Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal entries in debit and credit on given transactions Change the session date to January 8, 2022. Create shortcuts or change modules and enter following

Journal entries in debit and credit on given transactions

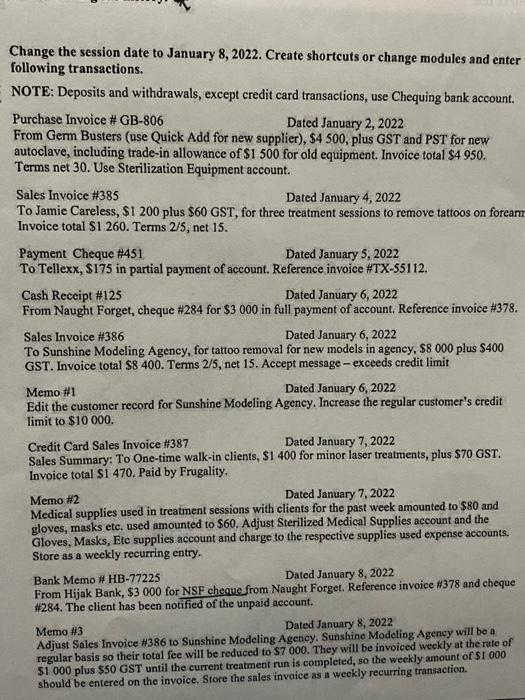

Change the session date to January 8, 2022. Create shortcuts or change modules and enter following transactions. NOTE: Deposits and withdrawals, except credit card transactions, use Chequing bank account. Purchase Invoice # GB-806 Dated January 2, 2022 From Germ Busters (use Quick Add for new supplier), $4 500, plus GST and PST for new autoclave, including trade-in allowance of $1 500 for old equipment. Invoice total $4 950. Terms net 30. Use Sterilization Equipment account. Sales Invoice # 385 Dated January 4, 2022 To Jamie Careless, $1 200 plus $60 GST, for three treatment sessions to remove tattoos on forearm Invoice total $1 260. Terms 2/5, net 15. Payment Cheque #451 Dated January 5, 2022 To Tellexx, $175 in partial payment of account. Reference invoice #TX-55112. Cash Receipt # 125 Dated January 6, 2022 From Naught Forget, cheque # 284 for $3 000 in full payment of account. Reference invoice # 378. Sales Invoice #386 Dated January 6, 2022 To Sunshine Modeling Agency, for tattoo removal for new models in agency, $8 000 plus $400 GST. Invoice total $8 400. Terms 2/5, net 15. Accept message - exceeds credit limit Memo #1 Dated January 6, 2022 Edit the customer record for Sunshine Modeling Agency. Increase the regular customer's credit limit to $10 000. Credit Card Sales Invoice #387 Dated January 7, 2022 Sales Summary: To One-time walk-in clients, $1 400 for minor laser treatments, plus $70 GST. Invoice total $1 470. Paid by Frugality. Memo #2 Dated January 7, 2022 Medical supplies used in treatment sessions with clients for the past week amounted to $80 and gloves, masks etc. used amounted to $60. Adjust Sterilized Medical Supplies account and the Gloves, Masks, Etc supplies account and charge to the respective supplies used expense accounts. Store as a weekly recurring entry. Bank Memo # HB-77225 Dated January 8, 2022 From Hijak Bank, $3 000 for NSF cheque from Naught Forget. Reference invoice #378 and cheque # 284. The client has been notified of the unpaid account. Memo #3 Dated January 8, 2022 Adjust Sales Invoice #386 to Sunshine Modeling Agency. Sunshine Modeling Agency will be a regular basis so their total fee will be reduced to $7 000. They will be invoiced weekly at the rate of $1.000 plus $50 GST until the current treatment run is completed, so the weekly amount of $1 000 should be entered on the invoice. Store the sales invoice as a weekly recurring transaction.

Step by Step Solution

★★★★★

3.60 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started