Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journal entries 2023 PROBLEM 1 - Investment in Bonds On September 1, 2019, A Co. purchased 10%, P6,000,000 face value bonds of X Co. at

journal entries

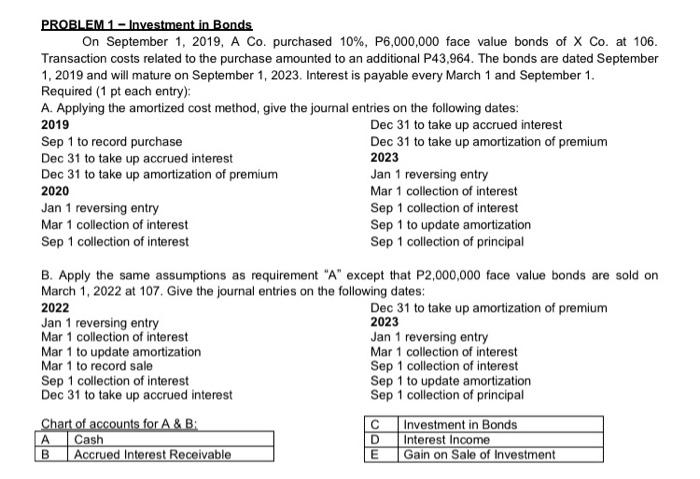

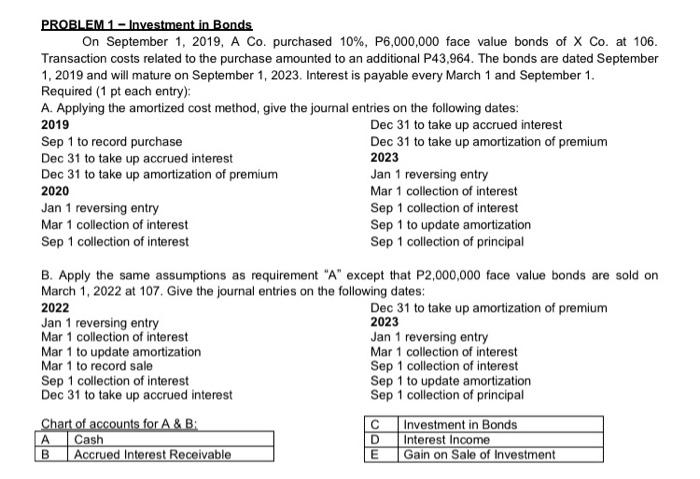

2023 PROBLEM 1 - Investment in Bonds On September 1, 2019, A Co. purchased 10%, P6,000,000 face value bonds of X Co. at 106. Transaction costs related to the purchase amounted to an additional P43,964. The bonds are dated September 1, 2019 and will mature on September 1, 2023. Interest is payable every March 1 and September 1. Required (1 pt each entry): A. Applying the amortized cost method, give the journal entries on the following dates: 2019 Dec 31 to take up accrued interest Sep 1 to record purchase Dec 31 to take up amortization of premium Dec 31 to take up accrued interest Dec 31 to take up amortization of premium Jan 1 reversing entry 2020 Mar 1 collection of interest Jan 1 reversing entry Sep 1 collection of interest Mar 1 collection of interest Sep 1 to update amortization Sep 1 collection of interest Sep 1 collection of principal B. Apply the same assumptions as requirement "A" except that P2,000,000 face value bonds are sold on March 1, 2022 at 107. Give the journal entries on the following dates: 2022 Dec 31 to take up amortization of premium Jan 1 reversing entry 2023 Mar 1 collection of interest Jan 1 reversing entry Mar 1 to update amortization Mar 1 collection of interest Mar 1 to record sale Sep 1 collection of interest Sep 1 collection of interest Sep 1 to update amortization Dec 31 to take up accrued interest Sep 1 collection of principal Chart of accounts for A & B: Investment in Bonds Cash Interest Income Accrued Interest Receivable Gain on Sale of Investment A B D E 2023 PROBLEM 1 - Investment in Bonds On September 1, 2019, A Co. purchased 10%, P6,000,000 face value bonds of X Co. at 106. Transaction costs related to the purchase amounted to an additional P43,964. The bonds are dated September 1, 2019 and will mature on September 1, 2023. Interest is payable every March 1 and September 1. Required (1 pt each entry): A. Applying the amortized cost method, give the journal entries on the following dates: 2019 Dec 31 to take up accrued interest Sep 1 to record purchase Dec 31 to take up amortization of premium Dec 31 to take up accrued interest Dec 31 to take up amortization of premium Jan 1 reversing entry 2020 Mar 1 collection of interest Jan 1 reversing entry Sep 1 collection of interest Mar 1 collection of interest Sep 1 to update amortization Sep 1 collection of interest Sep 1 collection of principal B. Apply the same assumptions as requirement "A" except that P2,000,000 face value bonds are sold on March 1, 2022 at 107. Give the journal entries on the following dates: 2022 Dec 31 to take up amortization of premium Jan 1 reversing entry 2023 Mar 1 collection of interest Jan 1 reversing entry Mar 1 to update amortization Mar 1 collection of interest Mar 1 to record sale Sep 1 collection of interest Sep 1 collection of interest Sep 1 to update amortization Dec 31 to take up accrued interest Sep 1 collection of principal Chart of accounts for A & B: Investment in Bonds Cash Interest Income Accrued Interest Receivable Gain on Sale of Investment A B D E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started