Answered step by step

Verified Expert Solution

Question

1 Approved Answer

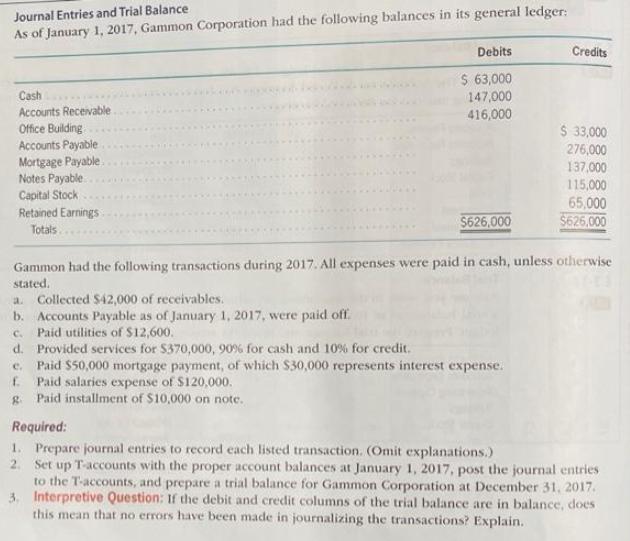

Journal Entries and Trial Balance As of January 1, 2017, Gammon Corporation had the following balances in its general ledger: Cash Accounts Receivable. Office

Journal Entries and Trial Balance As of January 1, 2017, Gammon Corporation had the following balances in its general ledger: Cash Accounts Receivable. Office Building Accounts Payable Mortgage Payable. Notes Payable.... Capital Stock Retained Earnings Totals.. a. Collected $42,000 of receivables. b. Accounts Payable as of January 1, 2017, were paid off. Debits $ 63,000 147,000 416,000 C. Paid utilities of $12,600. d. Provided services for $370,000, 90% for cash and 10% for credit. $626,000 Gammon had the following transactions during 2017. All expenses were paid in cash, unless otherwise stated. Credits Paid $50,000 mortgage payment, of which $30,000 represents interest expense. f Paid salaries expense of $120,000. g. Paid installment of $10,000 on note. $ 33,000 276,000 137,000 115,000 65,000 $626,000 Required: 1. Prepare journal entries to record each listed transaction. (Omit explanations.) 2. Set up T-accounts with the proper account balances at January 1, 2017, post the journal entries to the T-accounts, and prepare a trial balance for Gammon Corporation at December 31, 2017. Interpretive Question: If the debit and credit columns of the trial balance are in balance, does this mean that no errors have been made in journalizing the transactions? Explain. 3.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 SNO b d e C Utilities expense Cash f General Journal Cash Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started