Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journal entries while uploading on the chegg the pixel gets low i don't know can you do while zooming the image rations View Policies Current

journal entries

while uploading on the chegg the pixel gets low i don't know can you do while zooming the image

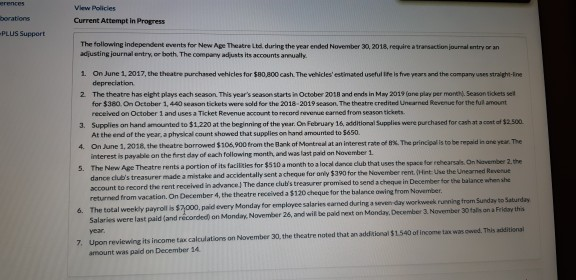

rations View Policies Current Attempt in Progress LUS Support The following independent events for New Age Theatre Ltd. during the year ended November 30, 2018, require a transaction jumal entry or an adjusting journal entry or both. The company adjusts its accounts 1. On June 1, 2017, the theatre purchased vehicles for $20,000 cash. The vehicles estimated test years and the correstraight line depreciation 2 The theatre base gays cheasonThis year's season starts in October 2018 and ends in May 2019 ose player month wohl for $380. On October 1, 440 mon tickets were sold for the 2018-2019 season. The theatre credited Urned with our received on October 1 and uses a Ticket Revount to record revenue and from a tickets. 2. Supplies on hand amounted to $1 220 at the beginning of the year. On February 16, additional Supplies were purchased for chat $2.900 At the end of the year, a ploysical count showed that supplies on hond amounted to $450 4. One 1, 2016, the theatre borrowed $106.900 from the Bank of Montrealarestrate the writerpalinone year. The interest is payable on the first day of each following month and was laun beri 5. The New Age Theatre rents a portion is facilities for $550 a month to local dance che that the pace for a shower the dance dub's treasure made a mistake and accidentally sont achegue for only for the Norber rent in the name account to record the rent received in advance The dance stressed to sendachin December for the lace when she returned from vacation On December 4, the theatre celed a $120ch for the balance in from November 4. The total weakly payroll $7,000 pad every Monday for enables tamedding verder weerground to Saturday Salaries were last paid and recorded on Monday, November 26, and will be pad on Monday December November and the yer 7. Upon reviewing is income tax call on November 30, the theatrete tutaditional 1.5 inches amount was paid on December 14 erences borations -PLUS Support View Policies Current Attempt in Progress The following independent events for New Age Theatre Ltd during the year ended November 30, 2016, require a transaction journal entry or an adjusting journal entry or both. The company adjusts its accounts annually 1. On June 1, 2017, the theatre purchased vehides for $80.800 cash. The vehicles estimated useful fe is true years and the company uses straight-line depreciation 2. The theatre has eight plays each season. This year's season starts in October 2018 and ends in May 2019 (one play per month Season tickets set for $380. On October 1, 440 season tickets were sold for the 2018-2019 season. The theatre credited Uncerned Revenue for the full amount received on October 1 and uses a Ticket Revenue account to record revenue earned from season tickets. 3. Supplies on hand amounted to $1.220 at the beginning of the year. On February 16, additional Supplies were purchased for cash at a cost of $2.500 At the end of the year, a physical count showed that supplies on hand amounted to $650. 4. On June 1, 2018, the theatre borrowed $106,900 from the Bank of Montreal at an interest of ex. The principal is to be repaid in one year. The interest is payable on the first day of each following month, and was last paid on November 1 5. The New Age Theatre rents a portion of its facilities for $510 a month to a local dance club that uses the space for rehearsals. On hvember 2.the dance club's treasurer made a mistake and accidentally sent a cheque for only $390 for the November rent. Hint Use the Unearned Revenue account to record the rent received in advance. The dance club's treasurer promised to send a cheque in December for the balance when she returned from vacation. On December 4, the theatre received a $120cheque for the balance wing from November 6. The total weekly payroll is $7000, paid every Monday for employee salaries camned during a day workweek running from Sunday to Saturday Salaries were last paid and recorded on Monday, November 26, and will be paid next on Monday, December 3. November 30tson a Friday this 7. Upon reviewing its income tax calculations on November 30, the theatre noted that an additional $1540 of income tax was owed. This ional amount was paid on December 14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started