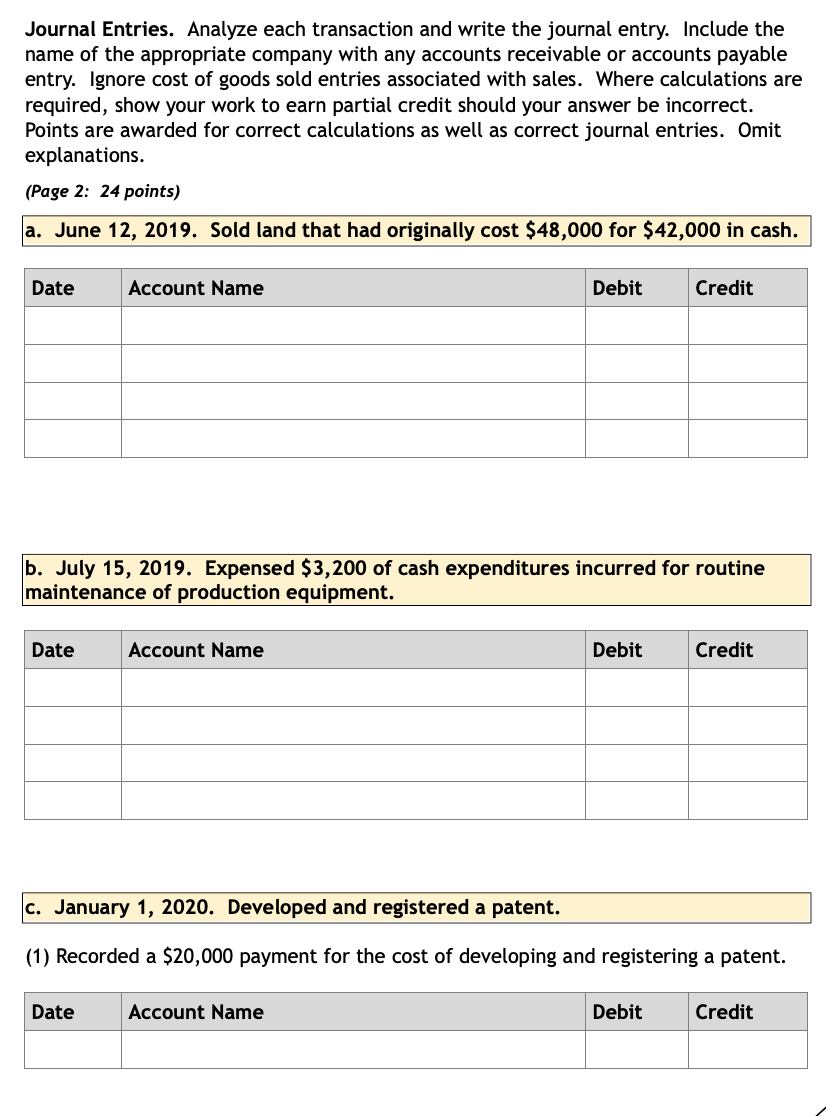

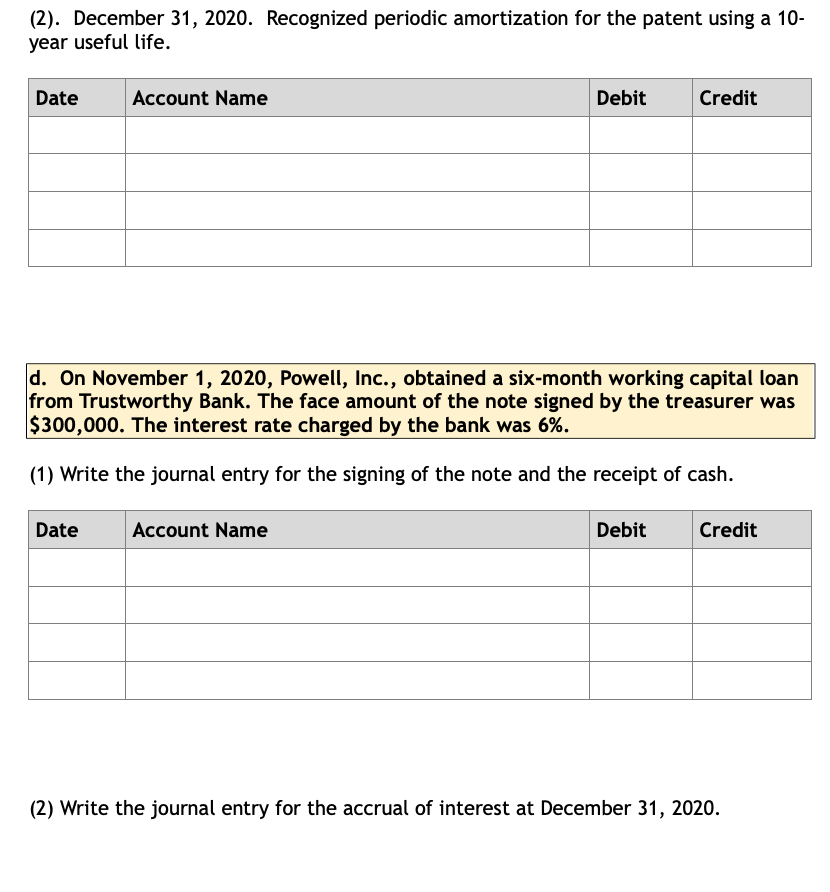

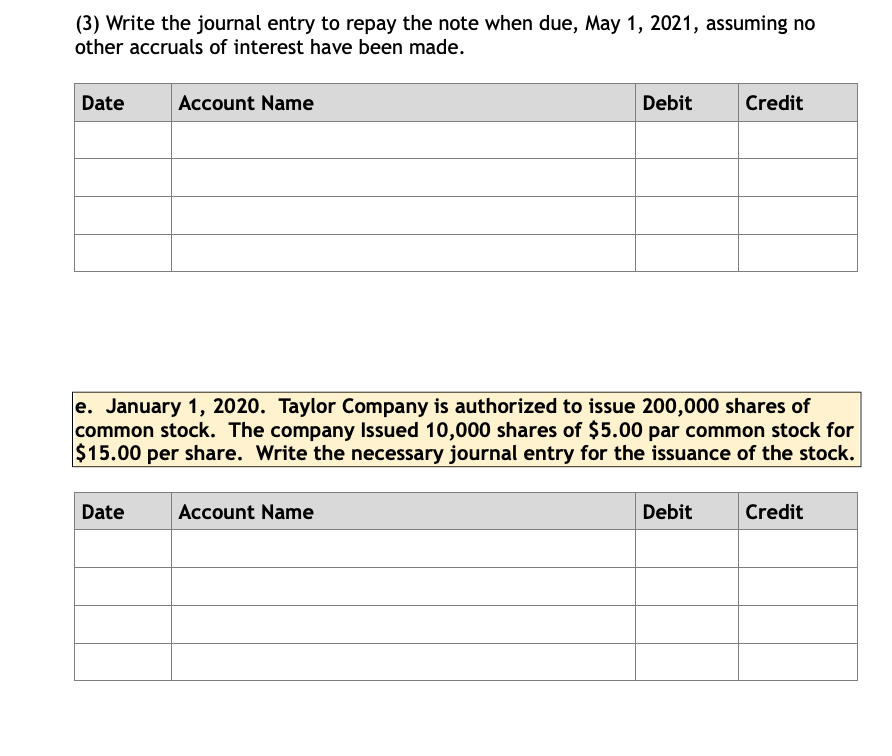

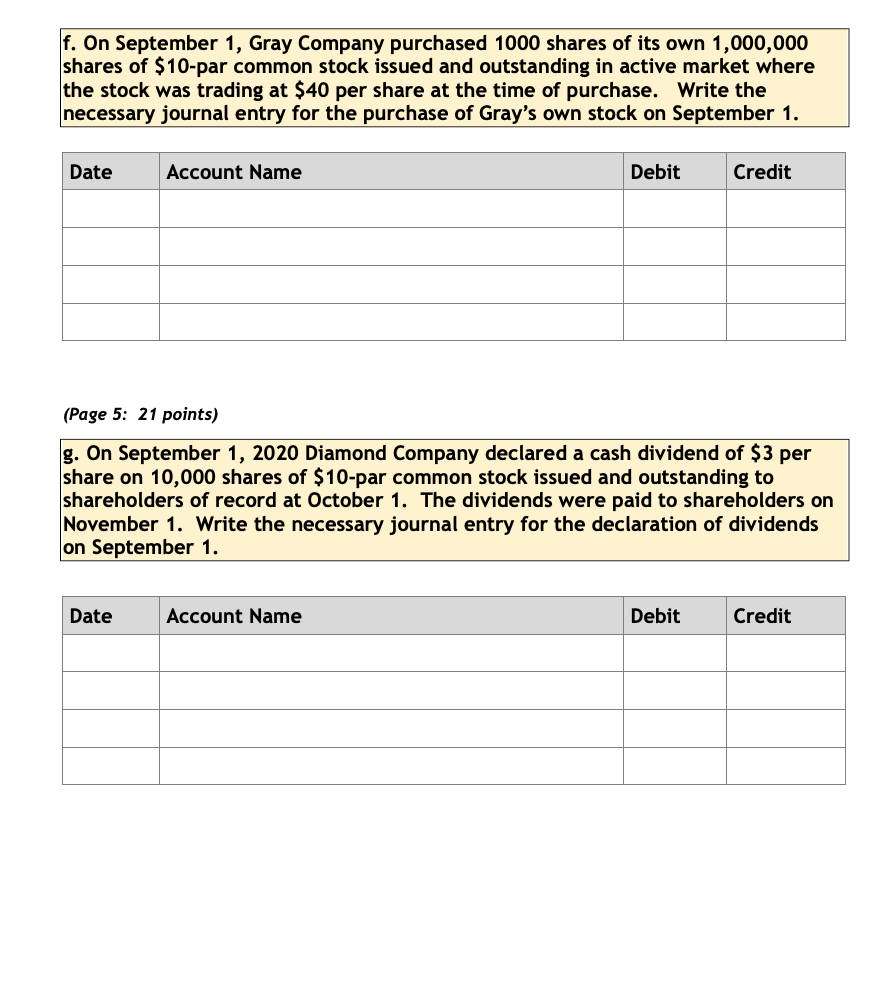

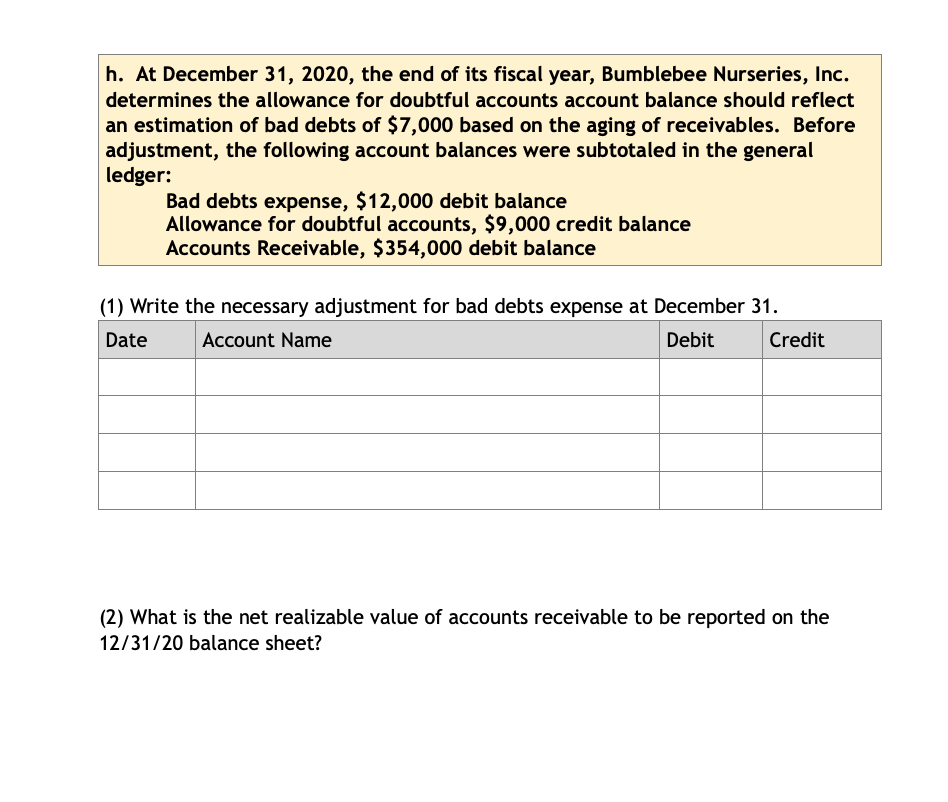

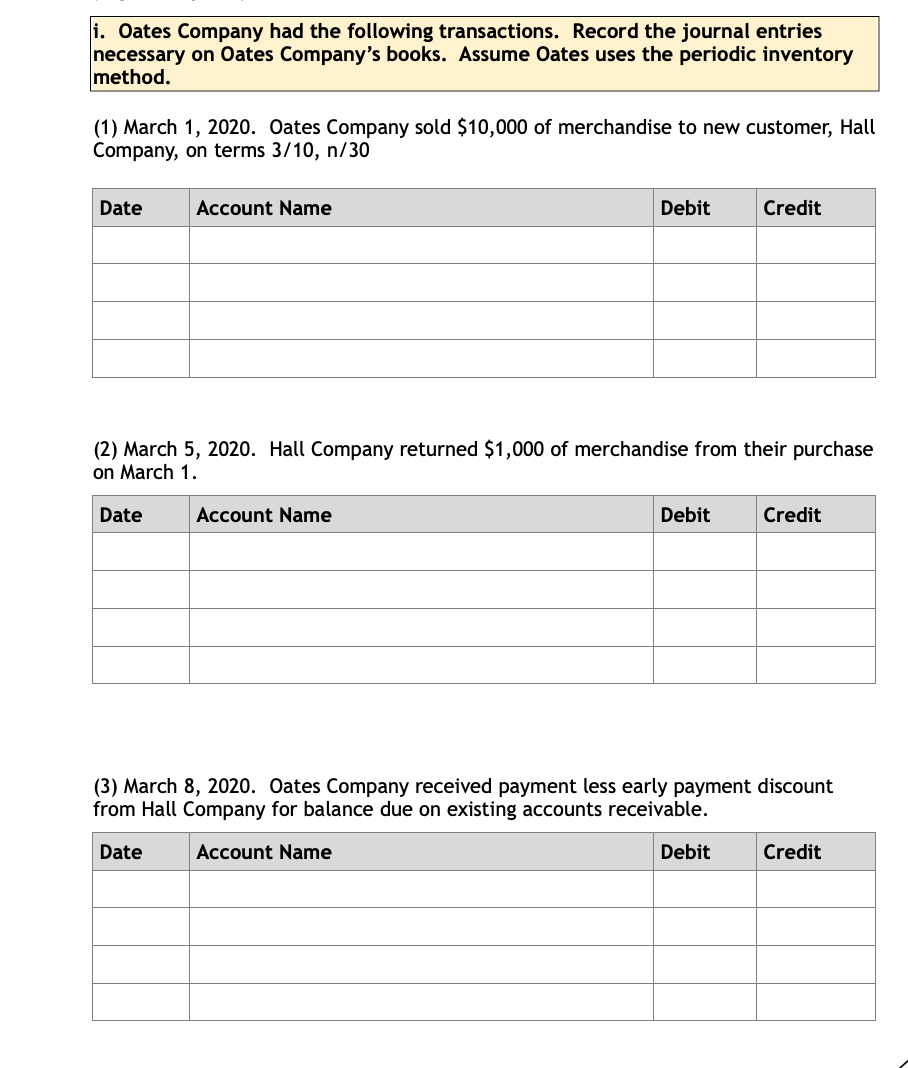

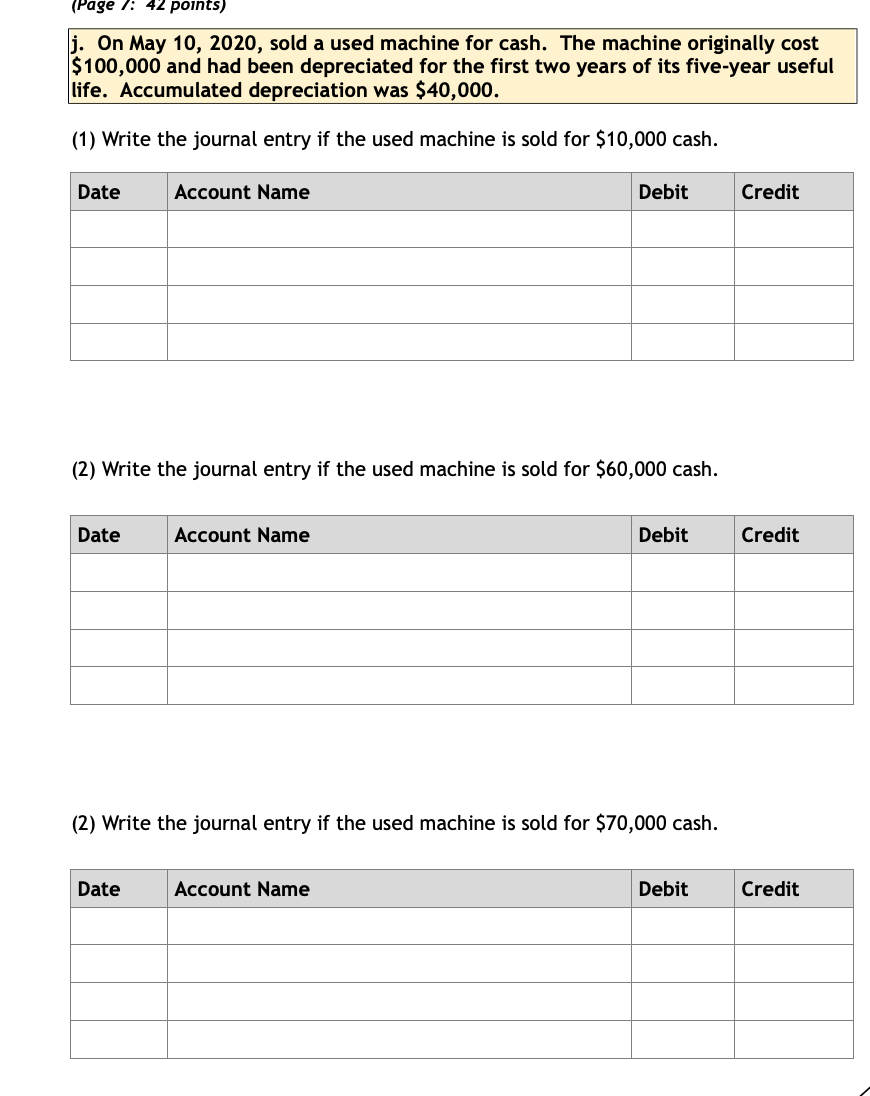

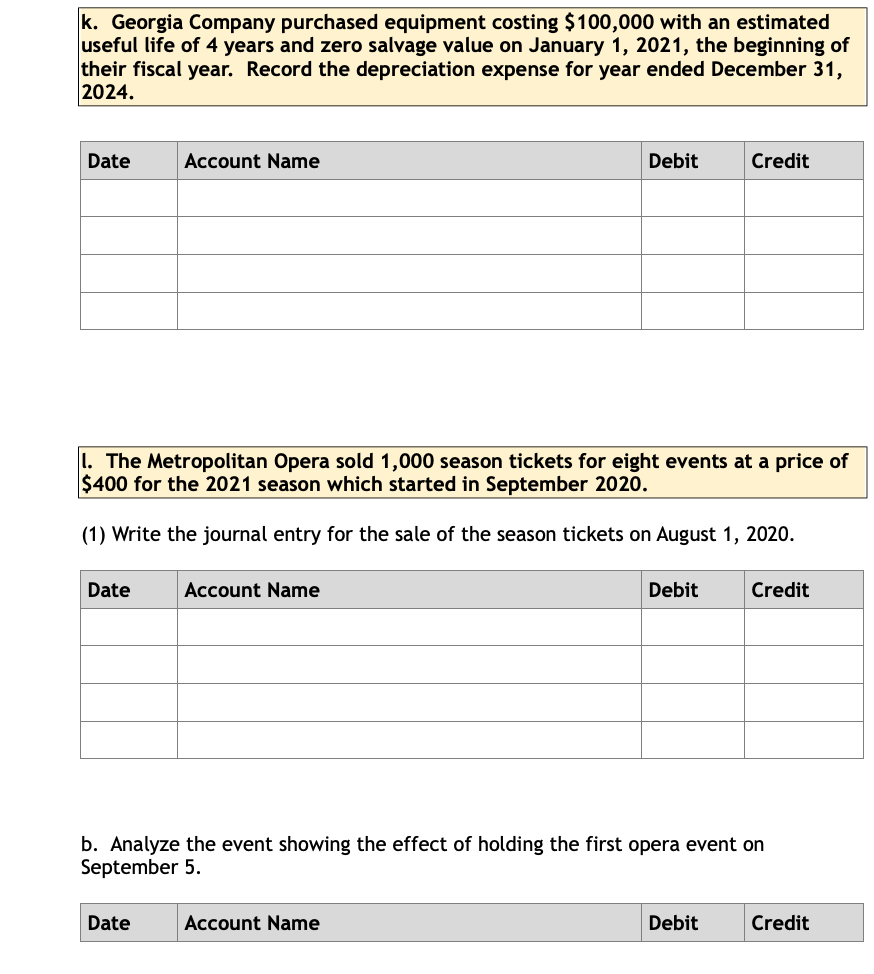

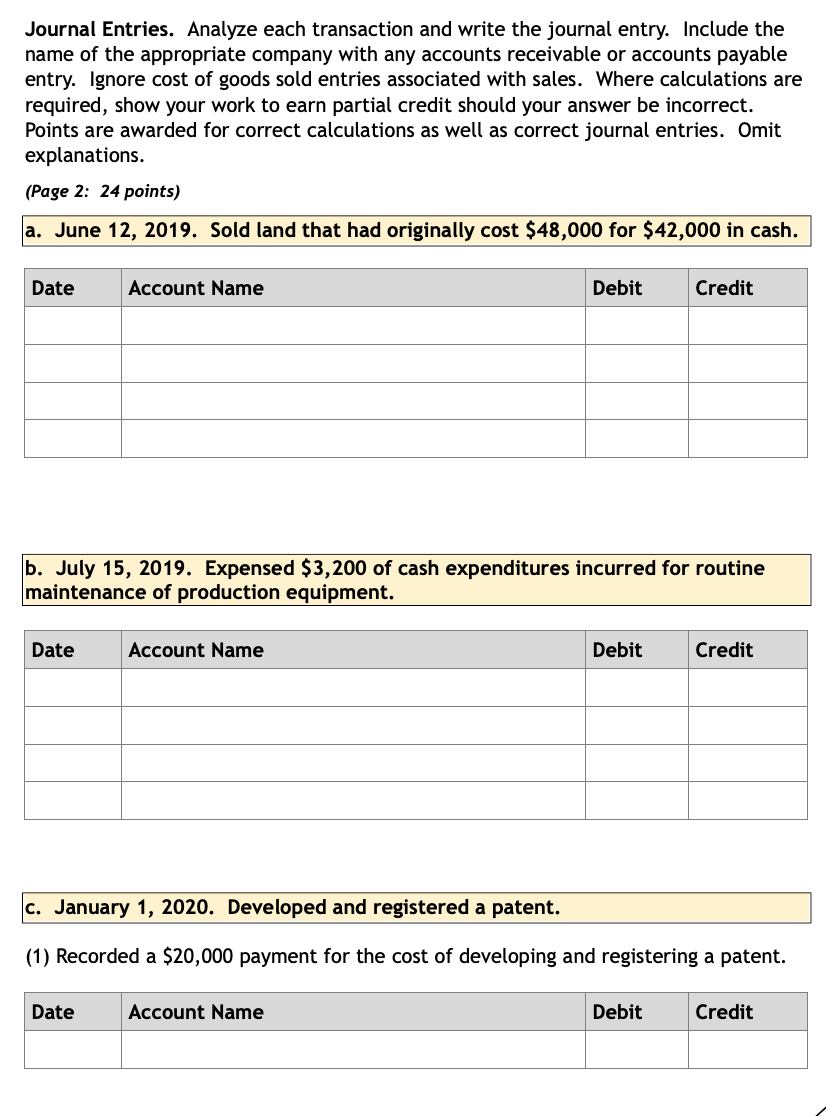

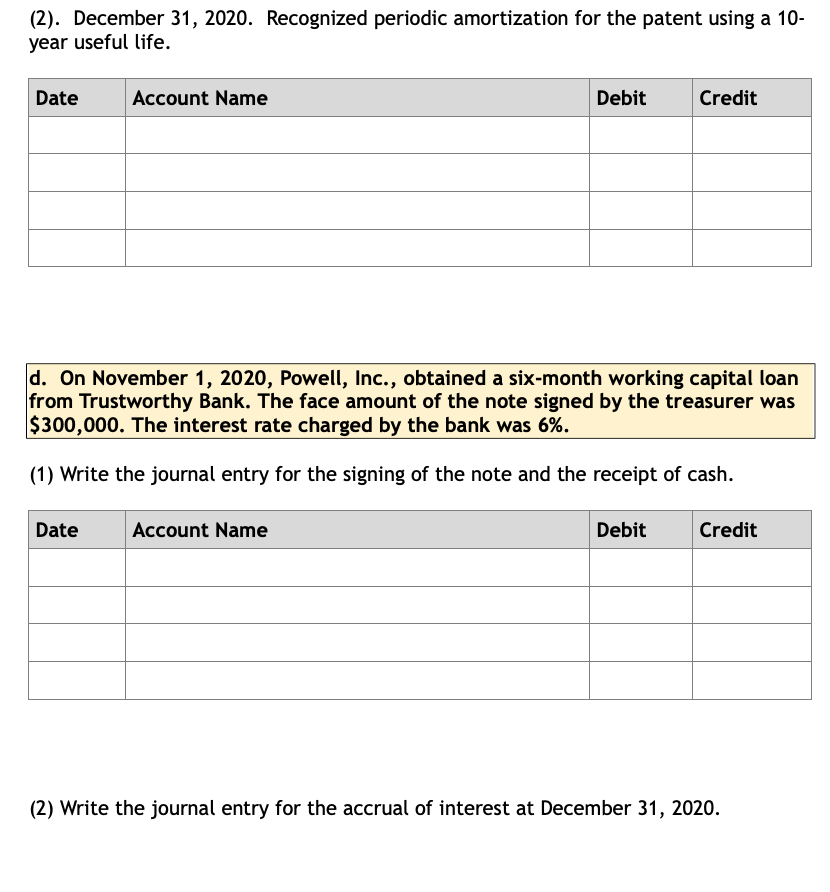

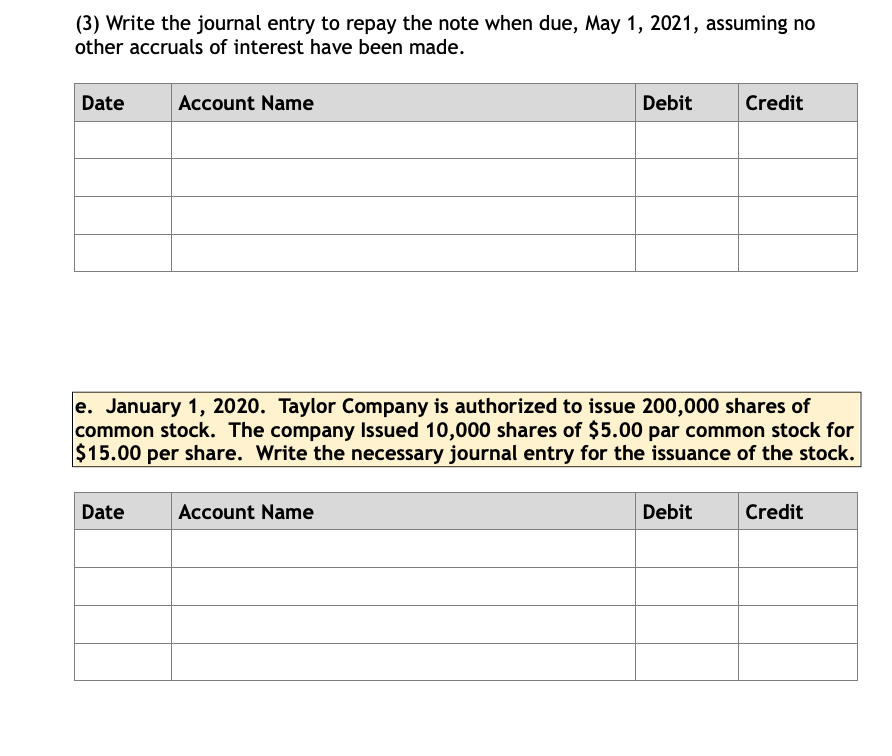

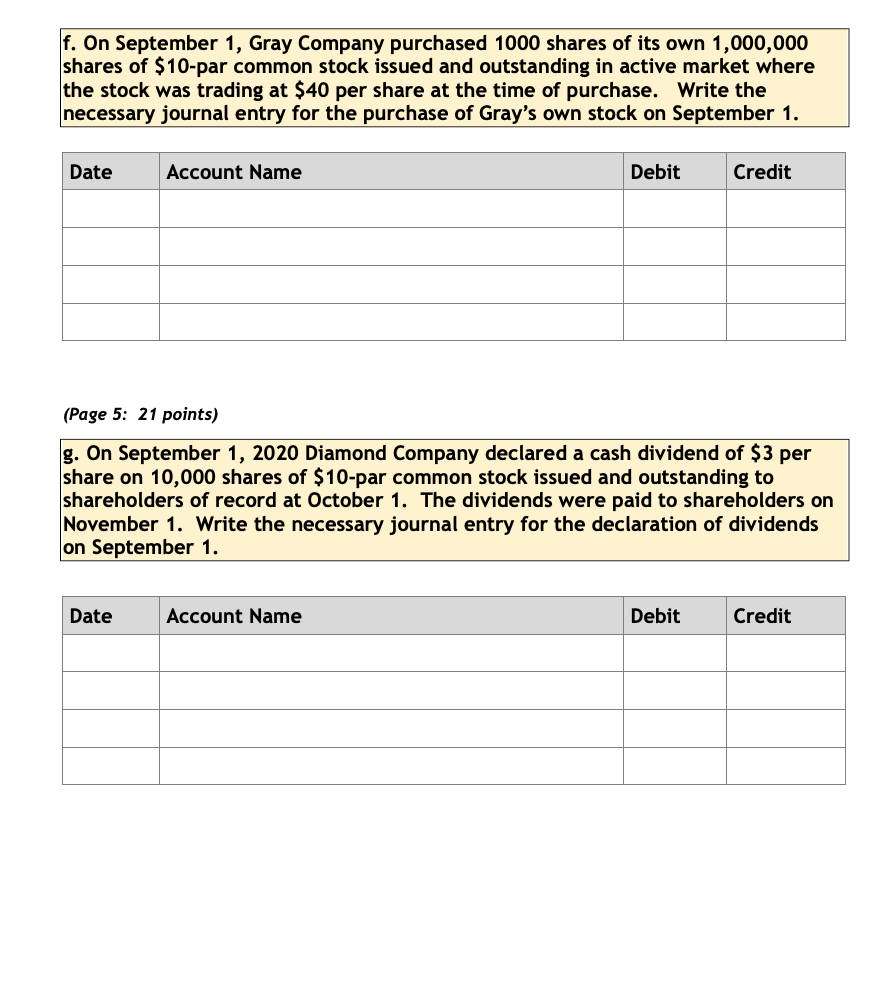

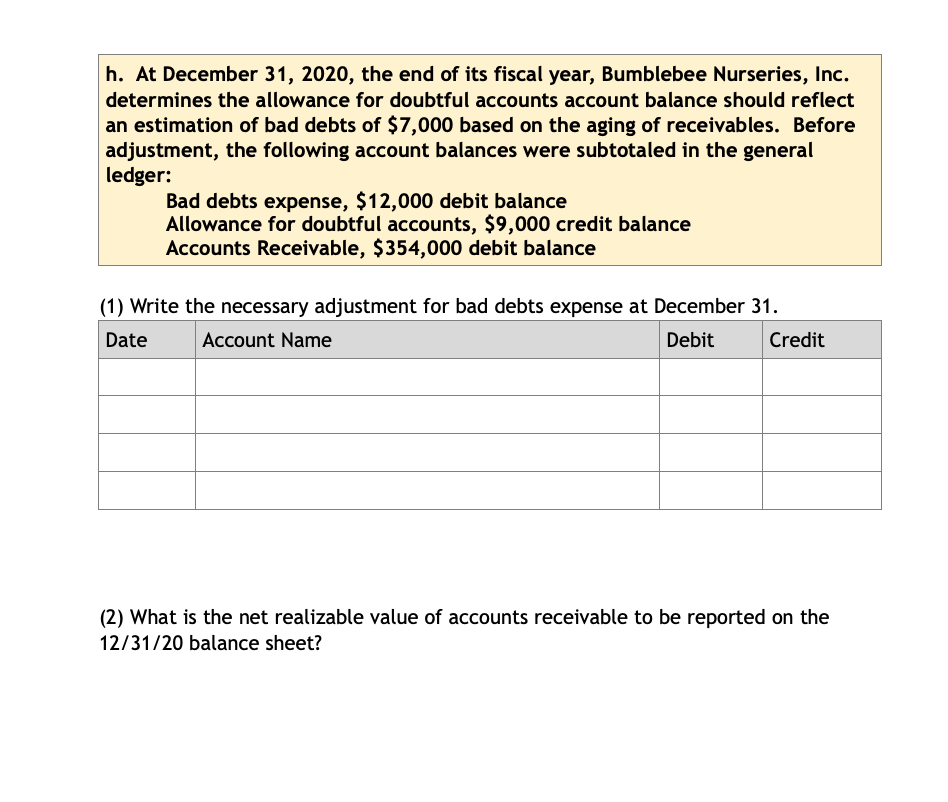

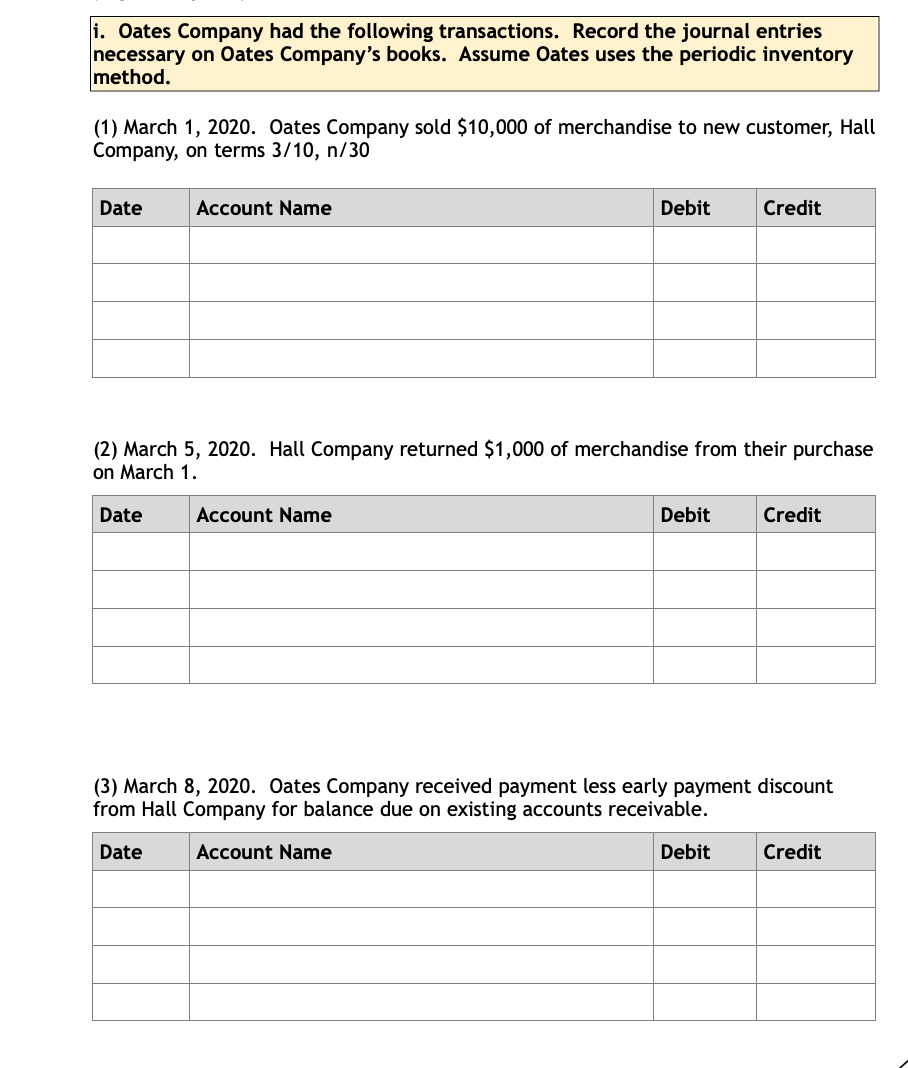

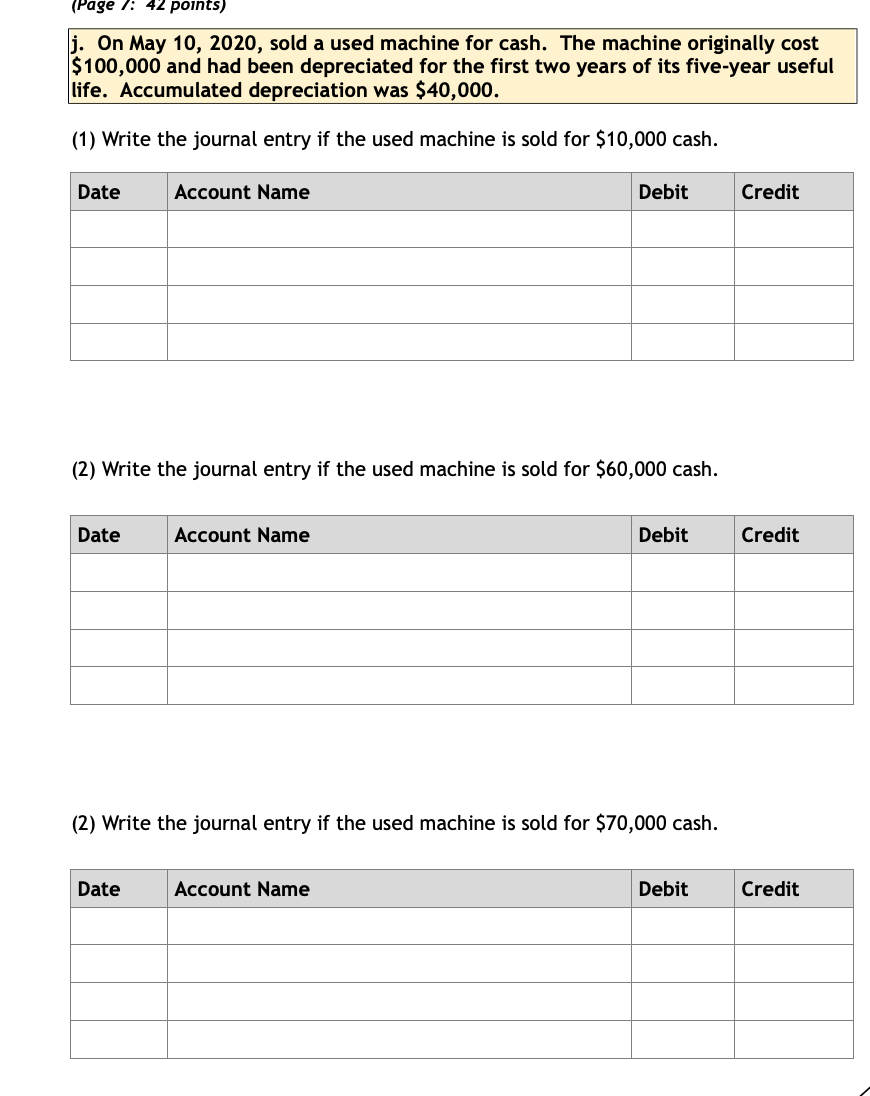

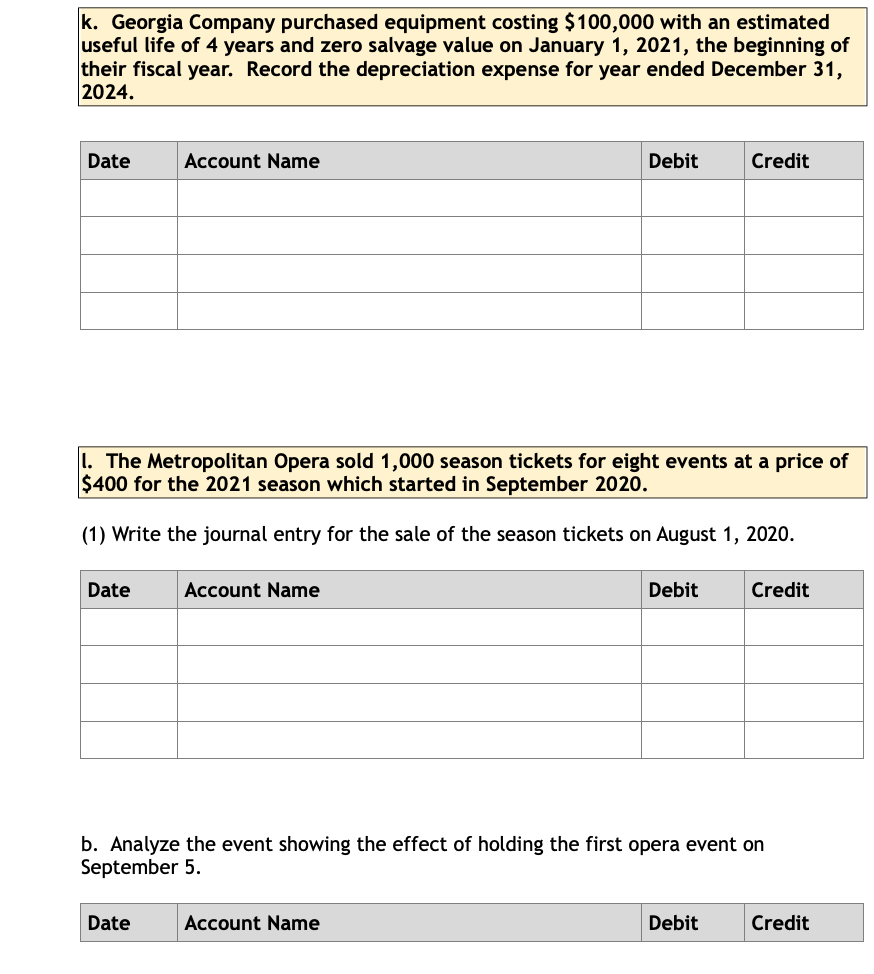

