Question

Journal entries and financial statements for a Private-Purpose Trust Fund The City of Tuffy is the trustee and custodian for cash collected from fees charged

Journal entries and financial statements for a Private-Purpose Trust Fund

The City of Tuffy is the trustee and custodian for cash collected from fees charged by a

local nonprofit cemetery association. The fees are paid by individuals and are dedicated

for cemetery plot maintenance for these individuals based on benefit terms

enumerated in the trust. The activity is administered through the Cemetery Care

Private-Purpose Trust, which has its own board of directors.

The following transactions and events occurred in the Trust Fund during the year.

1. Fees of $14,000 are collected.

2. Some of the cash collected ( $10,000) is invested in a certificate of deposit (CD).

3. A lawn care company is paid $1,500 for cemetery plot maintenance.

4. An accountant is paid $500 for bookkeeping services.

5. The CD matures with interest earnings of $400.

6. A new CD in the amount of $10,000 is purchased.

7. The lawn care company is owed an additional $500 for cemetery plot

maintenance performed in 2022.

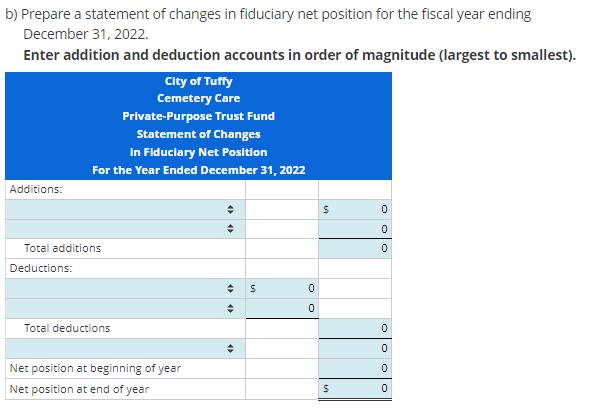

b) Prepare a statement of changes in fiduciary net position for the fiscal year ending

December 31, 2022.

Enter addition and deduction accounts in order of magnitude (largest to smallest).

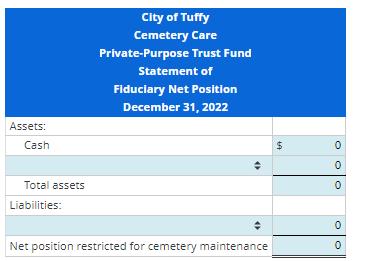

c) Prepare a statement of fiduciary net position as of December 31, 2022.

(Assume that this is the first year of operations for this Trust Fund.)

b) Prepare a statement of changes in fiduciary net position for the fiscal year ending December 31, 2022. Enter addition and deduction accounts in order of magnitude (largest to smallest). Additions: City of Tuffy Cemetery Care Private-Purpose Trust Fund Statement of Changes in Fiduciary Net Position For the Year Ended December 31, 2022 Total additions Deductions: Total deductions Net position at beginning of year Net position at end of year # " $ 0 0 $ in S 59 0 0 0 0 0 0 0

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Cash 14000 Additionsfees 14000 To record collection of fees Investmentscertificates of deposit 10000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started