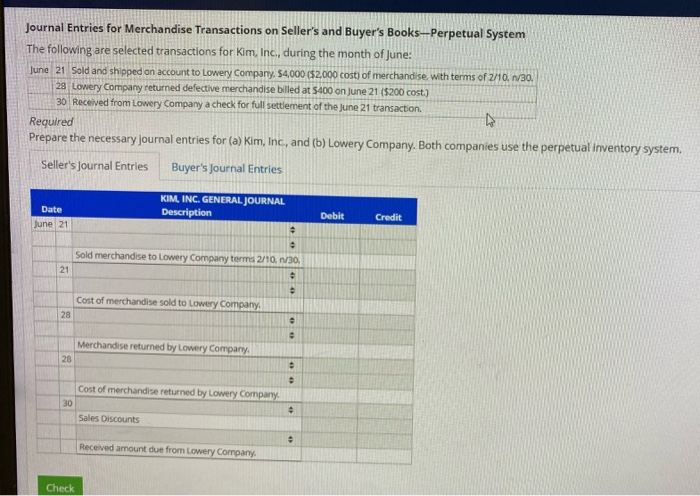

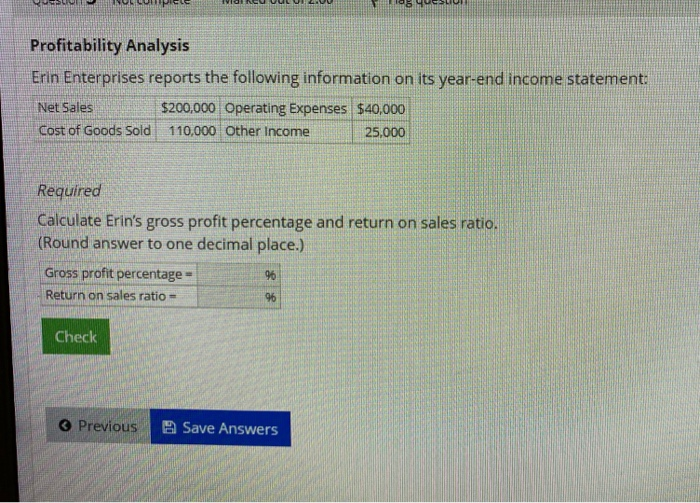

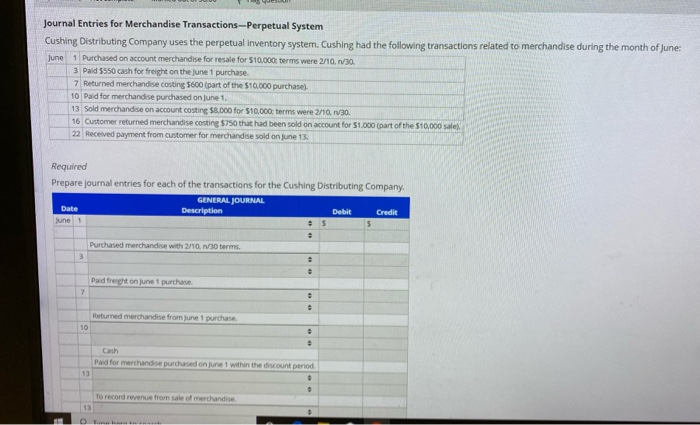

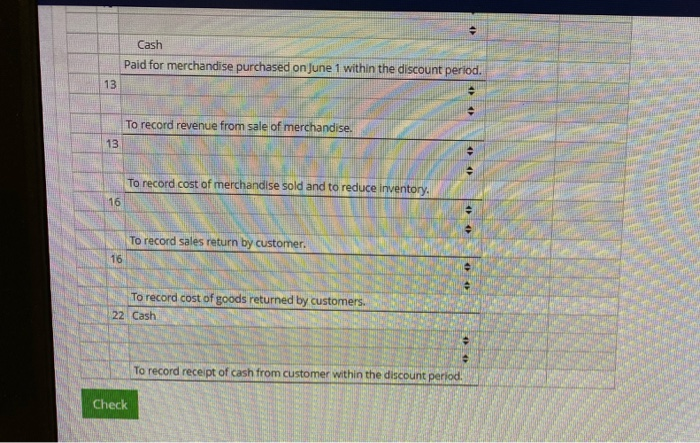

Journal Entries for Merchandise Transactions on Seller's and Buyer's Books-Perpetual System The following are selected transactions for Kim, Inc, during the month of June: June 21 Sold and shipped on account to Lowery Company, $4,000 (52,000 cost of merchandise. With terms of 2/10.30 28 Lowery Company returned defective merchandise billed at 5400 on June 21 ($200 cost.) 30 Received from Lowery Company a check for full settlement of the june 21 transaction Required Prepare the necessary Journal entries for (a) Kim, Inc, and (b) Lowery Company. Both companies use the perpetual Inventory system. Seller's Journal Entries Buyer's Journal Entries Date KIM, INC. GENERAL JOURNAL Description Debit Credit June 21 Sold merchandise to Lowery Company terms 2/10, 1/30, Cost of merchandise sold to Lowery Company Merchandise returned by Lowery Company Cost of merchandise returned by Lowery Company Sales Discounts Received amount due from Lowery Company Check DL A NUL LUPO VISINU UULUI2.00 B le=9Sc-LOI Profitability Analysis Erin Enterprises reports the following information on its year-end income statement: Net Sales $200,000 Operating Expenses $40,000 Cost of Goods Sold 110,000 Other Income 25.000 Required Calculate Erin's gross profit percentage and return on sales ratio. (Round answer to one decimal place.) Gross profit percentage- Return on sales ratio = Check Previous Save Answers Journal Entries for Merchandise Transactions-Perpetual System Cushing Distributing Company uses the perpetual inventory system. Cushing had the following transactions related to merchandise during the month of June: June 1Purchased on account merchandise for resale for $10.000 terms were 2/10. 30 3 paid $550 arch for frecht on the une purchase 7 Returned merchandise costing 1500 part of the 10.000 purchase 10 Paid for merchandise purchased on June 1 13 Sold merchandise on account costing 5.000 for $10,000 terms were 2/10, 1/30. 16 Customer returned merchandise costing 5750 that had been sold on account for $1.000 (part of the $10,000 sale 22 Received payment from customer for merchandise sold on June 13. Required Prepare journal entries for each of the transactions for the Cushing Distributing Company GENERAL JOURNAL Date Description Debit Credit Purchand merchandise with 2/10 Paidret on June purchase Returned merchandise from june purchase. Cath Paid for merchandse purchased on june within the discount period To record revenue from sale of merchandise Cash Paid for merchandise purchased on June 1 within the discount period. 13 . To record revenue from sale of merchandise. To record cost of merchandise sold and to reduce GE 16 To record cost of goods returned by customers. 22 Cashier AGA A To record receipt of cash from cust Check