Journal Entries. Analyze each transaction and write the journal entry. Include the name of the appropriate company with any accounts receivable or accounts payable entry. Ignore cost of goods sold entries associated with sales. Where calculations are required, show your work to earn partial credit should your answer be incorrect. Points are awarded for correct calculations as well as correct journal entries. Omit explanations. (Page 2: 24 points) a. June 12, 2019. Sold land that had originally cost $48,000 for $42,000 in cash. Date Account Name Debit Credit b. July 15, 2019. Expensed $3,200 of cash expenditures incurred for routine maintenance of production equipment. Date Account Name Debit Credit c. January 1, 2020. Developed and registered a patent. (1) Recorded a $20,000 payment for the cost of developing and registering a patent. Date Account Name Debit Credit (2). December 31, 2020. Recognized periodic amortization for the patent using a 10- year useful life. Date Account Name Debit Credit d. On November 1, 2020, Powell, Inc., obtained a six-month working capital loan from Trustworthy Bank. The face amount of the note signed by the treasurer was $300,000. The interest rate charged by the bank was 6%. (1) Write the journal entry for the signing of the note and the receipt of cash. Date Account Name Debit Credit (2) Write the journal entry for the accrual of interest at December 31, 2020. (3) Write the journal entry to repay the note when due, May 1, 2021, assuming no other accruals of interest have been made. Date Account Name Debit Credit e. January 1, 2020. Taylor Company is authorized to issue 200,000 shares of common stock. The company Issued 10,000 shares of $5.00 par common stock for $15.00 per share. Write the necessary journal entry for the issuance of the stock. Date Account Name Debit Credit f. On September 1, Gray Company purchased 1000 shares of its own 1,000,000 shares of $10-par common stock issued and outstanding in active market where the stock was trading at $40 per share at the time of purchase. Write the necessary journal entry for the purchase of Gray's own stock on September 1. Date Account Name Debit