Question

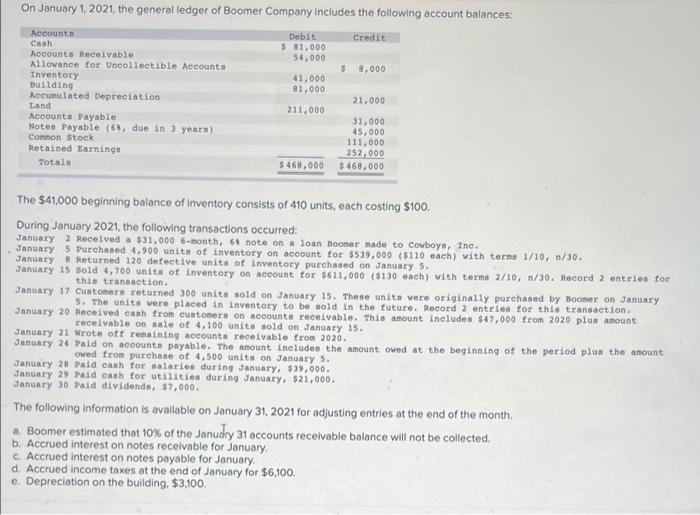

journal entries, income statement, and balance sheet would be much appreciated. thanks! 1. Record each of the transactions listed above in the 'General Journal' tab

journal entries, income statement, and balance sheet would be much appreciated. thanks!

| 1.

| Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 - 13) assuming a FIFO perpetual inventory system. The gross method is used for recording discounts on purchases and sales of inventory. | |

| 2. | Review the unadjusted Trial Balance in the 'Trial Balance' tab to confirm that debits equal credits and that ending account balances are shown correctly as debits or credits. The year on the Trial Balance tab is incorrectly shown as 2018 instead of 2021.

| |

| 3. | Record adjusting entries on January 31 in the 'General Journal' tab (these are shown as items 14-18).

| |

| 4. | Review the Adjusted Trial Balance as of January 31, 2021, in the 'Trial Balance' tab to confirm that debits equal credits and that ending account balances are shown correctly as debits or credits.

| |

| 5. | Prepare a multiple-step income statement for the period ended January 31, 2021, in the 'Income Statement' tab. Select "Adjusted Trial Balance" at the top left. You may not use every line on the income statement. Enter "Net income" as the title for the last line.

| |

| 6. | Prepare a classified balance sheet as of January 31, 2021, in the 'Balance Sheet' tab. Select "Adjusted Trial Balance" at the top left. Show any NONCURRENT liabilities on the line below the Current section.

| |

| 7. | Record the closing entries in the 'General Journal' tab (these are shown as items 19 and 20). In the second closing entry, close all temporary accounts with debit balances (expenses, contra-revenues, dividends).

| |

| 8. | Review the Post-closing Trial Balance as of January 31, 2021, in the 'Trial Balance' tab to confirm that only permanent account balances are included; temporary accounts should be closed. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started