, 9/16/21 Deposit #3 DO 18. 9/20/21 Ck #1007 19. 9/22/21 20. 9/23/21 Deposit #4 21. 9/23/21 Ck #1008 Sold merchandise that cost $2,000 to Pedro's Party Planners on account for $4,000. The cost of the bears $1,700, the cost of the balloons $300. $330 of sales tax was recorded. (Invoice number A1021) Purchased $300 of ribbon and other supplies from Floral Fantasy on account. Purchased additional bears from Betty's Bears on account, invoice number SG0610, for $5,500. Credit terms were 2/15, n/30. Recorded cash sales for the first five days of operation Sales totaled $6,000, sales tax collected $495. A total of $6,495 in cash was deposited in the bank. The cost of the merchandise sold was $4,200 (bears were $3,900; balloons $300). Received and paid the $300 invoice number A1021 for ribbon and supplies purchased on 9/14/2021. Mr. Edwards participated in a weekend arts/crafts fair at the mall. He felt that this was a good way to publicize his new business. Received payment in full from Pedro's Party Planners. The payment was deposited in the bank. The mall charged $300 for the use of their space for the fair. Mr. Edwards considers this an advertising expense. Mr. Edward paid the bill. Paid invoice number GG2001 from Brenda's Balloons. Cash sales for the month totaled $7,000. Sales tax on the sale is $578. The cost of the merchandise sold was $4,200 (bears $4,000 and balloons $200) Paid the balance to Betty's Bears. There are two invoices. Paid $400 for fliers, posters and business cards. This is considered prepaid advertising. Received but did not pay the utility bill for the month, $120. Paid the first monthly installment on the computer equipment. The payment amount is $848. Of this amount, $48 is for interest and $800 is for principal. Make the check payable to Office Mart. Recorded cash sales for the last week of the month. Sales of $3,400 were deposited. The cost of the merchandise sold was $1,200 for the bears; and balloons were $50. Sales tax collected is $280. Paid all sales tax owed for September to the Comptroller of Public Accounts. Declared and paid a cash dividend of $200 to Ted Edwards 22. 9/23/21 23. 9/23/21 Ck #1009 Deposit #5 24. 9/23/21 25. 9/23/21 Ck #1010 Ck #1011 26. 9/25/21 27. 9/30/21 Ck #1012 28. 9/30/21 Deposit #6 29. 9/30/21 Ck #1013 30. 9/30/21 Ck #1014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started