Credit (Page 5: 21 points) g. On September 1, 2020 Diamond Company declared a cash dividend of $3 per share on 10,000 shares of $10-par common stock issued and outstanding to shareholders of record at October 1. The dividends were paid to shareholders on November 1. Write the necessary journal entry for the declaration of dividends on September 1. Date Account Name Debit Credit h. At December 31, 2020, the end of its fiscal year, Bumblebee Nurseries, Inc. determines the allowance for doubtful accounts account balance should reflect an estimation of bad debts of $7,000 based on the aging of receivables. Before adjustment, the following account balances were subtotaled in the general ledger: Bad debts expense, $12,000 debit balance Allowance for doubtful accounts, $9,000 credit balance Accounts Receivable, $354,000 debit balance (1) Write the necessary adjustment for bad debts expense at December 31. Date Account Name Debit Credit (2) What is the net realizable value of accounts receivable to be reported on the 12/31/20 balance sheet? i. Oates Company had the following transactions. Record the journal entries necessary on Oates Company's books. Assume Oates uses the periodic inventory method. (1) March 1, 2020. Oates Company sold $10,000 of merchandise to new customer, Hall Company, on terms 3/10, n/30 Date Account Name Debit Credit (2) March 5, 2020. Hall Company returned $1,000 of merchandise from their purchase on March 1. Date Account Name Debit Credit (3) March 8, 2020. Oates Company received payment less early payment discount from Hall Company for balance due on existing accounts receivable. Date Account Name Debit Credit (Page 7: 42 points) j. On May 10, 2020, sold a used machine for cash. The machine originally cost $100,000 and had been depreciated for the first two years of its five-year useful life. Accumulated depreciation was $40,000. (1) Write the journal entry if the used machine is sold for $10,000 cash. Date Account Name Debit Credit (2) Write the journal entry if the used machine is sold for $60,000 cash. Date Account Name Debit Credit (2) Write the journal entry if the used machine is sold for $70,000 cash. Date Account Name Debit Credit k. Georgia Company purchased equipment costing $100,000 with an estimated useful life of 4 years and zero salvage value on January 1, 2021, the beginning of their fiscal year. Record the depreciation expense for year ended December 31, 2024. Date Account Name Debit Credit 1. The Metropolitan Opera sold 1,000 season tickets for eight events at a price of $400 for the 2021 season which started in September 2020. (1) Write the journal entry for the sale of the season tickets on August 1, 2020. Date Account Name Debit Credit b. Analyze the event showing the effect of holding the first opera event on September 5. Date Account Name Debit Credit